In a recent statement to the House Financial Services Committee, a US Treasury official highlighted the growing concerns around using crypto in illicit finance activities.

As the crypto industry expands, preventing these new technologies from being used for illegal finance becomes a bigger challenge.

US Treasury Seeks Greater Authority to Tackle Crypto Crimes

The US Treasury’s Under Secretary for Terrorism and Financial Intelligence, Brian Nelson, voiced his concern, emphasizing the need for greater authority to tackle the misuse of cryptocurrencies by malicious actors. The committee hearing, scheduled for February 15, will tackle these important issues.

Nelson’s statement highlights the advanced ways terrorists and other criminals use digital assets for illegal purposes. Although crypto assets are currently a small part of terrorist financing compared to traditional methods, the potential for increase is concerning.

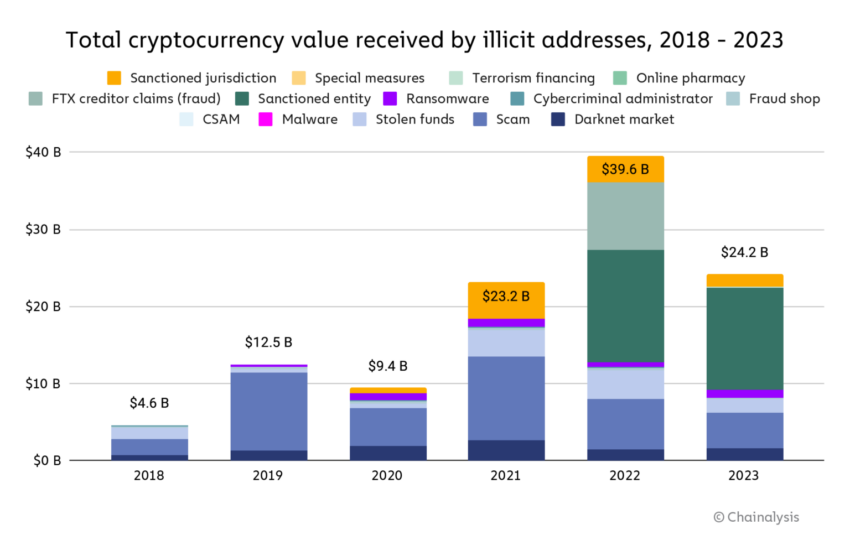

The Treasury’s recent risk assessments reveal how various threat actors, including ransomware cybercriminals, scammers, and terrorist groups, misuse crypto. These assessments also highlight the vulnerabilities that enable jurisdictional arbitrage and non-compliance by some financial institutions.

Hence, Nelson stressed the need for additional tools and resources to combat illicit finance in the crypto market effectively.

“To root out illicit finance by players in virtual asset markets and forums, we need additional tools and resources. That is why we are eager to work with Congress to adopt common-sense reforms that update our tools and authorities to match the evolving challenges we face today,” Nelson wrote

Read more: 15 Most Common Crypto Scams To Look Out For

Lawmakers, like Senator Elizabeth Warren, are concerned about cryptocurrency in illicit finance. She supports tougher regulations, reintroducing the Digital Asset Anti-Money Laundering Act (DAAMLA) to combat crypto’s use in money laundering and terrorism financing.

However, the DAAMLA has been criticized by the Blockchain Association. The firm claims the bill could hurt US interests and the economy by driving the crypto industry abroad.

“Sen. Warren’s DAAMLA legislation, however, would inadvertently hinder law enforcement and national security efforts by driving the majority of the digital asset industry overseas. This shift could also lead to increased liquidity in unregulated off shore exchanges and a loss of valuable expertise and visibility for the US in the blockchain realm. Further, this legislation, if implemented, will have no meaningful effect on the foreign illicit actors it targets,” the Blockchain Association affirmed.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

While the Treasury points to the risks associated with virtual assets, it is important to note that traditional cash transactions remain the preferred method for criminal organizations involved in money laundering. The US Treasury’s assessments indicate that cash’s anonymity, stability, and widespread acceptance make it a favored medium for illicit finance.

![]()

PrimeXTB

PrimeXTB ” target=”_blank”>Explore →

![]()

Coinbase

Coinbase” target=”_blank”>Explore →

![]()

AlgosOne

AlgosOne” target=”_blank”>Explore →

![]()

UpHold

UpHold” target=”_blank”>Explore →

![]()

iTrustCapital

iTrustCapital” target=”_blank”> Explore →

Explore more

The post US Treasury Highlights Growing Concerns of Crypto in Illicit Finance Activities appeared first on BeInCrypto.