Top NFT Investments to Watch for Maximum Returns in 2025

The NFT space has seen explosive growth, evolving from a niche digital asset class to a mainstream phenomenon. Initially gaining traction in the art world, NFTs now span multiple industries, including gaming, virtual real estate, and entertainment. The rise of blockchain technology, along with NFTs’ ability to provide unique ownership and provenance, has revolutionized how we think about digital assets. From digital collectibles to virtual goods, NFTs have become integral to the development of the metaverse and decentralized applications, establishing themselves as a transformative force in the digital economy.

Looking ahead to 2025, the NFT market is poised for further growth driven by several key factors. Technological advancements in blockchain, the increasing adoption of Web3, and the expansion of the metaverse are expected to fuel demand for NFTs. As more industries adopt these technologies and consumers engage in virtual worlds, NFTs will become more ingrained in everyday digital experiences. For investors, 2025 offers a promising landscape of high-return opportunities, with new and innovative NFT projects on the horizon, making it an exciting time to explore the potential of this evolving market.

Table of the Content

Understanding NFTs and Investment Potential

Criteria for Selecting High-Return NFTs

The Top 10 NFTs to Watch in 2025 for High-Return Investments

· 1. Bored Ape Yacht Club (BAYC)

· 2. Decentraland LAND

· 3. The Sandbox

· 4. CryptoPunks

· 5. Azuki

· 6. DeGods

· 7. Pudgy Penguins

· 8. The Ape Society

· 9. Saved Souls

· 10. TG.Casino NFTs

How to Maximize Your Returns in NFTs

Conclusion

FAQ

Understanding NFTs and Investment Potential

NFTs (Non-Fungible Tokens) are unique digital assets that represent ownership or proof of authenticity of a specific item, often tied to art, collectibles, or in-game assets. As the NFT space expands, the potential for these digital assets to offer substantial returns grows, attracting investors looking for high-yield opportunities. The investment potential of NFTs largely hinges on factors like rarity, utility, and the strength of the underlying project. Strong communities and innovative NFT development are crucial in determining which NFTs will appreciate in value. As more industries, including gaming, fashion, and entertainment, integrate NFTs into their ecosystems, the market’s growth and opportunities for profitable investments will continue to rise.

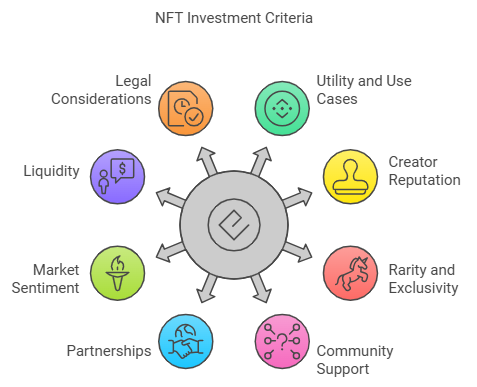

Criteria for Selecting High-Return NFTs

When selecting NFTs with high-return potential, consider the following key criteria:

1. Utility and Use Cases

- Beyond Art: NFTs offering more than just visual art, such as virtual real estate, in-game assets, or access to exclusive experiences, tend to offer higher long-term value.

- Functionality: Look for NFTs that provide ongoing utility, such as membership to private communities, event access, or benefits in a larger ecosystem (e.g., metaverse integration).

2. Creator and Project Reputation

- Established Creators: NFTs from well-known and respected creators or brands generally hold greater value. A strong track record and fanbase can drive demand.

- Team and Vision: The development team behind the project is crucial. A transparent, skilled team with a clear roadmap indicates a greater chance for success.

3. Rarity and Exclusivity

- Limited Editions: Scarcity drives demand. NFTs with limited editions or unique traits (e.g., one-of-a-kind pieces) are more likely to appreciate in value.

- Unique Characteristics: The more rare or distinctive the asset, the higher its potential for growth.

