Kraken, a leading cryptocurrency exchange, has joined forces with industry giants Coinbase and Binance in a legal standoff against the US Securities and Exchange Commission (SEC). These lawsuits could have a major impact on the ongoing discourse over crypto regulation.

Kraken, during a testimony before both the House Financial Services Committee and the House Agriculture Committee on May 10, 2023, argued that existing laws fall short in covering the digital asset industry.

Kraken Ups the Ante Against SEC

The exchange stressed the need for Congress to develop a more comprehensive set of rules to safeguard consumers and investors. A day after this testimony, the SEC announced its intention to sue Kraken.

This was met with a firm response from Kraken, which filed a motion to dismiss the lawsuit. The exchange’s argument hinges on the claim that the digital assets in question do not constitute investment contracts, thus falling outside the SEC’s purview.

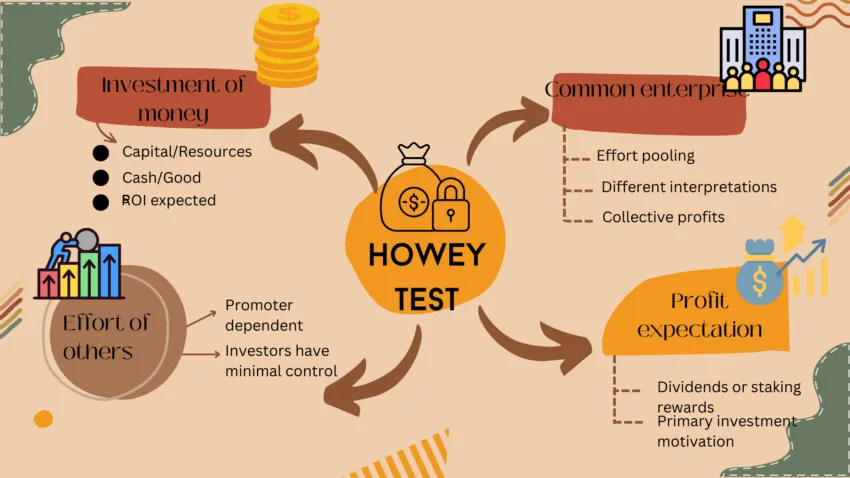

The SEC determines this classification by using the Howey Test. An asset can be classified as a security if it meets any of the four characteristics of the test. Kraken argues that none of its listed assets fall under these attributes.

Read more: What Is the Howey Test and How Does It Impact Crypto?

A recent Kraken blog post explained its point of view:

“Even taking all of the SEC’s allegations in the Complaint as true – and many are not – its argument is flawed as a matter of law.”

Coinbase and Binance Suits Ongoing

Coinbase, another prominent player in the crypto space, is escalating its own battle with the SEC. The exchange has launched an appeal against the SEC, pushing it to make a clear-cut decision on classifying cryptocurrencies. Paul Grewal, Coinbase’s Chief Legal Officer, described the SEC’s stance as:

“Arbitrary and capricious, an abuse of discretion, and contrary to law.”

Meanwhile, Binance is preparing to confront the SEC in a Washington courtroom. The SEC’s lawsuit against Binance includes allegations of artificially inflating trading volumes and enabling the trading of crypto tokens deemed securities.

Read more: Who Is Changpeng Zhao? A Deep Dive Into the Ex-CEO of Binance

Binance’s response underscores its position that the SEC lacks the authority to oversee crypto assets. This is a stance echoed by Coinbase in its legal struggle.

The collective stance of these major exchanges highlights a fundamental clash over the SEC’s role in regulating the crypto market. Its concerted efforts to seek legal clarity and challenge the SEC’s authority over crypto asset management underscore the industry’s need for sensible guidelines.

![]()

PrimeXTB

PrimeXTB ” target=”_blank”>Explore →

![]()

Coinbase

Coinbase” target=”_blank”> Explore →

![]()

AlgosOne

AlgosOne” target=”_blank”>Explore →

![]()

Wirex App

Wirex App” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

Margex

Margex” target=”_blank”>Explore →

Explore more

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post This Leading Crypto Exchange Rallies With Coinbase, Binance in Legal Standoff Against SEC appeared first on BeInCrypto.