Contents

- Schiff’s victory lap

- Spot Bitcoin ETFs make a splash

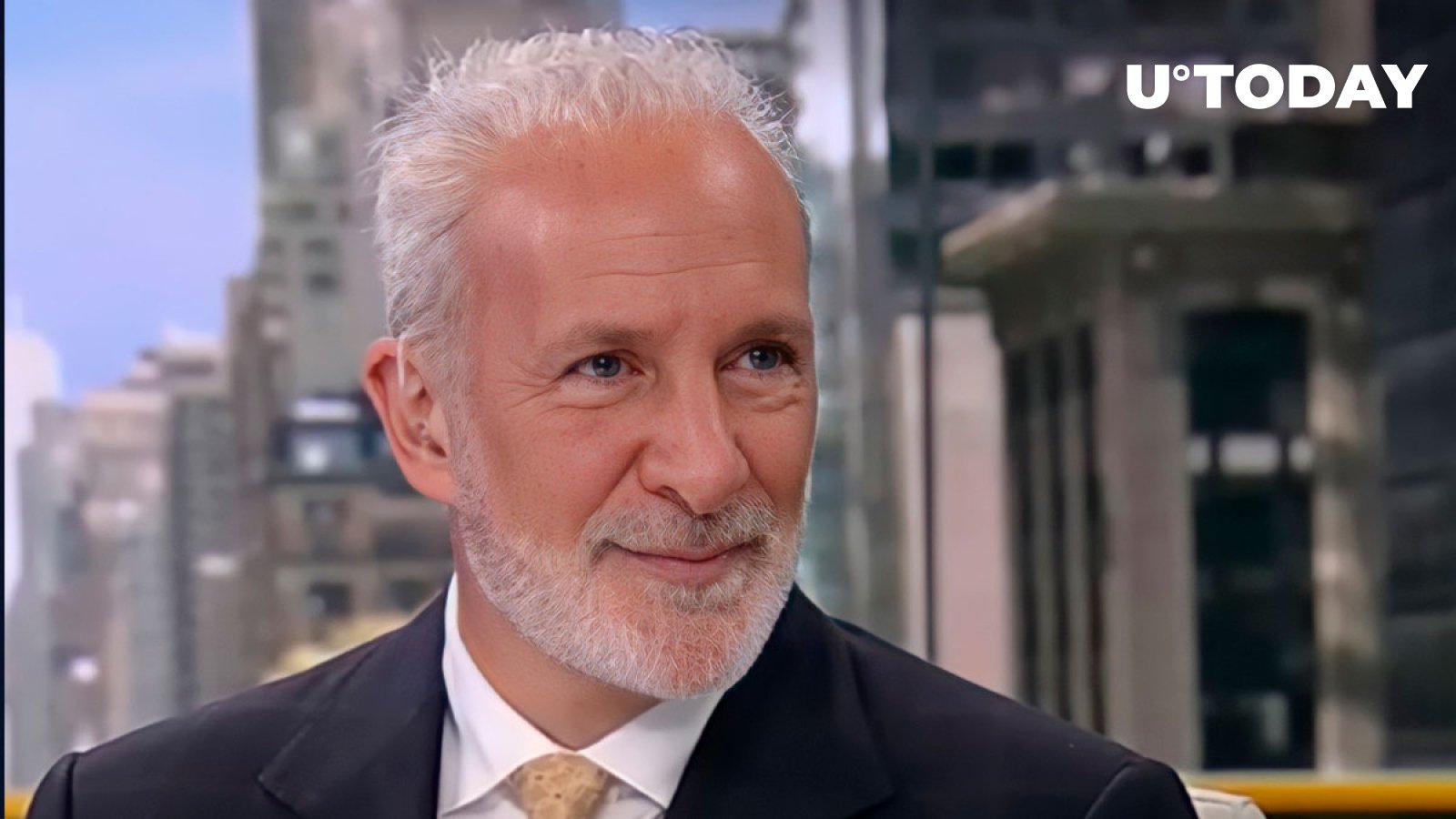

Renowned economist and financial commentator Peter Schiff has recently taken to X (formerly Twitter) to express his skepticism about the sustainability of Grayscale’s Bitcoin Trust (GBTC) amid the collapse of the Bitcoin price. The flagship cryptocurrency is down nearly 7% over the last 24 hours, crashing below the $44,000 level.

Schiff, a long-time critic of Bitcoin and other cryptocurrencies, questioned how long GBTC could continue its heavy spending on advertising as the Net Asset Value (NAV) of their Bitcoin holdings is expected to decline sharply due to falling Bitcoin prices.

This comes at a time when competing Bitcoin ETFs are gaining popularity due to lower fees, leading to concerns about potential shareholder exodus.

Schiff’s victory lap

In a series of posts, Schiff appeared to take a victory lap, pointing out the orderly sell-off in Bitcoin, Bitcoin ETFs, and related equities.

He speculated on the potential for more aggressive selling in the future. Schiff also criticized the investors who speculated on the approval of spot Bitcoin ETFs. He believes they are now selling off their positions.

Furthermore, he stressed the fact that spot Bitcoin ETFs need to liquidate Bitcoin for U.S. dollars, a scenario that could pose problems given the past reliance on Tether for liquidity and price support.

Spot Bitcoin ETFs make a splash

The debut of spot Bitcoin ETFs in the U.S. market was significant, with offerings from Bitwise Invest, Fidelity, and BlackRock pulling in $625.8 million in net inflows.

However, Grayscale’s Bitcoin Trust experienced outflows of $95 million. This discrepancy in performance raises questions about investor preferences and the sustainability of Grayscale’s high fee structure.

Reports suggest that Grayscale sent a substantial amount of Bitcoin to a Coinbase Prime deposit address, possibly indicating a shift of investor assets to other ETFs or regular selling activity.