Crypto Arbitrage Bots are Revolutionizing Altcoin Investments in 2025

Crypto arbitrage involves taking advantage of price discrepancies for the same cryptocurrency across different exchanges or markets, allowing investors to buy low in one place and sell high in another. This strategy has gained traction among altcoin investors, who often face volatile market conditions. Its appeal lies in the potential for low-risk profits, as arbitrage exploits temporary inefficiencies without relying heavily on broader market trends. For altcoins, which tend to have higher price fluctuations and lower liquidity compared to major coins like Bitcoin, arbitrage opportunities are particularly abundant.

In 2025, the use of advanced tools like arbitrage bots has become indispensable for crypto traders. These bots automate and execute trades in real-time, far faster than human capabilities, ensuring that fleeting opportunities are captured. Automated trading systems, powered by AI and machine learning, are now integral to the crypto ecosystem, offering precision, speed, and adaptability in highly competitive markets. With the evolution of technology and increasing market complexity, such systems have become essential for maintaining an edge in the rapidly expanding world of cryptocurrency.

What is Crypto Arbitrage?

Crypto arbitrage refers to the practice of exploiting price differences of the same cryptocurrency across different exchanges or markets. Traders can purchase a digital asset at a lower price on one exchange and sell it at a higher price on another, making a profit from the discrepancy in prices. This process takes advantage of inefficiencies in the market, which can arise from different liquidity levels, market depth, or time delays between exchanges. To streamline and optimize this process, Crypto Arbitrage Bots Development plays a crucial role, automating trades and executing them in real-time, ensuring that opportunities are captured quickly and efficiently.

Types of Crypto Arbitrage

- Spatial Arbitrage: This occurs when the same asset has different prices on different exchanges. The bot buys the asset on the exchange at the lower price and sells it on the exchange at the higher price.

- Temporal Arbitrage: This happens when the price of an asset changes over time on the same exchange, and the bot buys and sells the asset at different times to capitalize on these fluctuations.

- Triangular Arbitrage: This involves using three different currency pairs on the same exchange to create an arbitrage opportunity. The bot trades between three assets to profit from the price discrepancies within the exchange.

How Crypto Arbitrage Bots Work

Crypto arbitrage bots work by automatically identifying and exploiting price differences for the same cryptocurrency across different exchanges. Here’s how they operate:

- Market Scanning: The bot continuously scans multiple exchanges to find price discrepancies for a specific altcoin or cryptocurrency.

- Price Comparison: It compares the buy price on one exchange with the sell price on another. If the price difference exceeds transaction fees, the bot identifies an arbitrage opportunity.

- Execution: Once an opportunity is found, the bot buys the cryptocurrency at a lower price on one exchange and sells it at a higher price on another, making a profit from the price difference.

- Automation: The entire process is automated, allowing the bot to execute trades at high speed and with minimal human intervention, ensuring quick exploitation of arbitrage opportunities before they disappear.

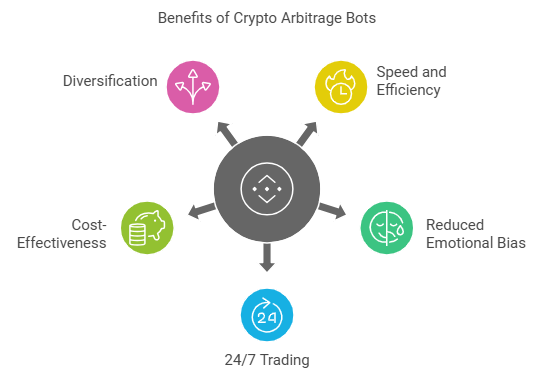

Benefits of Using Crypto Arbitrage Bots for Altcoin Trading

Using crypto arbitrage bots for altcoin trading offers several key benefits, making them a valuable tool for both novice and experienced investors:

1. Speed and Efficiency

Crypto arbitrage bots can scan multiple exchanges in real-time and execute trades instantly, taking advantage of small price differences before they close. Altcoins, which are often more volatile and less liquid than major cryptocurrencies, present frequent opportunities that require quick action. Bots can perform these tasks much faster than human traders, allowing investors to capitalize on fleeting arbitrage chances.

