Crypto exchange Bitgamo has announced plans to deploy up to 75 crypto ATMs across Europe in the coming year. The move comes amid Bitgamo’s remarkable growth as the sole no-KYC crypto-to-fiat exchange, offering competitive exchange rates.

However, with Europe’s MiCA rules underway, can all platforms implement their ambitious expansion?

Bitgamo to Operate New Crypto ATMs in Europe

Crypto automated teller machines (ATMs) have gained immense popularity within the crypto community. Bitgamo’s announcement of 75 new ATMs in Europe as the exchange grows bigger.

The exchange has reportedly become one of the few exchanges in the crypto industry with a no-KYC exchange policy. It grants users the ability to exchange cryptocurrencies without undergoing registration.

Benefitting from its Luxembourg base, Bitgamo also operates within a legal framework that treats cryptocurrencies as assets, eliminating the need for a mandatory Know Your Customer (KYC) process.

Read more: 7 Best Bitcoin ATMs With Low Fees and High Privacy

However, amid Bitgamo’s no-KYC success, challenges may arise with the impending implementation of the European Union’s (EU) Markets in Crypto-Assets Regulation (MiCA) in the coming year. MiCA, published in the Official Journal of the European Union on June 9, 2023, represents the EU’s comprehensive regulatory framework for crypto assets.

It aims to address various crypto-related provisions while also closing existing loopholes.

Loose Guidelines Might Not Float Well in Europe

Sam Altman, CEO of OpenAI, recently expressed concerns about the EU’s tight regulations. He hinted that the AI platform might consider exiting Europe if the current regulatory drafts remain unchanged, citing potential over-regulation.

In September, numerous cryptocurrency exchanges, including Bitget, bolstered their Know-Your-Customer (KYC) verification standards. The move enhances user security and also aligns with evolving global regulatory standards.

Read more: 13 Best No KYC Crypto Exchanges in 2023

Notably, the Financial Action Task Force (FATF) had previously stressed the importance of collective efforts to combat proliferation, terrorism financing, and money laundering in the crypto sector.

However, Bitgamo remains optimistic about its prospects, with Gabriel Weber, Director of Communications at Bitgamo, stating the exchange is now ready for the next growth stage. Weber noted,

“In 2024, we are all set to install 75 crypto ATMs throughout Europe. Just like our online platform, these ATMs will also provide you the best market rate.”

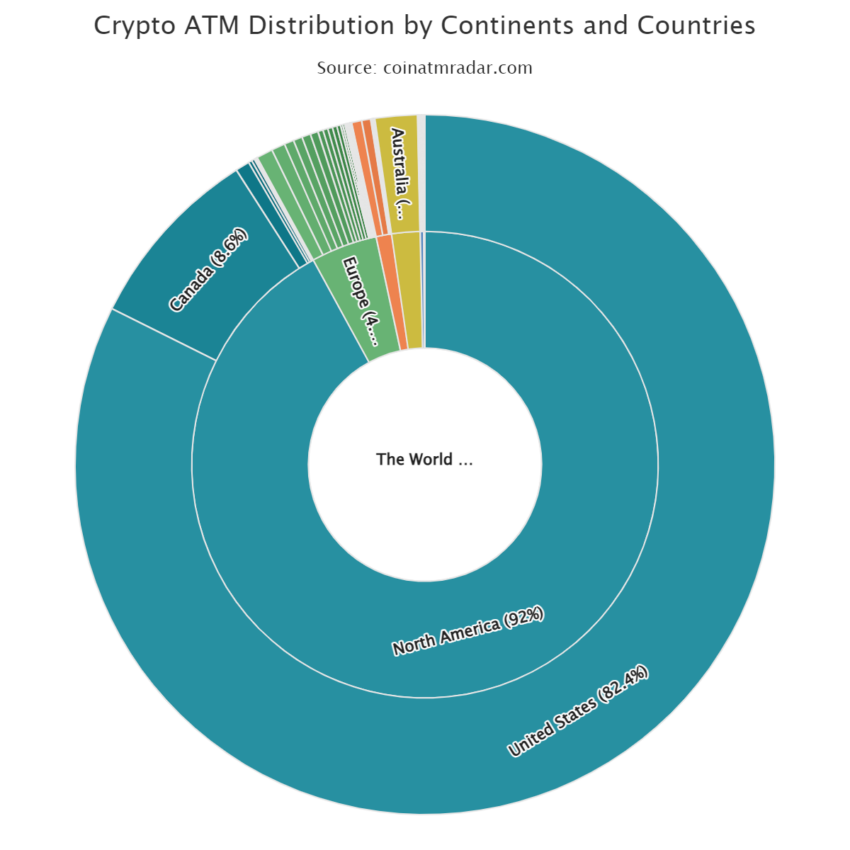

According to data from Coin ATM Radar, there are currently 32,088 Bitcoin ATMs worldwide, operated by 508 entities. There are 1,473 crypto ATMs in Europe, accounting for 4.6% of the global total. Spain leads the European charts with a 0.8% concentration of crypto ATMs.

The post No-KYC Exchange Plans Expansion with 75 Crypto ATMs Across Europe Next Year appeared first on BeInCrypto.