4. Community and Network Support

- Active Community: A strong, engaged, and loyal community is often a sign of an NFT’s longevity and value. Look for projects with active Discord, Twitter, or other social media presence.

- Network Effect: NFTs that tap into growing or emerging communities (e.g., gaming, metaverse, or digital art) tend to have better long-term growth potential.

5. Partnerships and Collaborations

- Brand and Celebrity Endorsements: NFTs associated with major brands, celebrities, or influencers can experience significant demand spikes.

- Cross-Industry Collaborations: Partnerships that extend across multiple industries (e.g., gaming, fashion, sports, and entertainment) can add long-term value.

6. Market Sentiment and Trends

- Cultural Relevance: NFTs tied to trending cultural movements (e.g., memes, digital art movements, or events) often see quicker growth.

- Adoption and Media Buzz: Projects gaining mainstream media coverage or aligning with broader trends like the metaverse or Web 3.0 often outperform.

7. Liquidity and Trading Volume

- Market Demand: NFTs that are actively traded on established platforms like OpenSea or Rarible are often easier to liquidate and carry more consistent value.

- Sales History: A strong sales history, high trading volume, and frequent price appreciation often indicate a healthy, growing market.

8. Long-Term Viability

- Sustainability: Consider whether the project has long-term growth potential. Some NFTs tied to emerging technologies or the metaverse will likely appreciate as the ecosystem develops.

- Roadmap and Future Plans: Evaluate the project’s roadmap and future updates to ensure they have a clear vision for continued growth.

The Top 10 NFTs to Watch in 2025 for High-Return Investments

Explore the top 10 NFTs to watch in 2025 for high-return investments, offering unique utility, scarcity, and strong community support.

1. Bored Ape Yacht Club (BAYC)

Blockchain: Ethereum

The Bored Ape Yacht Club (BAYC) is a premier collection of 10,000 unique hand-drawn digital avatars, each featuring a distinct design, personality, and characteristics. Created by Yuga Labs in 2021, these NFTs are more than just collectibles; they offer their holders access to an exclusive online club, real-world events, and additional perks, making them a prominent status symbol in the NFT space.

Category: NFTs, Digital Art, Collectibles

Key Features:

- Limited Edition of 10,000 NFTs

- Exclusive member benefits (events, parties, etc.)

- Strong community and brand collaborations

- Intellectual property rights for the owners

Reasons to Invest:

BAYC has become a cultural phenomenon, with strong backing from celebrities and collectors. Its scarcity and utility, combined with its expanding brand presence, give it a unique position in the NFT and digital asset market. BAYC represents a blend of exclusivity, digital ownership, and community engagement, making it a desirable asset for long-term investment.

2. Decentraland LAND

Blockchain: Ethereum

Decentraland LAND is a non-fungible token (NFT) representing a parcel of virtual land in Decentraland, a decentralized metaverse built on the Ethereum blockchain. LAND is used to create and manage virtual experiences, including games, social spaces, art galleries, and more, all accessible to users within the Decentraland platform. Each LAND token is unique, offering true ownership within the metaverse.

Category: Virtual Real Estate, Metaverse, NFTs

Key Features:

- Virtual land ownership within Decentraland

- Customize, build, and monetize virtual spaces

- Seamless integration with Decentraland’s ecosystem

- Community-driven governance and decentralized control

Reasons to Invest:

Decentraland’s LAND offers an opportunity to own a piece of the growing metaverse, where virtual real estate is becoming increasingly valuable. As more users and businesses engage with the virtual world, the demand for LAND is expected to rise. Additionally, LAND holders can monetize their properties, rent spaces, or create experiences, providing potential for passive income. Its position within the growing digital economy makes it a promising long-term investment.

