Crypto news: Last week the crypto world experienced exuberance and shock in equal measure. On-chain metrics revealed Bitcoin (BTC) whales are growing increasingly bullish in light of the recent US Federal Reserve (Fed) rate pauses, while the conviction of former crypto mogul Sam Bankman-Fried (SBF) marked a stunning fall from grace for one of crypto’s early champions and refocused scrutiny on crypto.

Fed Chair Jerome Powell affirmed on Wednesday the central bank will hold interest rates unchanged at 5.25-5.5%, marking the third consecutive rate pause in this cycle. On-chain data revealed patterns that the Fed’s policy is turning investors bullish toward Bitcoin, even as former crypto champion Sam Bankman-Fried withered under the guilty verdict of nine jury members in Manhattan.

Bitcoin Upside From Fed Decision

The Federal Open Markets Committee (FOMC) announced on Nov. 1 that the central bank would keep interest rates fixed. Powell admitted the move would slow economic growth as the Fed but was necessary to fight inflation.

The decision to keep rates constant saw Treasury yields fall from 4.73% from 5% earlier this week. This reduction means that markets believe that the Fed may be done hiking rates.

A pause could be bullish for Bitcoin and cryptocurrencies, since rate increases have historically coincided with massive declines in the price of Bitcoin. Between March and December 2022, when the Fed’s rate hikes were at their most aggressive, Bitcoin fell 66% from $47,000.

Bullish Bitcoin Whale Transactions

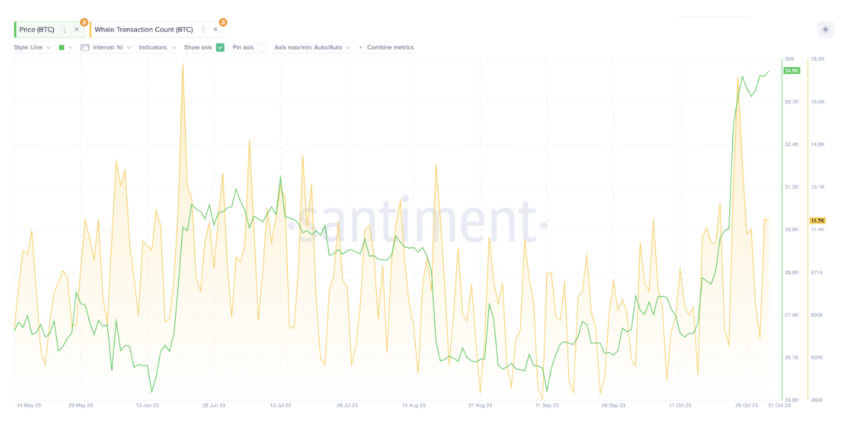

Before the FOMC announcement, BeInCrypto’s on-chain analyst Ibrahim Ajibade said on-chain activity showed crypto investors had already penciled in a rate pause. Between Oct. 22 and Nov 1, Bitcoin attracted 7,000 daily transactions by large crypto holders, called whales.

On Oct. 24 alone, there were 17,520 large transactions, the largest since BlackRock announced its intention to file for a Bitcoin exchange-traded fund. Intuitively, a rise in whale transaction count is bullish because it points to a higher demand for Bitcoin from institutional and high net-worth individuals.

Read more: Top 11 Public Companies Investing in Cryptocurrency

Another metric, called the Global In/Out of the Money data, which tracks historical buying trends, revealed that the $35,100 resistance level is the most urgent hurdle Bitcoin must overcome before reaching $40,000.

Read more: 8 Best On-Chain Analysis Tools in 2023

VanEck Predicts Solana Surge by 2030

But Bitcoin is not the only beneficiary of the most recent rate pause. Crypto asset manager VanEck believes that Solana could rise more than 10,000% by 2030 if its user base rises to 100 million.

A bull market, widely believed to be not too far away, could see the asset surge to $3,211. The network, criticized for its downtime and centralization, recently struck partnerships with Visa and Shopify that could help increase its user base.

Following the FOMC announcement, the price of Solana surged 16% to $39.36 on Nov. 1. The Fed news saw it break out from its $28 horizontal resistance area established after it collapsed in November last year.

Crypto Assets Were Not SAFU After All

Staying on-chain, crypto sleuth ZachXBT revealed that users of a password manager called LastPass lost approximately $4 billion in crypto assets on Oct. 25. A hack that started in December affected 80 entities who stored their crypto assets on LastPass.

ZachXBT advised people who stored keys or seed phrases on LastPass to move their assets. Tayvano, a Twitter user who also worked on the investigation, advised those affected to file a complaint with the Internet Crime Complaint Center (IC3).

Read more: Top 10 Must Have Cryptocurrency Security Tips

Musk’s X Experiment So Far

Off-chain, BeInCrypto recently reflected on how successful billionaire entrepreneur Elon Musk has been in turning X, formerly Twitter, into an “everything app.” After Musk acquired Twitter, he rebranded the platform to X as he charted a new course for the platform.

