In an announcement made earlier today, US-based blockchain company Ripple said that it had inked an agreement with leading Spanish bank Banco Bilbao Vizcaya Argentaria (BBVA) to provide the financial institution with Bitcoin (BTC) and Ethereum (ETH) custody services.

Ripple To Provide Bitcoin, Ethereum Custody Services To BBVA

Ripple, the blockchain firm behind the XRP token, today said it had partnered with BBVA to provide its digital asset custody solution to the bank. To recall, in July 2025, BBVA announced the launch of its Bitcoin and ETH trading and custody services for all retail customers in Spain.

According to today’s announcement, Ripple will offer Ripple Custody – its institutional-grade digital asset self-custody technology – to BBVA to help it benefit from a scalable and secure custody service for tokenized assets, including digital assets.

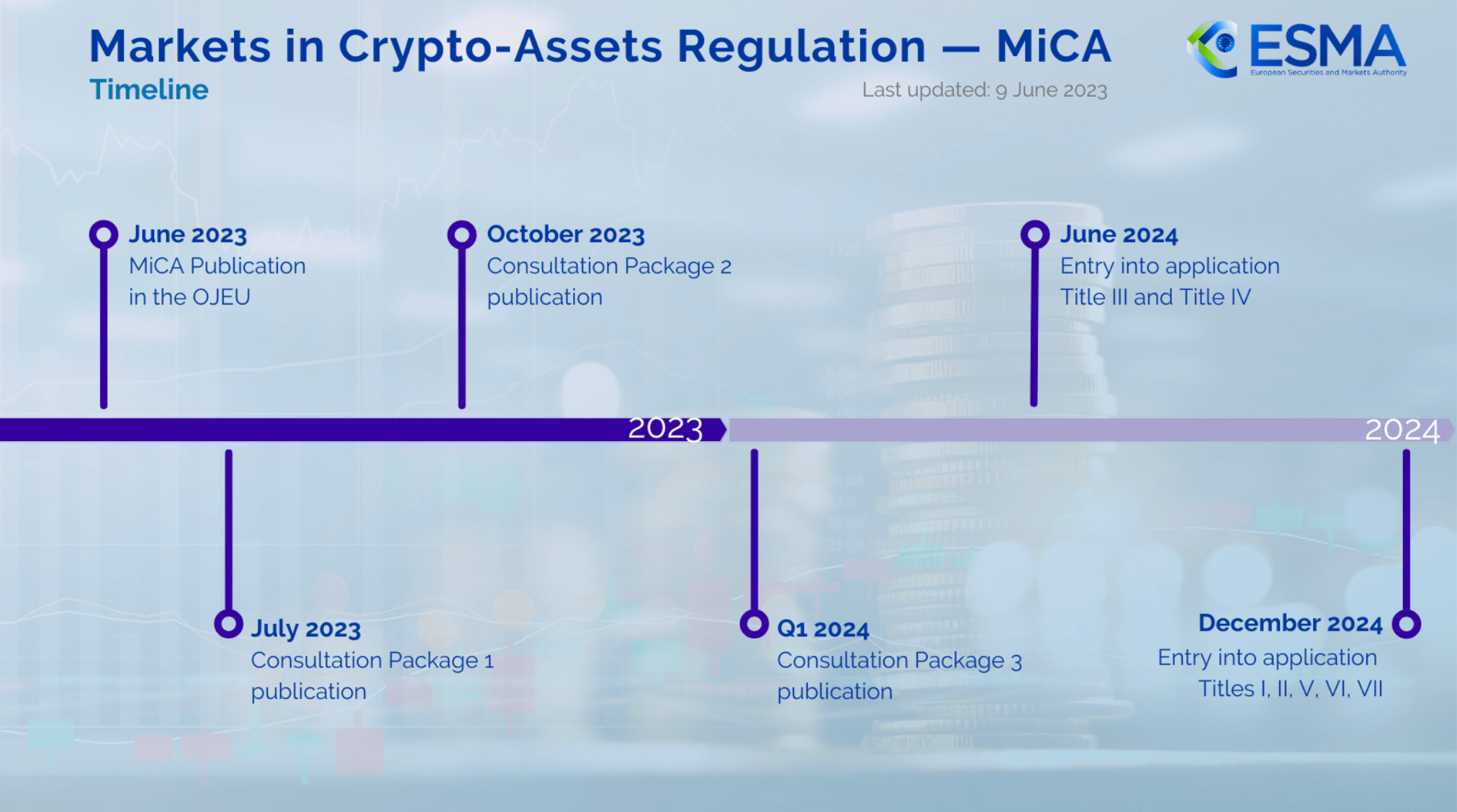

Cassie Craddock, Managing Director of Europe at Ripple, said that with the implementation of the European Union’s (EU) Market’s in Crypto-Assets regulation (MiCA) across the continent, it has become easier for the region’s banks to offer digital asset services to their customers.

For the uninitiated, Europe’s MiCA is the EU’s comprehensive legal framework designed to regulate digital assets, stablecoins, and other related service providers across all member states.

Ripple Custody will enable BBVA to meet rapidly increasing customer demand for access to digital assets such as BTC and ETH. At the same time, it will also ensure that the bank fulfills the strict regulatory, security, and operational requirements. Francisco Maroto, Head of Digital Assets at BBVA said:

Ripple’s custody solution allows us to leverage proven and trusted technology that meets the highest security and operational standards, allowing BBVA to directly provide an end-to-end custody service to its customers. Through this agreement we can deliver on our goal of supporting our customers to explore digital assets, backed by the strength and security of a bank like BBVA.

It is worth highlighting that the agreement between BBVA and Ripple is just the latest chapter in the relationship between the two entities. Ripple already provides crypto custody solutions to Turkey-based Garanti BBVA and BBVA Switzerland.

Crypto Custody Solutions In Focus

Over the past month, several developments have occurred in the industry pertaining to crypto custody solutions. For instance, recently Ripple joined forces with UAE-based Ctrl Alt to expand its crypto custody services.

A favorable stance toward digital assets in the US is a key factor encouraging banks to offer crypto custody solutions to their clients. For example, US Bancorp recently resumed its Bitcoin custody services after a hiatus of three years.

In similar news, the “big three” banking regulators in the US – namely the OCC, Federal Reserve, and FDIC – recently jointly issued guidance on how banks should approach the custody of digital assets. At press time, Bitcoin trades at $111,040, down 1.2% in the past 24 hours.