3. The Sandbox

Blockchain: Ethereum

The Sandbox is a decentralized virtual world and gaming platform where users can create, own, and monetize their virtual experiences and assets. Built on the Ethereum blockchain, it allows users to buy, sell, and trade virtual land, games, and assets as NFTs. The platform has gained traction with its play-to-earn model, enabling both creators and players to participate in a thriving virtual economy.

Category: Virtual Real Estate, Gaming, Metaverse, NFTs

Key Features:

- User-owned virtual world with customizable assets

- Play-to-earn opportunities through gaming experiences

- Marketplace for buying, selling, and trading virtual land and assets

- Integration with popular tools like VoxEdit for asset creation

- Partnerships with major brands and celebrities

Reasons to Invest:

The Sandbox is a leading player in the metaverse, with a strong community and growing ecosystem. Its play-to-earn model offers long-term potential for creators and investors to generate revenue. As virtual worlds become more integrated into mainstream culture, The Sandbox’s established presence and partnerships position it well for future growth. Investing in virtual land and assets can offer significant returns as the metaverse expands.

4. CryptoPunks

Blockchain: Ethereum

CryptoPunks is one of the earliest and most iconic NFT collections, created by Larva Labs in 2017. Comprising 10,000 unique 24×24 pixel art characters, CryptoPunks are stored on the Ethereum blockchain. As one of the first successful NFT projects, CryptoPunks has become a symbol of the digital art and collectible movement, often seen as a prestigious status symbol in the NFT community.

Category: NFTs, Digital Art, Collectibles

Key Features:

- Limited edition of 10,000 unique characters

- First-mover advantage in the NFT space

- High rarity and distinctive pixel art designs

- Owners hold intellectual property rights for their punks

- No two CryptoPunks are the same, each with unique traits

Reasons to Invest:

CryptoPunks are considered a foundational collection in the NFT space, with historical significance and cultural influence. Their scarcity, combined with high demand from collectors, makes them valuable assets. As one of the most recognized NFT projects, they hold long-term investment potential, with their rarity and association with digital art history ensuring sustained interest and high resale value.

5. Azuki

Blockchain: Ethereum

Azuki is a premium NFT collection that blends anime-inspired art with decentralized digital ownership. Launched in 2022, Azuki features a series of 10,000 hand-drawn avatars that combine vibrant designs and unique personalities. Beyond the art, Azuki aims to build a global community, offering members exclusive access to both digital and real-world experiences. The project focuses on creating a dynamic ecosystem, including the future development of a metaverse.

Category: NFTs, Digital Art, Community, Metaverse

Key Features:

- Limited edition of 10,000 NFTs with anime-inspired artwork

- Exclusive community access and events

- Strong emphasis on building a metaverse and ecosystem

- High rarity traits and frequent collaborations with artists and brands

- Holders gain full intellectual property rights for their avatars

Reasons to Invest:

Azuki has quickly become a leading project in the NFT space due to its unique art, strong community engagement, and plans for an expanding digital ecosystem. Its anime style appeals to a global audience, while its emphasis on ownership and metaverse development adds utility and long-term value. With high-profile collaborations and continuous community growth, Azuki offers strong potential for both cultural influence and financial return.

6. DeGods

Blockchain: Solana (soon to migrate to Ethereum)

DeGods is a premier NFT collection known for its bold, high-quality art and vibrant community. Launched in 2021, DeGods has become one of the most influential and popular NFT projects on the Solana blockchain. The collection consists of 10,000 unique digital avatars, each with distinct characteristics and traits. DeGods focuses on creating a premium experience for its holders, with exclusive benefits, events, and future developments in the DeGods ecosystem, including its upcoming migration to Ethereum.

Category: NFTs, Digital Art, Collectibles

Key Features:

- Limited edition of 10,000 NFTs with detailed artwork

- Strong, engaged community and VIP experiences

- Frequent collaborations with artists, brands, and other NFT projects

- Holder-exclusive benefits, such as staking rewards and events

- Future plans for ecosystem expansion and cross-chain functionality

Reasons to Invest:

DeGods is seen as one of the most prestigious and forward-thinking NFT collections. Its unique art style, dedicated community, and migration to Ethereum enhance its long-term value. The project’s emphasis on rewards and exclusivity offers tangible benefits to holders, making it an attractive investment in the evolving NFT landscape.

