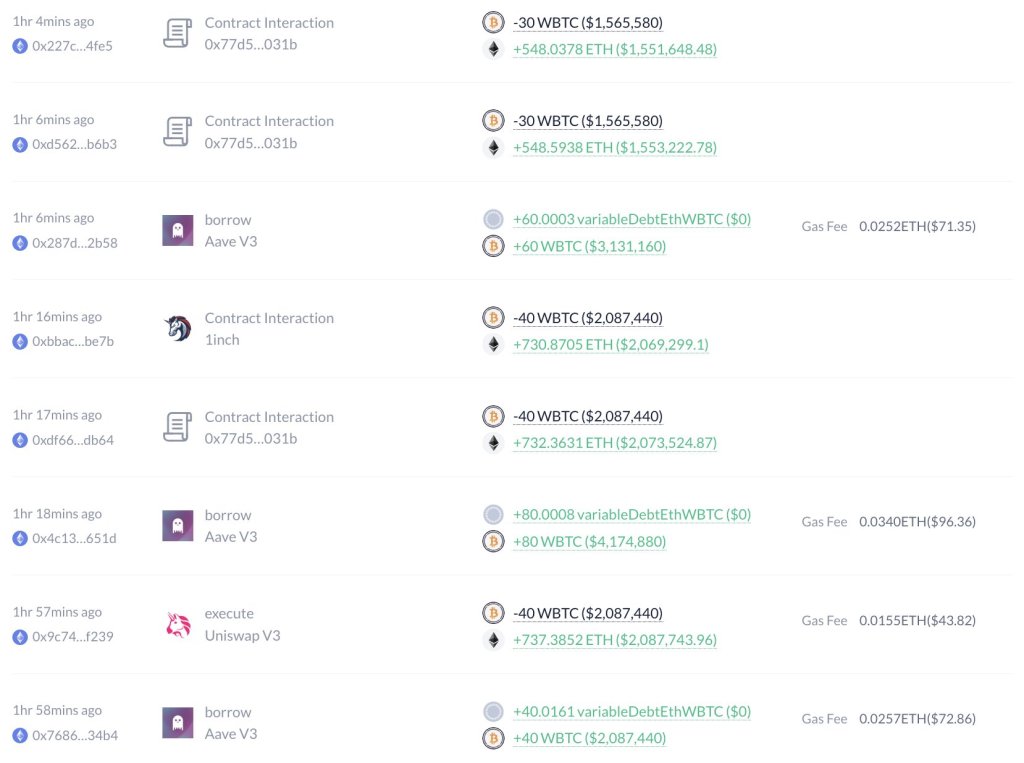

On-chain data shows that one whale is rapidly accumulating Ethereum (ETH), selling large amounts of Wrapped Bitcoin (WBTC) via Aave, a popular non-custodial protocol.

Whale Borrows WBTC From Aave, Buys ETH

As of February 16, Lookonchain data showed that the whale borrowed 280 Wrapped Bitcoin (WBTC), equivalent to approximately $14.6 million, Aave, one of the leading DeFi protocols.

Related Reading: How Much To Hack Bitcoin And Ethereum? New Study Reveals Price

Afterward, the whale purchased 5,150 ETH. The whale is actively buying ETH, not from centralized exchanges but via decentralized protocols. This move shows the trader expects ETH to outperform the digital gold in the session ahead.

What could have triggered the whale to accumulate ETH and dump the resurgent Bitcoin is not immediately clear. However, what’s known is that since mid-January, Ethereum has been outperforming Bitcoin in price and various other metrics.

To illustrate, ETH is up roughly 13% versus BTC in the last trading month. Even though ETH prices cooled off from January’s peaks, the uptrend remains. Looking at the development in the daily chart, BTC bulls clawed back losses versus ETH.

Still, they failed to reverse losses posted in January completely. Thus far, the immediate support is at 0.052 BTC, marking the current February lows. Even so, a sharp loss below this critical support might strengthen BTC in the short to medium term.

Related Reading: Bitcoin Contract Explosion: Frenetic Activity As $23 Billion Floods Major Exchanges

The broader crypto community remains bullish on Bitcoin, even with the crypto whale opting for ETH. From the daily chart, BTC is at around 2024 highs, the highest in slightly over two years. Experts and analysts expect more gains in the days ahead. Provided BTC remains above the psychological support at $50,000, the odds of the world’s most valuable coin floating to $70,000, or better, remains high.

Billions Of Dollars Flowing To Bitcoin

Wall Street and retail investors are plowing billions of dollars into BTC following the approval of spot Bitcoin exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC). At the same time, the general investor and trader sentiment is that Bitcoin will roar, considering the expected supply shock once the network halves miner rewards in early April. Then, if the current demand remains, the resulting imbalance could see BTC rally to six figures.

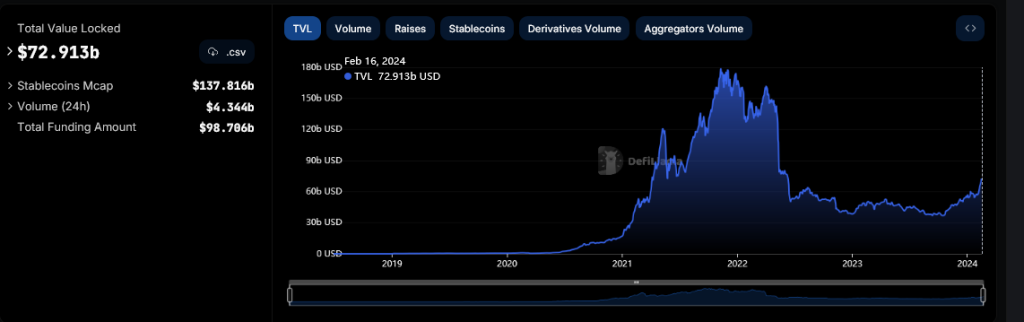

Meanwhile, rising Bitcoin prices have propped up altcoins, with Ethereum rallying in dollar value over the past few weeks. Though the coin is capped below $3,000, supporters expect more gains in the medium term, citing improving defi, reading from the expanding total value locked (TVL) according to DeFiLlama data.