2. Reduced Emotional Bias

Human traders can be influenced by emotions such as fear or greed, leading to poor decision-making. Arbitrage bots, however, follow pre-set rules and algorithms, executing trades based on data rather than emotions. This ensures a more disciplined and consistent trading approach, improving the chances of profitability.

3. 24/7 Trading

The cryptocurrency market operates 24/7, and so do arbitrage bots. They never need breaks and can constantly monitor markets across various exchanges. This means bots can act on arbitrage opportunities that may arise at any time, even when the trader is offline or asleep.

4. Cost-Effective

By automating trading processes, arbitrage bots can reduce the need for constant monitoring and manual intervention. This can save time and effort while also lowering the cost of managing multiple exchanges and portfolios. Bots can also identify opportunities that would be difficult for humans to spot, helping traders maximize their profits with minimal effort.

5. Diversification

Many bots support a wide range of altcoins and exchanges, allowing traders to diversify their portfolios and explore numerous arbitrage opportunities across different markets. This diversification can help mitigate risks while increasing the chances of profitable trades.

Overall, crypto arbitrage bots streamline the process of capitalizing on price differences, offering faster execution, less emotional trading, and greater market opportunities for altcoin investors.

Top Crypto Arbitrage Bots for Altcoin Investors in 2025

he top crypto arbitrage bots for altcoin investors in 2025, maximizing profits with automated trading.

1. 3Commas

3Commas is a widely recognized trading platform offering a popular arbitrage trading bot that supports multiple exchanges. Known for its user-friendly interface, it caters to both novice and experienced traders, simplifying the complexities of cryptocurrency trading.

Key Features

- SmartTrade: Allows users to execute advanced trading strategies with a single click, including trailing stop-loss and take-profit orders.

- Automated Portfolio Management: Helps users manage and diversify their portfolios automatically, reducing the need for constant monitoring.

- Backtesting: Enables users to test strategies using historical data to optimize performance.

- Exchange Integration: Compatible with major exchanges like Binance, Coinbase, Kraken, and others, ensuring seamless connectivity.

Best For

3Commas is ideal for traders looking for a comprehensive platform with both automation and advanced portfolio management features, providing an accessible solution for individuals seeking to enhance their trading strategies.

2. HaasOnline

HaasOnline is renowned for its powerful algorithmic trading bots, offering advanced arbitrage strategies that cater to experienced traders. With a strong focus on deep customization, it enables users to fine-tune their trading strategies to meet specific needs.

Key Features

- HaasScript: A powerful scripting language that allows for highly customizable trading strategies, giving traders full control over their bots’ behavior.

- Backtesting: Allows traders to test strategies with historical data, optimizing performance before live deployment.

- 50+ Technical Indicators: Provides a vast range of indicators for analysis, from moving averages to oscillators, ensuring that users can create sophisticated strategies.

- Arbitrage and Multi-Bot Support: Includes advanced arbitrage capabilities and supports multiple bots running simultaneously, ideal for complex trading operations.Best For

HaasOnline is best suited for advanced traders who require high levels of customization, offering deep technical features to optimize trading strategies and improve overall performance.

3. Cryptohopper

Cryptohopper is a versatile trading platform that enables users to automate their trades across multiple exchanges, including arbitrage trading. With an intuitive interface, it caters to both beginners and intermediate traders looking to automate their trading strategies with ease.

Key Features

- Marketplace for Buying Strategies: Users can purchase or subscribe to pre-made trading strategies from other traders, providing a shortcut to advanced trading without needing to build strategies from scratch.

- Social Trading: Allows users to follow and copy the trades of successful traders, learning from their strategies while automating their own trades.