7. Pudgy Penguins

Blockchain: Ethereum

Pudgy Penguins is a beloved NFT collection consisting of 8,888 uniquely designed penguins, each with a distinct personality and appearance. Launched in 2021, the project quickly gained attention for its fun, cute, and accessible art, fostering a dedicated and growing community. Beyond digital collectibles, Pudgy Penguins aims to build a long-term brand, with plans for toys, merchandise, and metaverse integration.

Category: NFTs, Collectibles, Community

Key Features:

- Limited edition of 8,888 NFTs with hand-drawn designs

- Active, passionate community with real-world meetups and events

- Expanding brand with merchandise, collaborations, and partnerships

- Strong utility with exclusive perks for holders, such as access to a private club

- Focus on longevity, including future plans for metaverse integration and physical products

Reasons to Invest:

Pudgy Penguins has become a highly recognizable NFT project, blending collectible appeal with strong community ties and brand expansion. Its unique art, fun themes, and growing ecosystem, including physical merchandise and metaverse potential, provide substantial long-term value. Investing in Pudgy Penguins offers a chance to be part of an evolving brand with strong market presence and cross-industry appeal.

8. The Ape Society

Blockchain: Cardano

The Ape Society is a premium NFT collection consisting of 10,000 hand-drawn, ape-themed avatars, each featuring unique traits and characteristics. Launched in 2021, The Ape Society has gained attention for its high-quality art, strong community focus, and immersive ecosystem. The project blends collectibles with a dynamic metaverse experience, offering holders exclusive benefits, such as access to a virtual society with play-to-earn elements and staking rewards.

Category: NFTs, Digital Art, Community, Metaverse

Key Features:

- Limited edition of 10,000 hand-drawn, unique ape avatars

- Community-driven governance with voting rights

- Staking rewards and in-game economy

- Exclusive events and benefits for holders

- Plans for an immersive metaverse experience

Reasons to Invest:

The Ape Society stands out for its premium artwork, strong community, and integration with the Cardano blockchain, providing unique advantages. The project’s focus on an immersive metaverse, staking rewards, and future growth potential makes it an attractive investment. As the NFT and metaverse space continues to expand, The Ape Society’s increasing utility and loyal following position it for long-term success and value appreciation.

9. Saved Souls

Blockchain: Ethereum

Saved Souls is a unique NFT collection that blends digital art with a narrative-driven, immersive experience. The collection features hand-drawn, mysterious souls represented as 10,000 individual NFTs, each with distinct characteristics. The project’s storyline focuses on redemption, with holders participating in an evolving lore and storyline. Alongside its captivating art, Saved Souls emphasizes community engagement, gamification, and interactive rewards for holders.

Category: NFTs, Digital Art, Storytelling, Community

Key Features:

- 10,000 hand-drawn, unique digital soul avatars

- Story-driven narrative that evolves with the community

- Exclusive rewards and benefits for holders, including access to in-game content

- Strong focus on community involvement and gamification

- Future development of a metaverse experience and interactive features

Reasons to Invest:

Saved Souls offers a unique blend of captivating art, rich storytelling, and community-driven content. With its focus on gamification and future metaverse development, the project promises ongoing engagement and potential for growth. As the NFT space continues to evolve, Saved Souls offers a long-term investment opportunity driven by its compelling narrative, active community, and evolving features.

10. TG.Casino NFTs

Blockchain: Ethereum

TG.Casino NFTs is an innovative collection of digital assets that merges the worlds of gambling and blockchain technology. The project features unique NFT collectibles that offer holders exclusive access to a virtual casino platform. These NFTs represent various in-game perks, including VIP membership, higher stakes, and exclusive rewards within the TG.Casino ecosystem. TG.Casino is designed to integrate both entertainment and earning potential through its play-to-earn model.

