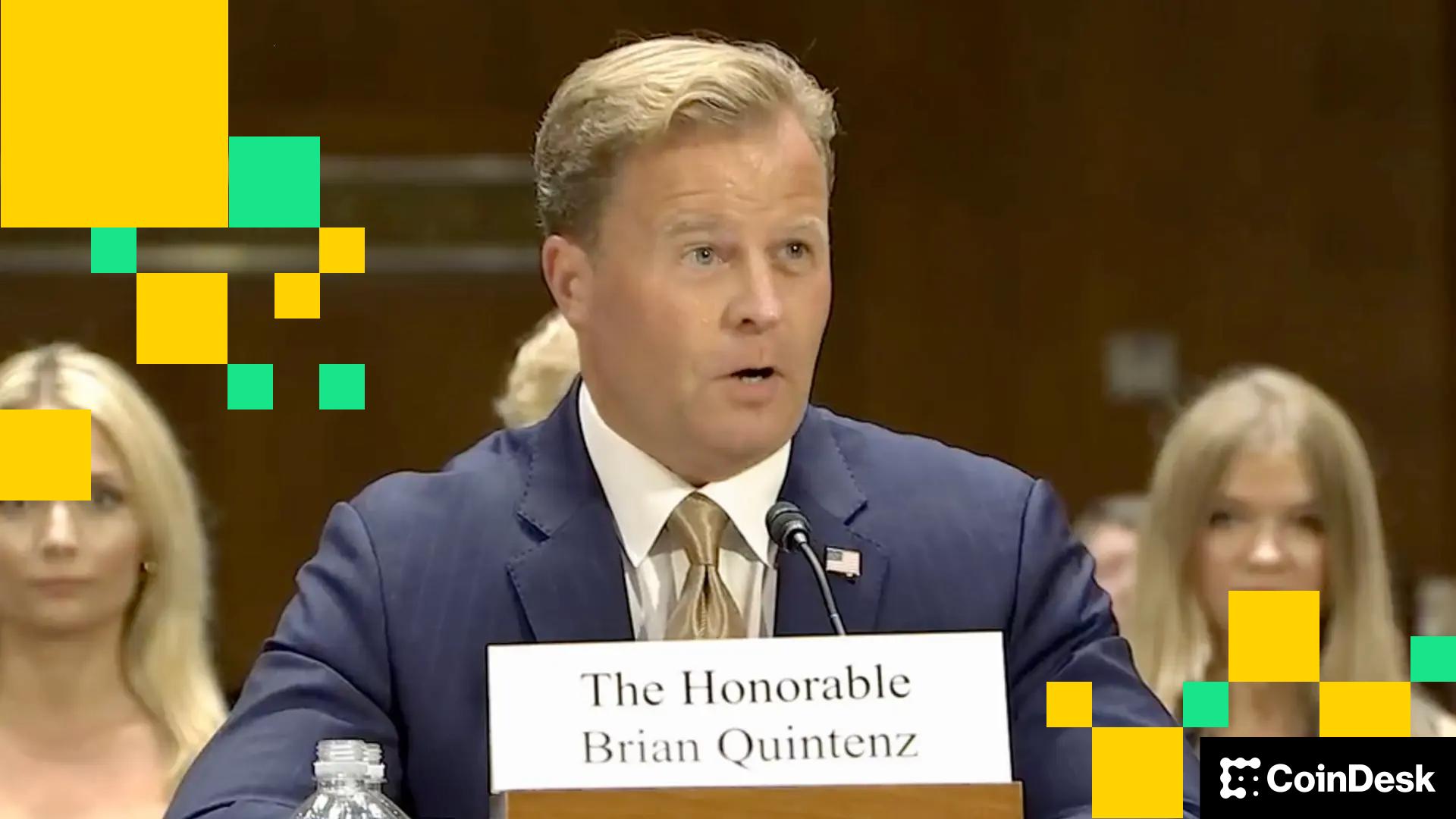

SUI Group (SUIG), a Nasdaq-listed company tied to the Sui blockchain ecosystem, has appointed Brian Quintenz as an independent director to its board, the firm said in a press release on Tuesday.

Quintenz will also serve on the board’s audit committee, the company said.

SUIG shares are lower by 2.2% on Tuesday. The SUI token continued its 2026 rally, higher by 14% over the past 24 hours.

His appointment follows the transition of SUI Group chief financial officer Joseph A. Geraci II from a board seat to a board observer role. With the change, the board now has five members, three of whom are considered independent under Nasdaq listing standards.

Quintenz is a former commissioner of the U.S. Commodity Futures Trading Commission (CFTC), where he served after being nominated by Presidents Barack Obama and Donald Trump and confirmed unanimously by the Senate.

During his tenure at the agency, he was involved in oversight of derivatives markets, financial technology and early regulation of bitcoin futures.

More recently, Quintenz was global head of policy at a16z crypto, the digital asset arm of venture capital firm Andreessen Horowitz, where he led regulatory and government engagement efforts.

He currently serves on the board of Kalshi, a CFTC-regulated event-based derivatives exchange, and has advised companies across digital assets and traditional financial markets.

The White House withdrew Quintenz’s nomination to run the CFTC in September, capping off a month-long fight over U.S. President Donald Trump’s pick for the agency chair. Michael Selig was sworn in as the sixteenth Chairman in December.

SUI Group said the appointment adds regulatory and policy experience as it develops a treasury strategy centered on the SUI token.

“Brian is a widely respected leader in the digital asset industry, with a rare combination of capital markets expertise, regulatory credibility, and deep infrastructure knowledge,” said Marius Barnett, chairman of the board, in the release.

“His decision to join our board and support our SUI treasury strategy represents a meaningful validation of both SUIG and the long-term potential of the Sui ecosystem,” he added.

The company maintains a formal relationship with the Sui Foundation and is focused on building what it describes as an institutional-grade digital asset treasury platform, while continuing its specialty finance operations.

Read more: Sui Blockchain to Host Native Stablecoins Backed by Ethena and BlackRock’s Tokenized Fund