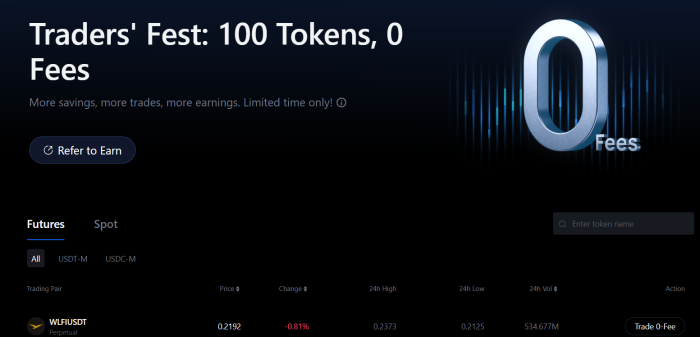

MEXC, one of the world’s fastest-growing cryptocurrency exchanges, reported record growth in the second quarter of 2025 after rolling out a zero-fee campaign on high-demand futures pairs.

The bold strategy, designed to reduce barriers to entry and capture market momentum, comes as the broader digital asset market continues to embrace stablecoins amid broader crypto adoption.

Zero-Fee Push Aligns with Market Focus

According to the CoinGecko Q2 2025 Crypto Industry Report, the total cryptocurrency market capitalization rose 24% quarter-on-quarter, while the stablecoin market hit an all-time high of $243.1B. $USDC expanded by $1.4B in circulation, highlighting investor appetite for compliant, dollar-backed assets.

MEXC seized on the trend by eliminating trading fees on selected $USDC-margined futures pairs. The initiative gave traders cost-free access to fast-growing markets while positioning the exchange at the center of the industry’s shifting narrative.

By zeroing in on where the liquidity was flowing and removing cost friction, MEXC amplified user participation and market depth across key pairs.

Winners Among Trading Pairs

The exchange’s campaign produced notable winners across both mainstream and emerging assets:

- $TON/$USDC captured 42% market share in its category.

- $ETH/$USDT, the flagship mainstream trading pair, secured a 33% share.

- $ONDO/$USDC and $POPCAT/$USDC each posted more than 5% market share gains.

The results underscored how MEXC’s mix of blue-chip tokens, infrastructure plays, and high-risk meme coins allowed the platform to serve a broad spectrum of trading appetites.

$ETH and $TON attracted institutional-minded investors, while $POPCAT drew in speculative retail traders and meme coin degens chasing volatility.

From Meme Frenzy to Mainstream Focus

The strong quarterly performance also reflected a broader pivot in market psychology. In the first quarter, the meme coin market profited from tokens like Dogwifhat, Brett, and Book of Meme surging in popularity.

But as US regulators passed crypto-friendly rules and fostered a more welcoming blockchain framework, investors redirected their attention to infrastructure upgrades, DeFi applications, and regulatory-friendly assets in Q2.

MEXC’s zero-fee campaign mirrored this change in sentiment. By offering cost-free access to sectors aligned with the new narrative, the exchange effectively turned user preference into trading volume.

Building a Foundation for Long-Term Growth

The zero-fee initiative not only lowered trading costs but also created a feedback loop of higher participation, deeper liquidity, and growing market share.

The campaign laid the groundwork for the exchange’s next phase of expansion, particularly in futures markets where competition among global platforms remains fierce.

With over 40M users spanning 170 countries, MEXC has built a reputation as one of the industry’s most accessible exchanges. The platform frequently lists trending tokens, provides promotional airdrops, and maintains one of the lowest fee structures in the sector.

Its focus on simplicity – under the motto ‘Your Easiest Way to Crypto’ – has helped it build a strong following among both retail traders and more seasoned investors.

Industry Context: Stablecoins and DeFi in the Spotlight

The emphasis on $USDC-margined pairs comes at a time when stablecoins are increasingly viewed as the backbone of the crypto economy. Beyond functioning as a liquidity layer, stablecoins are now integral to payment rails, cross-border settlement, and decentralized finance platforms.

The $243.1 billion stablecoin market cap milestone in Q2 reflects both resilience and evolution.

The sector is expanding not just in raw numbers but also in diversity, with compliant tokens like $USDC gaining traction alongside algorithmic and yield-bearing alternatives.

MEXC’s decision to highlight $ONDO/$USDC as part of its zero-fee campaign reflects how exchanges are now competing not just on volume but also on narrative alignment with emerging sectors.

DeFi has also continued to capture institutional interest, with projects like Ondo Finance ($ONDO) demonstrating new ways to bridge traditional financial instruments with blockchain technology.

MEXC Looks to the Future

The strong quarterly showing cements MEXC’s status as one of the most competitive exchanges in the futures market.

The zero-fee futures initiative may prove to be more than just a short-term promotional boost. By positioning itself as the go-to platform for traders chasing the most relevant narratives, the exchange has built a strategic foundation that could sustain growth well into 2026 and beyond.

As always, do your own research. This isn’t financial advice.

Authored by Bogdan Patru, Bitcoinist – https://bitcoinist.com/mexcs-zero-fee-futures-drive-q2-growth-stablecoins-defi