In an impressive display of growth, USDT issuer Tether consolidated 80 tons of gold into a single Swiss vault, representing around $8 billion. Gold’s value has been on the rise, and the firm is looking to buy more.

However, this stockpile still represents less than 5% of Tether’s USDT reserves, and there hasn’t been an audit yet. The company certainly has an impressive footprint, but there are outstanding questions about its internals.

Tether’s New Gold Reserve

Tether, one of the world’s leading stablecoin issuers, has a widely known association with gold, launching a token based on the metal almost exactly two years ago.

Earlier this year, the company declared that it held 7.7 tons of gold, and it’s evidently been acquiring more. Today, a Bloomberg article reveals Tether’s consolidated stockpile in a Swiss vault:

“We have our own vault. I believe it’s the most secure vault in the world. If you have your own vault, eventually with the size, it gets much cheaper to do custody,” claimed CEO Paolo Ardoinio. He added that gold “should logically be a safer asset than any national currency.”

Based on this interview, Tether has purchased 0.3 tons of gold since publishing its Q1 2025 report. It’s currently one of the largest holders in the world.

This is especially impressive considering that Tether’s main competitors on this front are international banks and world governments.

If nothing else, it’s a good time to invest in gold; several geopolitical developments have strengthened its position recently. It may be difficult to determine the “all-time high” of a commodity that has been used for millennia. Suffice it to say, gold’s at its highest point in hundreds of years.

By moving all its gold reserves into one vault, Tether has created a few opportunities for itself. Maintaining a single facility has fewer overhead costs, and it could streamline the storage process for future acquisitions.

Plus, the vault represents an impressive public accomplishment for Tether.

Still, Tether did not buy this gold as an investment vehicle. These commodities make up its stablecoin reserves, which have never been audited. Despite promises to perform an audit and threats from the US’ legal system, Tether has yet to conduct such an audit.

Some community members reacted negatively to the Swiss vault announcement, considering it a distraction from the audit question. Tether may soon become an integral part of global dollar dominance, making this question extremely relevant.

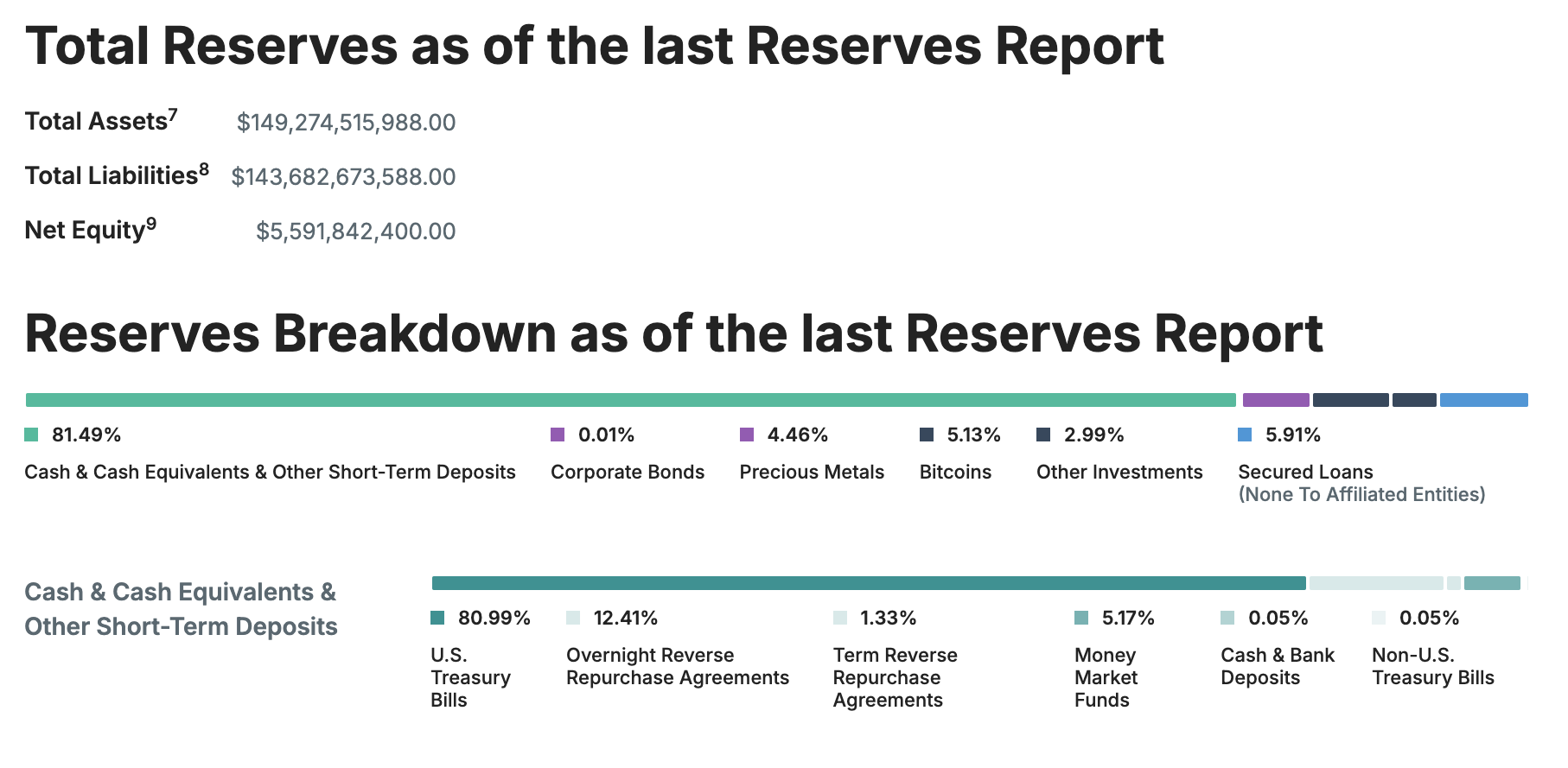

The crux of the issue is simple: Tether holds $8 billion in gold but has issued over $159 billion in circulating USDT tokens. To be sure, the firm is certainly very profitable, and it holds substantial assets.

Tether’s Q1 2025 report also showed $98 billion in US Treasury bond holdings, and this number has likely increased, too. Gold, however, is less than 5% of its portfolio:

All that is to say, Tether’s new $8 billion gold vault is certainly very impressive. However, the crypto industry shouldn’t necessarily consider the reserve issue settled.

This stockpile is a tiny fraction of its purported reserves, and it’ll be a footnote in a larger audit of the company. There are still outstanding questions about the other 95% of assets backing USDT’s peg.

The post Tether Consolidates Gold Reserves Worth $8 Billion in Swiss Vault appeared first on BeInCrypto.