- Backtesting Tools: Provides the ability to test strategies on historical data, ensuring their viability before applying them in live markets.

- Multi-Exchange Integration: Supports integration with popular exchanges like Binance, Coinbase, and Kraken, allowing seamless trading across platforms.

Best For

Cryptohopper is ideal for beginners to intermediate traders who want an easy setup while still having access to advanced trading strategies and tools.

4. Kryll.io

Kryll.io is a cloud-based crypto trading platform that enables users to create custom trading strategies, including arbitrage, without needing coding skills. Its intuitive design and user-friendly interface make it an ideal solution for those who want to automate their trading with tailored strategies.

Key Features

- Drag-and-Drop Strategy Builder: Allows users to design personalized trading strategies by simply dragging and dropping various modules, making it accessible even for non-technical users.

- Backtesting: Users can test their strategies on historical data to evaluate performance before deploying them in live markets.

- Social Trading: Offers a feature for users to follow and copy the strategies of successful traders, learning and adapting to new techniques.

- Cloud-Based: The platform operates entirely in the cloud, ensuring accessibility from any device without the need for installation.

Best For

Kryll.io is perfect for traders who want to design custom arbitrage strategies without the need for coding, offering a flexible and accessible way to automate crypto trading.

5. Quadency

Quadency is a versatile crypto trading platform that allows users to automate trading strategies, including arbitrage, across multiple exchanges. With a focus on simplicity and efficiency, it provides an easy-to-use interface suitable for traders at all levels.

Key Features

- Pre-Built Strategies: Quadency offers a selection of pre-built trading strategies, including arbitrage, that users can quickly deploy without needing to design their own.

- Backtesting: Provides the ability to test strategies on historical data to optimize and refine them before applying them in live markets.

- Paper Trading: Allows users to simulate real-market conditions without risking actual funds, perfect for practicing strategies and gaining confidence.

- Exchange Integration: Supports integration with major exchanges like Binance, Kraken, and Coinbase, allowing seamless trading across platforms.

Best For

Quadency is ideal for traders seeking a straightforward, automated solution for crypto trading, with easy setup and effective strategy execution, making it a great choice for both beginners and intermediate traders.

6. ArbiSmart

ArbiSmart is a specialized arbitrage bot focused on crypto arbitrage, offering users opportunities for cross-exchange trading. Designed to automate the process, it aims to deliver passive income through profitable arbitrage strategies without requiring active management.

Key Features

- Automatic Arbitrage: ArbiSmart scans multiple exchanges to identify and execute profitable arbitrage opportunities, automating the entire process for the user.

- Risk Management: The platform integrates risk management tools, helping users safeguard their investments by minimizing exposure to market volatility.

- User-Friendly Interface: With a simple and intuitive interface, ArbiSmart makes it easy for both beginners and experienced traders to set up and monitor their arbitrage trading activities.

- Cross-Exchange Opportunities: The bot seamlessly connects to various exchanges, ensuring access to the best arbitrage opportunities across different platforms.

Best For

ArbiSmart is best suited for those seeking a passive income stream from crypto arbitrage strategies, offering an easy and automated way to earn profits from price discrepancies across exchanges.

7. Gunbot

Gunbot is a powerful trading platform that offers highly customizable bots capable of executing arbitrage strategies. Designed for experienced traders, it provides a range of advanced features to fine-tune and optimize trading strategies for maximum profitability.

Key Features

- Multiple Strategy Options: Gunbot offers a variety of built-in strategies, including arbitrage, that can be customized to suit specific trading styles and goals.

- Backtesting: Users can test their strategies on historical data to assess performance and make necessary adjustments before applying them in live markets.

- Exchange Integration: Compatible with major crypto exchanges like Binance, Kraken, and Bitfinex, Gunbot allows seamless integration across multiple platforms for efficient trading.