Musk’s links with Dogecoin suggested he might integrate a native “X” token into the social media app. While the billionaire dismissed the idea, new CEO Linda Yaccarino affirmed that X is working with partners to integrate video, audio, messaging, and banking services.

So far, Musk has been unable to completely eliminate bots, something he vowed to do as part of an effort to turn the platform around. Subscription tiers, including the aptly-named “not-a-bot” trial in New Zealand and the Philippines, have had limited success.

While user numbers declined since Musk took over, the platform remains a popular hub for crypto enthusiasts, influencers, politicians, and CEOs. Tweets by Musk also continue to move crypto markets.

Hasta La Vista, SBF

Speaking of CEOs, former FTX CEO Sam Bankman-Fried was convicted on several counts of fraud and money-laundering in a Manhattan Federal Court on Thursday. The verdict came after prosecutors urged jurors to believe court evidence over Bankman-Fried’s “storytelling.”

Once a titan of the crypto industry, Bankman-Fried’s fall from grace has been nothing short of stunning. It’s hard to believe that the person behind one of the biggest frauds in US history was once compared to banking godfather John Pierpont Morgan.

Bankman-Fried’s lawyers said the former crypto boss still maintained his innocence and will fight the judgment. Bankman-Fried’s sentencing trial is set to take place on March 10, 2024.

A week ago, hedge fund manager Travis Kling tweeted that FTX creditors may be fully compensated after Google invested $2 billion in Anthropic. The investment values the artificial intelligence firm at $4 billion, making it likely the bankruptcy estate will be able to recover the entirety of FTX’s investment.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

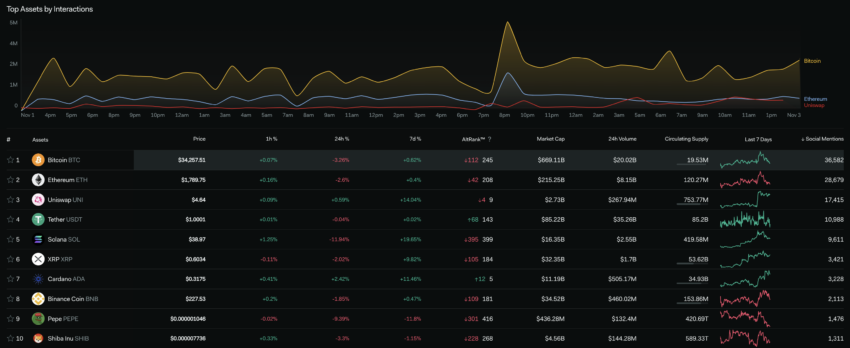

Crypto – Socially Speaking

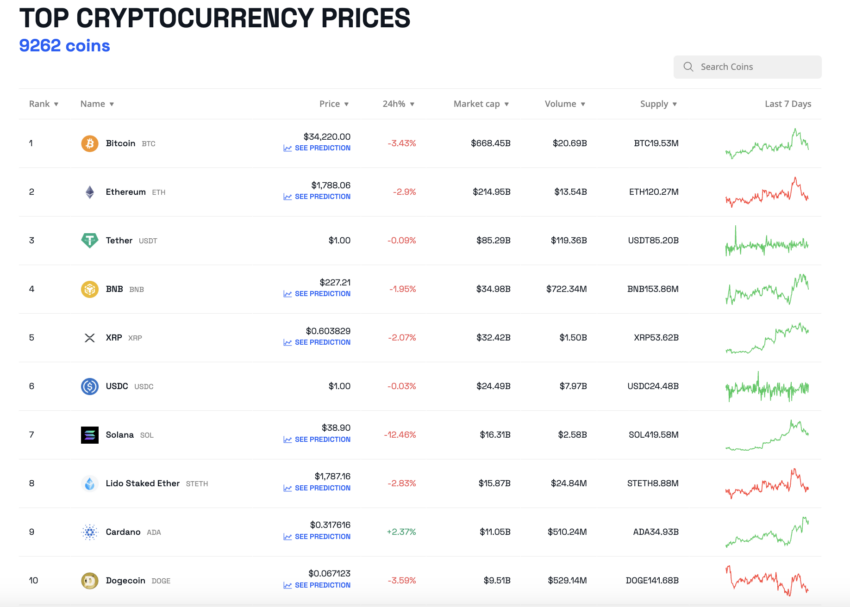

Top 10 Crypto Prices This Week

Do you have something to say about the impact of the Fed rate pause decision policy on Bitcoin, Sam Bankman-Fried, or any of the top stories this week? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Top crypto platforms | November 2023

OKX

OKX” target=”_blank”>Fees from 0.10% →

Kraken

Kraken” target=”_blank”>Up to 24% APY →

BYDFi

BYDFi” target=”_blank”>No KYC →

INX

INX” target=”_blank”>No fees 30 days →

The post This Week in Crypto: Good Night SBF, Fed Pauses Rates, and ‘X’ Changes Under Musk appeared first on BeInCrypto.