French Member of the European Parliament (MEP) Sarah Knafo delivered a high-profile address, urging the European Union (EU) to adopt a “Strategic Bitcoin Reserve” as part of a broader effort to promote financial autonomy and combat inflationary pressures.

A French magistrate and member of the Cour des Comptes, Knafo’s background includes public service and political advising, most notably for right-wing Jewish presidential candidate Éric Zemmour. Knafo’s public role has steadily risen since her election to the European Parliament in 2024.

Why The EU Needs A Strategic Bitcoin Reserve

In her speech on the Parliament floor, Knafo drew upon global examples—citing El Salvador’s early adoption of Bitcoin and political figures such as former US President Donald Trump and Federal Reserve Chairman Jerome Powell—to underscore a rising wave of institutional acceptance. She asserted that the EU’s current financial strategies put member states at a disadvantage within what she characterized as a rapidly evolving monetary landscape.

“Already 3 years ago, on the other side of the Atlantic, the president of El Salvador decided to invest for his country in crypto-currencies,” said Knafo, referencing El Salvador’s 2021 legal tender law. “At the time, he was reviled by the political class and the IMF. Today, he’s up 100%.”

Emphasizing a perceived missed opportunity for EU nations, Knafo argued that El Salvador’s move has yielded significant capital gains—resources that, she said, the country has used to bolster both “the security and sovereignty of his country.” Turning to the United States, she acknowledged that “Donald Trump will establish a strategic Bitcoin reserve for the United States.”.

Knafo also invoked the public stance of Federal Reserve Chairman Jerome Powell, stating that “Jerome Powell […] is now talking about it as ‘digital gold.’” She positioned these developments as signs that other major economies are adapting to decentralized finance, while “the European Union […] continues to accumulate tragically inflationary deficits,” with existing regulatory measures that she criticized as overly restrictive.

“We don’t want this dystopian world,” Knafo warned, referencing the European Central Bank’s work on a digital euro. “Where tomorrow a European bureaucrat will be able to prohibit us from certain transactions and even eliminate us from the banking system at the click of a button for something we say on social networks.”

Throughout her address, Knafo appealed for a wholesale shift in EU financial policy: “It’s time to say no to the totalitarian temptations of the European Central Bank, which wants to impose a digital euro entirely in its own hands […] It’s time to bet on freedom.”

She went on to advocate for a flourishing Bitcoin mining sector in the EU, suggesting that France’s nuclear energy infrastructure could supply a competitive edge. “We, the French, hold the cards with our nuclear trump card,” she said, framing domestic power generation as an untapped enabler of large-scale mining operations.

Knafo also addressed the need to adjust current taxation policies, urging lawmakers to “stop taxing cryptocurrency holders” and stressing that crypto-asset holders took personal risks to generate their wealth. She characterized existing government deficits as directly fueling inflation and economic instability: “Government deficits that drive money creation […] create inflation, that lead to chaos […] Let them protect themselves from the insane spiral you’ve created.”

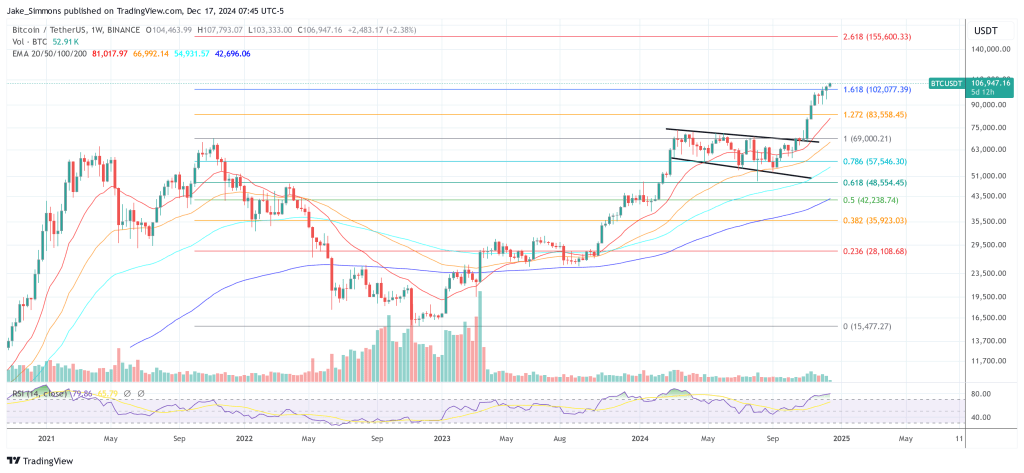

At press time, Bitcoin traded at $106,947.