- Customizable Settings: Gunbot enables users to adjust parameters such as trading pairs, risk management levels, and indicators to tailor their strategies.

Best For

Gunbot is ideal for experienced traders looking to fine-tune and optimize their arbitrage strategies with advanced customization and technical features.

8. Zenbot

Zenbot is an open-source crypto trading bot designed for high-frequency trading, including arbitrage strategies. Known for its advanced features and flexibility, Zenbot appeals to tech-savvy traders who require a customizable, powerful tool for automated trading across multiple exchanges.

Key Features

- AI-Driven Trading: Zenbot leverages artificial intelligence to optimize trading strategies, adapting to market conditions and making real-time decisions for higher efficiency.

- Backtesting: Users can test their strategies using historical data, allowing for better strategy refinement before deploying them in live markets.

- High-Frequency Trading Support: Zenbot supports high-frequency trading, enabling users to execute numerous trades per second, ideal for exploiting quick arbitrage opportunities.

- Open-Source: As an open-source platform, Zenbot allows users to modify and customize the bot’s code to suit their specific needs.

Best For

Zenbot is perfect for tech-savvy traders comfortable with open-source software, offering a customizable, high-frequency trading solution for those seeking to execute advanced arbitrage strategies.

9. Shrimpy

Shrimpy is a comprehensive crypto portfolio management platform that includes arbitrage bot capabilities. It allows users to automate trading strategies while efficiently managing and rebalancing their portfolios, providing a streamlined solution for both portfolio optimization and arbitrage trading.

Key Features

- Portfolio Rebalancing: Shrimpy helps users maintain a diversified portfolio by automatically rebalancing assets according to their predefined allocation strategies.

- Backtesting: Users can test their strategies using historical data, ensuring optimal performance before going live.

- Smart Trading Tools: Includes advanced trading features like social trading, automatic strategy execution, and support for a range of exchanges.

- Arbitrage Bot: Shrimpy’s arbitrage capabilities allow users to exploit price differences across multiple exchanges, maximizing profit potential.

Best For

Shrimpy is ideal for traders looking for an all-in-one platform that combines portfolio management with automated arbitrage strategies, offering an efficient and user-friendly solution for crypto asset management.

10. Autonio

Autonio is a versatile trading bot designed to automate crypto arbitrage strategies using advanced algorithms. Tailored for both beginners and experienced traders, it simplifies the process of exploiting arbitrage opportunities while incorporating smart trading capabilities for optimized performance.

Key Features

- Smart Trading: Autonio’s AI-powered algorithms help identify and execute the most profitable arbitrage opportunities across multiple exchanges in real-time.

- Backtesting: Users can test their trading strategies against historical market data to refine their approach before applying them to live trading.

- Real-Time Performance Tracking: The bot offers performance monitoring tools, allowing users to track their profits, losses, and overall strategy effectiveness in real time.

- User-Friendly Interface: With its intuitive design, Autonio caters to both novice and experienced traders, making complex arbitrage trading accessible to all.

Best For

Autonio is ideal for traders seeking a bot with built-in intelligence that identifies and capitalizes on arbitrage opportunities, streamlining the trading process with advanced automation and real-time insights.

11. Trality

Trality is a platform that empowers users to create and backtest their own arbitrage trading strategies, offering both a Python coding interface for advanced customization and an easy-to-use drag-and-drop tool for beginners. It combines flexibility with accessibility, catering to both developers and traders.

Key Features

- Algorithmic Trading: Trality enables users to develop algorithmic trading strategies, including arbitrage, with powerful tools that automate decision-making and execution.

- Backtesting: Users can test their strategies on historical data to optimize performance before using them in live markets.

- Python Coding for Customization: For developers, Trality offers full flexibility to code and fine-tune strategies using Python, providing a high level of customization.

- Drag-and-Drop Interface: Beginners can easily build strategies without coding by using the drag-and-drop feature, making the platform highly accessible.