Category: NFTs, Gaming, Gambling, Play-to-Earn

Key Features:

- Unique NFTs with in-game utility for a virtual casino

- Exclusive access to TG.Casino’s gambling platform

- VIP rewards, including higher stakes and increased odds

- Play-to-earn model for generating real-world value

- Partnerships with renowned gaming and gambling brands

Reasons to Invest:

TG.Casino NFTs provide an exciting opportunity for both gamers and investors, offering access to an innovative, play-to-earn casino ecosystem. The combination of NFTs with gambling creates a new revenue stream, while VIP features ensure continued value for holders. With growing demand for blockchain-based gaming and gambling, TG.Casino NFTs offer significant long-term investment potential and involvement in the evolving online gaming sector.

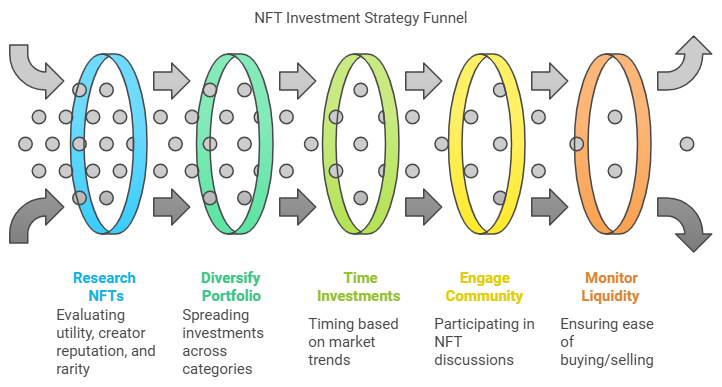

How to Maximize Your Returns in NFTs

Maximizing returns on NFT investments requires a well-rounded strategy, combining research, timing, diversification, and understanding of the market dynamics. Here are key steps to consider:

1. Research and Select High-Potential NFTs

- Evaluate Utility: Look for NFTs with strong use cases beyond just art. NFTs tied to virtual real estate, in-game assets, or memberships to exclusive communities often appreciate faster due to their functional value.

- Analyze Creator Reputation: Invest in NFTs created by established artists, creators, or brands with a strong following. The reputation of the creator or project is often a key indicator of long-term value.

- Assess Rarity and Exclusivity: Focus on NFTs with limited editions or unique characteristics, as scarcity often drives higher demand and value over time.

2. Diversify Your NFT Portfolio

- Multiple Categories: Don’t put all your capital into one type of NFT. Consider diversifying across:

- Art NFTs: Digital art from popular or emerging artists.

- Game NFTs: In-game assets, collectibles, or virtual goods tied to popular games or the metaverse.

- Utility NFTs: Tokens offering access to exclusive events, virtual real estate, or experiences.

- Blue-Chip and Emerging Projects: Mix established projects (e.g., CryptoPunks, Bored Ape Yacht Club) with promising new releases. Emerging projects can offer significant growth potential if they gain traction early.

3. Timing Your Investments

- Market Trends and Sentiment: Monitor broader trends in the NFT and cryptocurrency markets. Prices for NFTs can be highly volatile and tend to follow market sentiment. Investing when the market is low or during dips can increase your chances of a higher return.

- Hype Cycles and Demand: Pay attention to projects gaining attention due to media coverage, celebrity endorsements, or social media discussions. Timing your entry before a project goes viral can maximize potential returns.

- Exit Strategy: Plan your exit strategy carefully. While NFTs can appreciate in value, market conditions may change, and prices can fluctuate. Set price targets or be ready to liquidate if you see the market peak.

4. Engage with the NFT Community

- Active Participation: Join communities around the NFT projects you’re interested in. Participate in social media, Discord channels, or forums where discussions about upcoming drops and market sentiment take place.

