Sber, Russia’s largest universal bank which is majority-owned by the state, has begun marketing a new class of structured bonds whose payouts are indexed to the US-dollar price of Bitcoin and to movements of the dollar against the ruble, opening an officially regulated on-shore route into the world’s pre-eminent cryptocurrency for qualified Russian investors.

Russia Launches Bitcoin Linked Bonds

The notes, announced in a 30 May press release, are denominated in rubles and settle entirely inside the domestic clearing and depository infrastructure. Sber told clients the instrument “provides investors with two yield mechanisms: they can earn income from future US-dollar value changes in Bitcoin and from a possible US-dollar strengthening against the ruble,” while requiring neither a crypto wallet nor interaction with “unregulated foreign platforms.”

Sber is initially distributing the securities over the counter to a select group of qualified investors but intends to list subsequent tranches on the Moscow Exchange (MOEX) “to ensure transparency, liquidity and convenience for a wide range of qualified investors,” the bank said. It also confirmed that cash-settled Bitcoin futures will appear on its SberInvestments platform on 4 June, the same day MOEX is scheduled to launch its own contract.

The debut comes only days after the Bank of Russia relaxed its long-standing opposition to crypto-linked instruments. On 28 May the central bank said that brokers and exchanges may offer non-deliverable derivatives and structured products linked to digital assets to “qualified” market participants, provided no physical cryptocurrency changes hands.

Deputy chairman Anatoly Popov framed Sber’s bonds as the first tangible application of the new regime, promising investors “convenient and secure exposure to cryptocurrency assets — without direct ownership of cryptocurrencies, while fully complying with regulatory requirements on Russian infrastructure.”

Sber’s decision also reflects the bank’s broader digital-asset strategy. Over the past four years it has built a permissioned blockchain network, experimented with a ruble-pegged “Sbercoin” and integrated MetaMask connectivity, positioning itself as the domestic champion of tokenized finance even as international sanctions curtailed its foreign operations.

Structurally, the new bond functions as a synthetic call spread. Coupon payments reference the percentage change in BTC’s dollar price over a preset term, plus any appreciation of the dollar/ruble FX rate, subject to caps spelled out in the offering circular.

Because settlement is in rubles via Russia’s National Settlement Depository, investors remain within the local legal perimeter and avoid the custodial and tax complexities of holding spot Bitcoin abroad. Pricing details were not disclosed.

The US Falls Behind (But Could Still Win)

Market professionals view the product as a watershed. “I don’t think most grok what BitBonds are going to do for Bitcoin,” podcast host Marty Bent wrote on X. “BitBonds create a forward looking duration curve that brings certainty that x amount of bitcoin is off the market for y amount of time.”

The launch also triggered geopolitical commentary: “It appears that Russia has just soft-launched BitBonds through Sberbank — while the USA continues to drag its feet,” posted the pseudonymous trader British HODL, while analyst Justin Bechler argued that the instruments give “BRICS sovereigns and institutions instant access to Bitcoin exposure with zero friction.”

Bitcoin Magazine CEO David Bailey added, “We need BitBonds in America now. Like now now.”

In Washington, the idea of BitBonds exists only in white-paper form. Two months ago the Bitcoin Policy Institute (BPI) published “Bitcoin-Enhanced Treasury Bonds: An Idea Whose Time Has Come,” arguing that the US Treasury should issue up to $2 trillion of so-called BitBonds carrying a 1% coupon. 10% of the proceeds—about $200 billion—would be used to purchase BTC for the newly created Strategic Bitcoin Reserve; the rest would refinance conventional debt.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554 billion,” wrote co-authors Andrew Hohns and Matthew Pines, adding that the embedded BTC call option could “defease up to $50 trillion of federal debt by 2045 if historical growth rates persist.” Speaking at BPI’s Bitcoin for America forum in March, Hohns framed the concept as “a win-win-win—lower borrowing costs, a meaningful sovereign Bitcoin reserve, and upside participation for taxpayers.”

Yet the proposal remains in limbo. Treasury officials have not commented publicly, and while several pro-Bitcoin lawmakers—including Senators Cynthia Lummis and Bill Hagerty—say they are studying the framework, no enabling legislation has been introduced.

Technically, Russia’s product and BPI’s blueprint pursue the same goal—bringing BTC’s upside into regulated bond markets—but by opposite routes. Sber structure is a ruble-denominated note whose coupon is synthetically linked to spot BTC/USD and USD/RUB; settlement is entirely in fiat and cleared through domestic infrastructure.

The BPI vision creates a US Treasury security denominated in dollars, paying a below-market coupon but embedding a call option on Bitcoin; 10% of principal would buy—and permanently warehouse—physical BTC. In effect, Sber is offering investors price exposure while the BPI wants the sovereign itself to own coins.

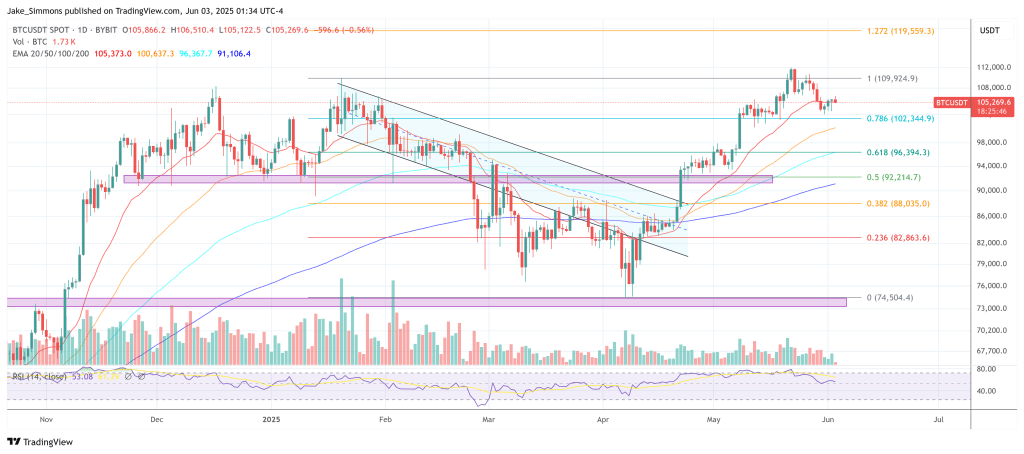

At press time, BTC traded at $105,269.