Best For

Trality is perfect for developers and traders who want a hybrid approach, combining Python coding for deep strategy customization with a simple drag-and-drop interface for ease of use.

12. Quadra Crypto Arbitrage Bot

The Quadra Crypto Arbitrage Bot is specifically designed to automate the process of identifying and executing profitable arbitrage opportunities between different crypto exchanges. With a focus on simplicity and efficiency, it provides a straightforward solution for traders seeking to capitalize on price discrepancies.

Key Features

- Multi-Exchange Support: Quadra supports integration with a wide range of crypto exchanges, ensuring access to numerous trading pairs and arbitrage opportunities.

- Automated Arbitrage: The bot automatically scans multiple exchanges and executes arbitrage trades without manual intervention, maximizing profit potential in real-time.

- Backtesting Tools: Users can test their strategies against historical data to evaluate performance and adjust their approach before going live.

- User-Friendly Interface: With a no-frills design, Quadra offers an easy setup, making it ideal for traders who want an efficient and simple arbitrage solution.

Best For

Quadra Crypto Arbitrage Bot is best for investors who are looking for a straightforward, automated arbitrage bot without the complexity of advanced features.

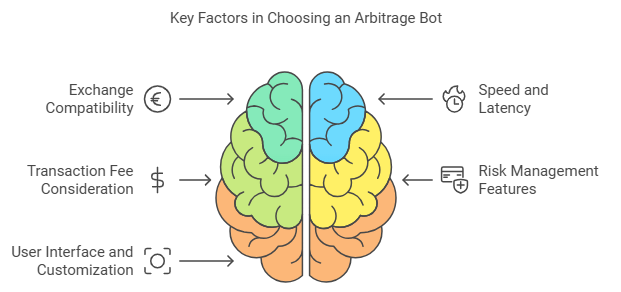

How to Choose the Right Arbitrage Bot for Altcoins

Choosing the right crypto arbitrage bot for altcoin trading requires careful evaluation of several key factors to ensure it meets your specific trading needs.

1. Exchange Compatibility

Ensure the bot supports a wide range of exchanges, especially those that list a variety of altcoins. Major exchanges like Binance, Kraken, and KuCoin, as well as smaller platforms, can provide different price gaps for arbitrage opportunities. The more exchanges the bot supports, the greater the chances of finding profitable arbitrage opportunities.

2. Speed and Latency

Speed is crucial in crypto arbitrage, especially with the volatile nature of altcoins. Choose a bot that can scan markets in real-time and execute trades at lightning speed. Lower latency ensures that the bot can capitalize on price discrepancies before they close, allowing you to secure profits quickly.

3. Transaction Fee Consideration

Transaction and withdrawal fees can significantly affect profits. The bot should be capable of factoring in fees across exchanges, ensuring that the arbitrage opportunity remains profitable after accounting for these costs. Look for bots that optimize for low-fee exchanges or dynamically adjust based on fee structures.

4. Risk Management Features

Choose a bot with built-in risk management tools like stop-loss and take-profit options. These features help minimize losses during unfavorable market conditions, especially in the volatile altcoin market. Customizable risk parameters will also allow you to tailor the bot’s trading strategy to your risk tolerance.

5. User Interface and Customization

A user-friendly interface is essential, especially for beginners. The bot should be easy to set up and use, with clear dashboards and real-time analytics. Additionally, customization options such as adjustable trading parameters and strategies will allow you to tailor the bot to your specific needs.

Future of Crypto Arbitrage Bots for Altcoin Investors

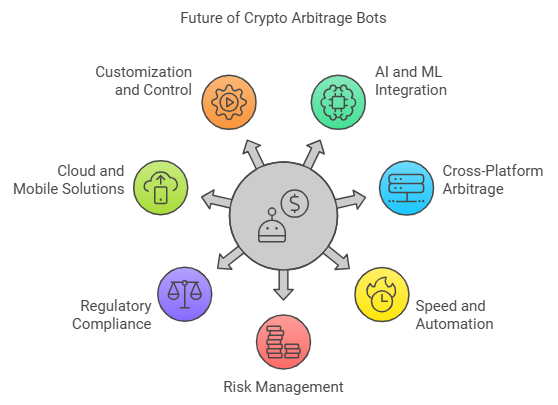

The future of crypto arbitrage bots for altcoin investors is set to be shaped by technological advancements, market evolution, and growing demand for more efficient trading solutions.

