What are DAOs? — For Dummies

You keep hearing the buzz term “DAO”, and you understand it stands for ‘Decentralized Autonomous Organization’, what does that actually mean? And why would you choose a DAO over a normal PLC?

Aims of this article:

- Define DAOs

- Characteristics of DAOs

- DAOs vs Traditional Companies

- Examples of DAOs

- Types of DAOs

DAOs: What Are They?

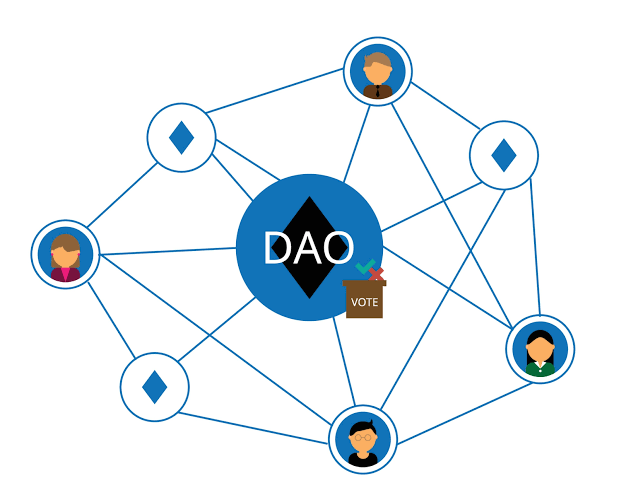

DAO: an organization that operates on BLOCKCHAIN technology, that makes decisions through a consensus mechanism (agreement) of its members rather than relying on a central authority.

Simple version: a digital club where decisions are made by members, every member has a say, and it operates using smart contracts (agreements that automatically execute, which are programmed by code).

Okay, so what does that actually mean?

In a normal company, shareholders have a right and say in decisions, the majority of the decisions are initiated by a central authority (the board of directors), but with a DAO, all decisions are based upon agreement, i.e. through voting.

In a DAO, normally, voters are token holders. It is the equivalent to being a shareholder.

Think of it this way:

DAO: fiat → tokens> voting

Traditional Company: fiat → shares → voting

Characteristics of DAOs

- Decentralization: operates on a decentralized network of computers (nodes) that collectively make decisions.

- Autonomous: use of smart contracts to automate decisions.

- Transparent: decisions recorded on blockchain-> transparency + visibility to all members of the DAO.

- Token-based governance: digital tokens represent membership and voting rights. The more tokens a member holds, the more influence they have in decision-making.

- Community-driven: governed by a community of members (token holders) who vote and propose changes.

- Immutable: decisions made through smart contracts are difficult to reverse or change, providing security and trust in the decision-making process.

Summary: decentralization, autonomy, transparency, immutable, token-based governance + community-driven

Story to aid recall: Think of a decentralized, autonomous, transparent community where decisions are made based on token holders’ voting preferences, and the outcome of decisions cannot be changed.

Note: DAOs are kind of immutable, in actuality, the smart contracts can be altered, but it would take a very long time.

Example — Real Life DAO

You and your friends want to decide what activities you should do, you create a digital system (DAO) that lets everyone vote on ideas and make decisions together.

- Members: people join your DAO using digital tokens, which are essentially membership cards. The more tokens you have, the more your vote counts

- Proposals: anyone in the DAO can suggest ideas e.g. let’s organize a game night, these proposals/ideas are just suggestions of what the group can do

- Voting: members vote for or against proposals. Proposals with the most votes are accepted and the DAO automatically executes the decisions with the most votes using a smart contract.

Here’s an example of Maker DAO’s polling on a proposal to provide a visual representation:

4) Transparency: all decisions and votes are recorded on the blockchain, therefore everything is transparent

5) Rewards and Punishments: some DAOs reward members who actively participate or contribute.

DAOs vs Traditional Companies

1) Centralization

– DAO: operates in a decentralized manner, without a central authority or management overseeing decisions. Instead, decisions are made collectively by its members through voting.

– Traditional Company: centralised structure, where decisions tend to be made by a board of directors or an executive team.

