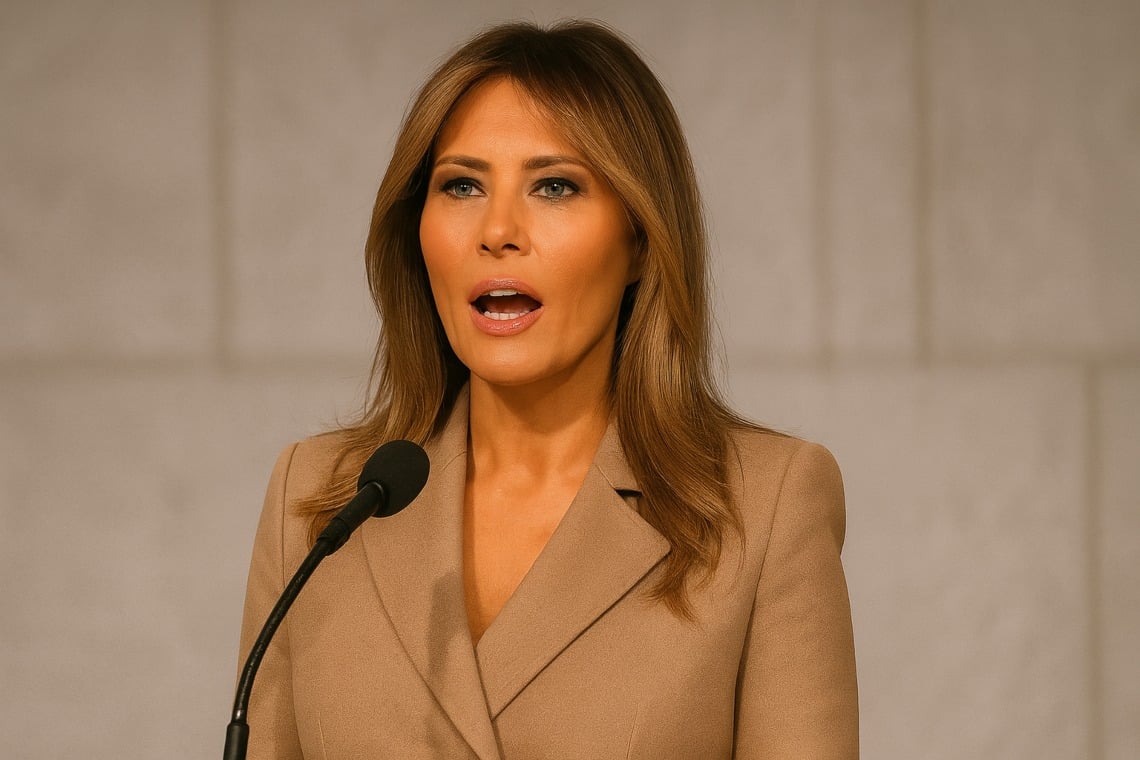

First Lady Melania Trump has not been named in suit, despite allegations of a pump-and-dump scheme orchestrated already before the launch of the $MELANIA meme coin.

What was the Melania meme coin’s market performance and tokenomics?

Market aggregators recorded a sharp spike and collapse: $MELANIA reached a peak near $13.73 before falling to about $0.10, while a separate $TRUMP token peaked around $45.47 and later traded near $5.79, according to CoinMarketCap.

These rapid swings echo other recent cases of memecoins that have sparked both excitement and skepticism among investors.

Public disclosures of tokenomics remain limited. Observers warn that opaque supply schedules and concentrated holdings can amplify volatility and distort secondary-market prices.

Does the MELANIA meme coin create legal or reputational risk for crypto and token platforms?

New court filings added allegations about $MELANIA to a Manhattan federal case on 23 October 2025, accusing Meteora executives of arranging trades that inflated and then dumped the token; the filings do not name Melania Trump, according to The Guardian coverage.

From a regulatory perspective, the token’s marketing and distribution mechanics raise potential scrutiny under SEC and FTC frameworks, particularly if promotional activity resembled investment pitches.

Note: celebrity-endorsed crypto projects often trigger consumer-protection concerns and heightened reputational exposure for exchanges and service providers.

What should investors watch in the Meteora exchange lawsuit?

- Public filings in Manhattan federal court for named defendants and evidence of coordinated trading.

- On-chain traces showing wallet concentration or rapid transfers between related addresses. This aligns with warnings from recent market incidents that highlight vulnerability to fraud and manipulation in loosely regulated environments.

- Exchange disclosures from Meteora about listings, internal transfers and compliance steps.

How should market participants interpret Melania’s meme coin developments?

Allegations of coordinated buying and rapid resale fit classic pump-and-dump crypto patterns, but they remain subject to court proof and forensic analysis.

For context, parallel investigations have linked some celebrity memecoin projects to broader money laundering inquiries, fueling further market caution.

In brief, verify sources, review smart-contract code and tokenomics, and prioritise transparency before treating headlines as investment signals.

Ongoing market volatility and regulatory scrutiny suggest that careful due diligence is essential.