Recently, blockchain analyst, ZachXBT, revealed an intriguing money laundering case. An entity transferred approximately 4,800 BTC, equivalent to about $144 million, from the Abraxas darknet market to a Bitcoin mixer.

Abraxas was an online dark marketplace that operated in the shadows until its sudden disappearance in November 2015. At that time, the community considered this closure as an exit scam.” Rug pulls, or exit scams, are maneuvers in which the founders disappear, stealing the users’ funds.

Abraxas Case with BTC: Darknet Market that Disappeared in 2015

The on-chain sleuth, ZachXBT, wrote on X (Twitter):

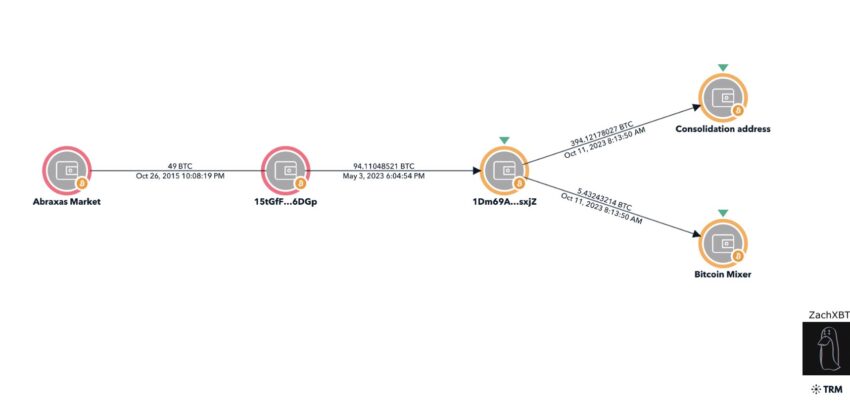

“An entity moved around 4,800 BTC ($144 million) originating from Abraxas darknet market which exit scammed in November 2015 after previously sitting dormant. They consolidated funds and also deposited to a Bitcoin mixer. This graph shows an example of the movements from one of the addresses.”

Read more: What Is a Rug Pull? A Guide to the Web3 Scam

This event left many Bitcoin (BTC) trapped in the market, and for eight years, these funds remained immobile. The event also raises additional concerns about regulating cryptocurrencies and the fight against money laundering in the digital sphere.

Does Abraxas Resurgence Involve BTC?

What has caught the attention of the crypto community is the recent movement of funds related to Abraxas. The entity behind the dark market, which has remained silent for almost a decade, has decided to transfer an impressive 4,800 BTC, valued at $144 million, to a Bitcoin coin mixer.

This unusual maneuver has raised the suspicions of blockchain experts such as ZachXBT, who suggest that the purpose behind this operation is money laundering.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

What is a Bitcoin Mixer?

A Bitcoin mixer, as the name implies, is a tool used to “mix” Bitcoin transactions, breaking up and redistributing the coins across multiple wallets over a set period of time.

The main function of the mixers is to obstruct any attempt to trace the operations. These tools are especially valuable for users who want to maintain a high degree of privacy when conducting transactions.

The wide range of approaches used by mixers also contributes to preserving user anonymity. An example of this is P2P providers, which act as platforms for the creation of groups in which users combine their resources. In these groups, the users are unaware of the origins and the destinations of assets.

Bad actors often use such techniques to hinder the traceability of their illicit transactions, such as money laundering. Lastly, the US Treasury has expressed interest in calling coin mixers a “top money laundering concern,” underscoring the seriousness of the problem.

“Today’s action underlines the Treasury’s commitment to combating the exploitation of mixed convertible virtual currency by a wide range of illicit actors, including state-affiliated cyber actors, cybercriminals and terrorist groups,” said a spokesman.

Read more: 13 Best Bitcoin Mixers and Tumblers in 2023

Mystery of Identity Behind Darknet Marketplace

One of the most intriguing aspects of this story is the identity behind the entity that is moving the Abraxas funds. Who was responsible for this operation?

What motivation led them to wait eight years before transferring funds to a coin mixer? These are unanswered questions that raise serious questions about regulation and transparency in the cryptocurrency space.

The case of the 4,800 BTC from Abraxas that have finally been moved to a coin mixer highlights once again the security and compliance challenges that cryptocurrencies face.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The post Nearly 4,800 Bitcoin (BTC) Linked to Defunct Darknet Marketplace Moved to Bitcoin Mixer appeared first on BeInCrypto.