1. Integration of Advanced AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) will significantly enhance the capabilities of crypto arbitrage bots. These technologies will allow bots to learn from historical data, adapt to changing market conditions, and predict price movements with greater accuracy. By analyzing vast amounts of market data in real-time, AI-powered bots will be able to detect even the smallest arbitrage opportunities across altcoin markets, optimizing profits for investors.

2. Cross-Platform Arbitrage

As decentralized finance (DeFi) platforms and decentralized exchanges (DEXs) gain prominence, the ability to execute arbitrage across both centralized and decentralized platforms will become essential. Future arbitrage bots will be designed to seamlessly operate across multiple exchange types, allowing traders to capitalize on price discrepancies not just between centralized exchanges (CEXs) but also between CEXs and DEXs. This expanded functionality will create more opportunities for altcoin investors to profit from market inefficiencies.

3. Enhanced Speed and Automation

Speed is crucial for crypto arbitrage, especially in volatile markets where altcoin prices can change rapidly. Future bots will benefit from faster processing speeds, low-latency execution, and advanced automation. With improved automation, bots will execute complex arbitrage strategies, such as triangular arbitrage or cross-currency arbitrage, in milliseconds. This will allow them to act on fleeting price differences faster than ever, increasing profitability.

4. Improved Risk Management

As the altcoin market becomes more volatile, risk management will be increasingly important. Future arbitrage bots will come with enhanced risk mitigation features, such as real-time volatility analysis, adjustable stop-loss orders, and customizable risk parameters. These features will help investors protect themselves from significant losses during market downturns and ensure consistent profitability.

5. Regulatory Compliance and Transparency

As regulatory scrutiny of cryptocurrencies intensifies, arbitrage bots will need to adapt to new laws and regulations. In the future, bots may be designed to automatically comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, ensuring that trades are secure and legally compliant. Additionally, bots will likely provide greater transparency, allowing users to track and verify trades more easily, which is crucial for building trust in a highly regulated market.

6. Cloud-Based and Mobile Solutions

With the increasing adoption of cloud computing and mobile trading, crypto arbitrage bots will be more accessible than ever. Cloud-based bots will offer scalability and allow traders to run them from any device with internet access. Mobile optimization will also enable traders to monitor and manage their strategies on the go, ensuring that arbitrage opportunities are never missed, no matter where they are.

7. Enhanced Customization and User Control

As demand grows for more personalized trading experiences, future crypto arbitrage bots will offer greater customization options. Traders will be able to adjust parameters such as trade frequency, asset pairs, and risk tolerance. Advanced bots may even allow users to develop their own custom algorithms for more tailored trading strategies, making it easier to fine-tune their arbitrage approach according to market conditions.

Conclusion

Arbitrage bots have become an essential tool for altcoin investors, offering the ability to efficiently capitalize on price discrepancies across multiple exchanges. With their real-time execution and precision, these bots allow traders to seize opportunities that would otherwise be missed, maximizing profits with minimal risk. As the market evolves, investing in reliable and well-designed Crypto Arbitrage Bots Development becomes crucial for staying ahead in the competitive crypto landscape. When choosing the right bot, it’s important to consider factors such as speed, reliability, security, and the ability to adapt to changing market conditions. By leveraging these tools and staying updated with market trends, investors can enhance their strategies and achieve greater success in the dynamic world of cryptocurrency.

Top 12 Best Crypto Arbitrage Bots for Altcoin Investors in 2025 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.