Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple chief technology officer (CTO) David “JoelKatz” Schwartz used a late-Wednesday post on X to frame a surge of payments and stablecoin companies launching their own base-layer networks as validation of blockchain’s role in finance—and to restate how the XRP Ledger’s design differs from the new entrants.

“We’ve been seeing more and more players in the payments and stablecoins space launch their own blockchains. To me, that’s a clear sign the market sees blockchain as core financial infrastructure — something we’ve believed in and have been building toward on the XRP Ledger for over 13 years,” he wrote, adding, “Launching a blockchain is hard. Building an ecosystem with developers, liquidity, trust, and real-world usage is even harder.”

Competition For Ripple And The XRP Ledger?

Schwartz situated XRPL’s posture in the long-running debate over network governance. “Some blockchains are built with permissioned validator sets controlled by one entity or a small group. This can provide control and compliance for specific, closed-network scenarios, but it limits reach, resilience, and the ability for anyone to contribute to securing and growing the network,” he wrote.

Related Reading

“As many of you know, the XRPL is public and permissionless at its core, with optional permissioned features for regulated use cases.” He argued that the ledger’s open base “makes it adaptable, interoperable, and well-positioned to serve as critical infrastructure for the world’s financial system — connecting assets, markets, and participants seamlessly across borders.”

The remarks arrive as two US fintech heavyweights move into L1 territory. Circle this week unveiled Arc, an EVM-compatible Layer-1 it says is “purpose-built for stablecoin finance,” with dollar-denominated fees (USDC as native gas), opt-in privacy, a built-in RFQ-style FX engine, and “deterministic sub-second settlement finality” via the Malachite consensus engine. Circle says Arc will enter private testnet in the coming weeks, target public testnet in the fall, and a mainnet beta in 2026.

Separately, Stripe is developing Tempo, a high-performance, payments-focused L1 being built in partnership with crypto VC firm Paradigm. Tempo is designed to run code compatible with Ethereum, is currently in stealth with a small team, and it remains unclear whether it will have a native token.

Schwartz also highlighted specific XRPL design choices he sees as aligned with financial-grade settlement. “It’s encouraging to see some newer chains adopt design choices that have long been part of the XRPL’s architecture, like deterministic finality … It shows there’s growing alignment in the industry on the importance of predictable, reliable settlement for financial applications without expensive validation,” he wrote.

He reiterated that XRPL fees are meant to stay “low and predictable, just fractions of a cent, without a separate gas token,” noting that “every transaction on the XRPL uses/burns XRP.” XRPL’s technical documentation specifies that each transaction destroys a small amount of XRP as an anti-spam fee, and describes consensus rules aimed at deterministic ordering and finality.

Related Reading

Where Schwartz drew a line was on governance flexibility. He acknowledged that permissioned validator sets can make sense for “specific, closed-network scenarios,” but underscored XRPL’s approach: a public, permissionless core with opt-in controls for compliance needs.

The ledger’s native features include Authorized Trust Lines, Deposit Authorization/Preauthorization, and issuer-level freeze tooling for issued assets—not for XRP itself—allowing regulated token issuers to gate or police flows without converting the entire network into a walled garden. XRPL’s own FAQ emphasizes that it is a decentralized, public blockchain where changes require supermajority validator approval.

The strategic contrast with the new fintech chains is already visible. Arc explicitly centers USDC—making fees dollar-denominated and embedding Circle’s payments stack—whereas XRPL retains XRP for fees and settlement while supporting issued assets through trust-line mechanics. If Tempo proceeds as reported, Stripe would be pursuing an Ethereum-compatible L1 optimized for predictable payments performance, potentially mirroring Arc’s enterprise-centric pitch but with a broader merchant-services integration surface.

Schwartz closed on a deliberately expansive note about the competitive set: “Looking forward to the next phase of XRPL innovations, bringing more programmability, compliance-grade capabilities, and deeper liquidity for institutional use,” he wrote—before welcoming rivals: “And to those just getting started… Welcome to the party! The crypto tent is only getting bigger.”

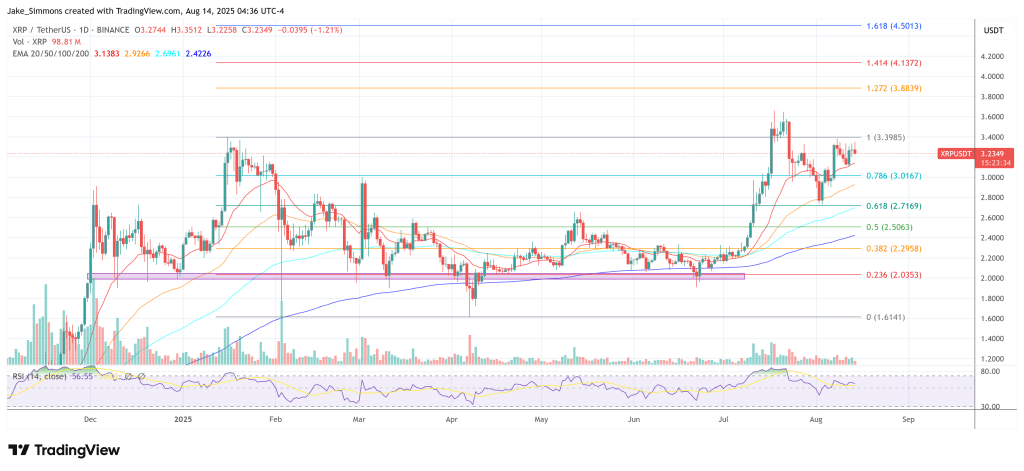

At press time, XRP traded at $3.23.

Featured image created with DALL.E, chart from TradingView.com