- Network and Collaborate: Connecting with other collectors, creators, and investors can provide valuable insights, early access to upcoming releases, or collaborations that could increase the value of your NFTs.

5. Leverage Partnerships and Collaborations

- Identify Strategic Partnerships: NFTs tied to brands, celebrities, or major collaborations tend to see a boost in value. Monitor for partnerships between NFT projects and influential entities.

- Cross-Promotion: Look for NFTs that are being marketed across multiple platforms, including gaming, fashion, and entertainment. NFTs integrated into larger ecosystems or projects can have higher liquidity and sustained demand.

6. Monitor Market Liquidity

- Liquidity and Trading Volume: The ease with which you can buy or sell an NFT is critical. NFTs with higher trading volumes are typically easier to liquidate. Make sure the NFT marketplace you’re trading on has strong liquidity, allowing you to enter and exit trades smoothly.

- Secondary Markets: Research secondary marketplaces (e.g., OpenSea, Rarible, and Foundation) to find NFTs with high resale potential. These platforms provide insights into trending collections and the most actively traded NFTs.

7. Maintain Long-Term Vision

- Hold for the Future: Many of the most successful NFT investments have been those that were held long-term. If you believe in the growth potential of an NFT, particularly those tied to the metaverse, gaming, or high-utility assets, holding can yield significant returns.

- Track Project Developments: Stay informed about the projects you’re invested in. If they release new features, collaborations, or roadmap updates, these can drive future value.

8. Tax and Legal Considerations

- Understand Tax Implications: NFT investments are subject to taxes, including capital gains tax, depending on your country’s tax laws. Keeping track of your transactions and understanding the tax implications will help you make better financial decisions.

- Regulatory Awareness: Stay aware of regulatory changes regarding NFTs and cryptocurrencies. Regulatory clarity can affect market sentiment and long-term viability.

Conclusion

In summary, the top 10 NFTs for 2025 represent a diverse range of innovative projects with strong growth potential, from virtual real estate and gaming assets to digital art and collectibles. As the NFT space continues to evolve, staying informed and conducting thorough research are essential steps for investors looking to capitalize on emerging opportunities. NFT Development will play a critical role in shaping the next generation of digital assets, with new platforms and technologies enabling more seamless integration into various industries. The future outlook for NFTs is bright, particularly as blockchain and Web3 technologies gain widespread adoption across sectors, creating a fertile environment for continued growth and innovation in the digital asset space.

FAQ

1. What are NFTs, and why are they a good investment?

NFTs (Non-Fungible Tokens) are unique digital assets verified on the blockchain, representing ownership of art, collectibles, virtual goods, and more. They’re a good investment because they offer scarcity and uniqueness, providing a sense of rarity and authenticity that can drive up value over time.

2. How do I identify high-potential NFT projects?

High-potential NFT projects typically have strong communities, partnerships with established creators or brands, unique concepts, and clear roadmaps. Projects that offer real utility or innovation, such as in gaming, virtual worlds, or art, also tend to have higher returns.

3. Can NFTs be resold for profit?

Yes, NFTs can often be resold on various marketplace platforms. Their value can increase based on demand, rarity, or the popularity of the project. However, like any investment, resale value is not guaranteed and depends on market trends and buyer interest.

4. What risks are associated with investing in NFTs?

Risks include market volatility, the potential for a project to lose relevance, technological issues, or even scams. It’s crucial to conduct thorough research and consider the long-term value of the NFT rather than relying on short-term gains.

5. How do I store NFTs safely?

NFTs are stored in digital wallets that support cryptocurrency and blockchain-based assets, such as MetaMask or Trust Wallet. It’s essential to use secure wallets and follow proper backup procedures to avoid losing access to your NFTs.

Top 10 NFTs to Watch in 2025 for High-Return Investments was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.