2) Decision-making

– DAO: decisions made through a consensus mechanism where members vote on proposals. Each member’s voting power is PROPORTIONAL to their stake in the DAO i.e., the number of tokens they hold

– Traditional company: shareholders vote on major decisions such as electing a board of directors, however, day-to-day decisions are typically made by the company’s management.

3) Governance

– DAO: smart contracts to automate governance processes, with rules and decision-making mechanisms encoded in the code

– Traditional company: governance involves, legal documents, shareholder agreements, and regulatory compliance. Decision-making involves formal meetings and paperwork.

4) Flexibility and Agility

– DAOs: flexible and agile as rules/protocols can be proposed and implemented through decentralized decision-making processes

– Traditional Company: bureaucratic hurdles and legal constraints when implementing changes to their structure or operations

5) Legal Status

– DAO: decentralized and borderless nature of many DAOs makes their legal recognition and compliance ambiguous

– Traditional Company: well-established legal frameworks and regulatory structures that define their status and operations

6) Ownership

-DAO: ownership represented by tokens, influence tied to their ownership stakes (amount of tokens they hold)

-Traditional Company: shareholders own shares that represent ownership in the company, influence is determined by the number of shares they hold

Types of DAOs

Note: this list is not exhaustive, rather it provides a few examples of the most common DAOs one is likely to come across.

Governance Protocol DAOs

Simple: DAOs focused on decision-making, tend to be in relation to borrowing and lending.

These DAOs focus on GOVERNING and making decisions for a specific blockchain protocol or platform. Token holders participate in voting and shape the protocol’s future. For example, with MakerDAO you can decide on stability fees and collateral types. Protocol Daos’ purpose is to supervise various governance functions within decentralized protocols and thus help with the decision-making processes.

Examples:

MakerDAO: operates on the Ethereum blockchain(protocol) and the purpose is to allow users to lend and borrow tokens at adjustable interest rates and with flexible repayment terms. Holders of MKR governance tokens (tokens you receive when submitting collateral) can engage in the decision-making process of the Maker Protocol such as voting on collateral requirements for collateralized debt positions (CDPs)

UniSwap: UNI (Uniswap) governance token provides the community with the ability to vote on the development and operations of Uniswap. The UNI token holders have the authority to govern Uniswap, handle the management of treasury funds, and control protocol fee switches.

Note: CDP — collateral (e.g. Ethereum) locked up, in exchange for a stablecoin, in MakerDAO the stablecoin is called DAI, this takes place through a smart contract.

Grant DAOs

Aim: provide financial support to projects that drive meaningful change, e.g. projects that work towards sustainability and fairness.

The firm that requires funding submits a proposal for funding-> proposal is voted on by the community if it should receive funding or not.

The community establishes criteria for a proposal to receive successful funding: project scope, funding required, potential impact, and project team capabilities.

Real-life example:

MolochDAOs objective is to improve Ethereum’s infrastructure.

Social DAOs

Purpose: provide a platform for like-minded people such as artists, creatives, and builders to come together to seek knowledge and opportunities. They nurture an environment where ppts can learn new things and engage in open projects, collaborative work and earn rewards. Sometimes social DAOs are referred to as creator DAOs, they often possess a barrier to entry such as requiring participants to participate in a minimum number of tokens or an NFT, to receive a personal invitation.

Examples:

Developer DAO: body of web3 enthusiasts + developers coming together with the shared objective of paving the way for the future of web3. Members with an invitation to their discord server can be part of their organization.

Friends With Benefits: DAO centered on developing a community and promoting creativity. Access to friends with benefits requires the possession of 75$FWB tokens, after admission, members are given full access to interact with developers, artists, and creators and attend special events.

Investment and Venture DAOs

These DAOs bring together capital from multiple sources with the aim of funding initiatives related to early-stage web3 startups, protocols, and off-chain investments. Venture DAOs allow a diverse range of individuals to participate in the investment process, thus breaking down traditional barriers and empowering a wider pool of investors.

Examples:

MetaCartel — provides finances and operational guidance to emerging decentralised applications.

BessemerDAO — shares insights and resources related to the crypto industry.

What are DAOs — For Dummies was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.