Over the past few days, the biggest news in the crypto world has undoubtedly been the passage of the GENIUS Stablecoin Act in the United States.

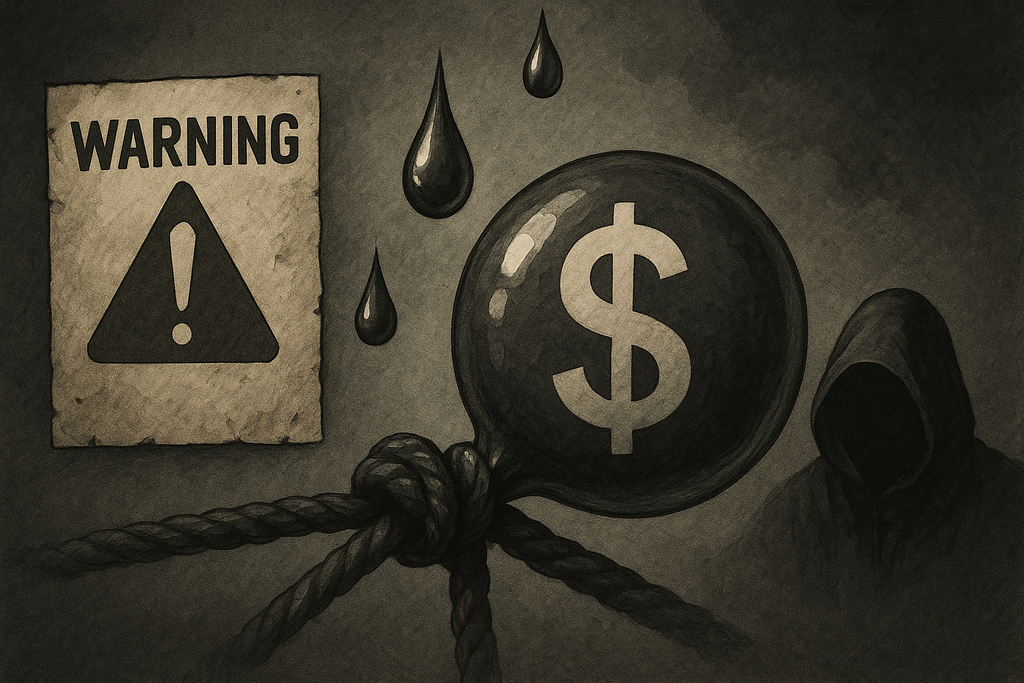

I’ve said before that the U.S. dollar is a lot like China’s college entrance exam system: not the best option, but arguably the least bad one. In a world where trust in global currencies is steadily eroding, the passage of the GENIUS Act can only be described in four words: a mixed blessing.

On the bright side, this marks the official opening of the floodgates for on-chain U.S. dollar liquidity. Bitcoin climbing above $107,000 and Ethereum touching $2,600 seem to confirm as much. And more importantly, this is just the beginning.

On the downside, the core principles of decentralization are once again under systemic pressure. The GENIUS Act effectively locks the issuance of stablecoins behind a wall of licensing. Whether it’s algorithmic stablecoins or overcollateralized crypto-backed assets, they will now have to face direct regulatory scrutiny.

Still, you have to admire the strategic prowess of the United States.Yes, the dollar is in decline. But it has indeed found a new way to prolong its reign. After the era of the petrodollar, the crypto dollar is shaping up to be the final adrenaline shot for U.S. monetary hegemony.

Amid a global wave of de-dollarization, the dollar has found its way back onto the world stage — this time, in the form of on-chain stablecoins. Liquidity is once again under dollar control — except now, it flows through wallet addresses.

Thankfully, it’s the dollar — and not the ruble.

But the question remains:What happens when a centralized dollar-backed stablecoin steps into a crypto world that was meant to be decentralized?Is it a blessing or a curse?

It could bring compliant capital flows — or it could push out truly decentralized experiments.It could help facilitate global financial freedom — or it could return control of value to those with the licenses.

And that’s the very question we need to address today.

Today marks the third and final installment of the “Decentralization Trilogy.” Before we dive in, let’s briefly recap the main points of the first two articles.

Part I: The Shattering of an Illusion

In the early morning of April 15, 2025, a single AWS fiber-optic cable was accidentally severed in Tokyo. Within just one hour, global crypto trading volume plummeted by over 15%.

Eight days later, small and mid-sized crypto platforms in Europe suffered another major blow. In response to the EU’s new MiCA advertising regulations, Google rolled out a strict new ad review system. Just three days after the update, ad exposure for smaller projects dropped by more than 67%.

Google didn’t have to cut your internet. It didn’t need to shut down your site. With just a few clicks behind the scenes, your website technically still existed — but no one could see it.

These two very real events tore the mask off “fake decentralization”: Even when assets are on-chain and governance is said to be decentralized, the system still depends heavily on centralized servers and Web2 platforms.

Part II: Redefining Real Decentralization

True decentralization doesn’t mean everything has to be coded onto a blockchain. Rather, it must fulfill three key criteria:

- A distributed ledger (e.g., Bitcoin, Ethereum), ensuring data integrity and immutability;

- An embedded incentive mechanism (PoW mining or PoS staking), compelling each node to honestly maintain the network;

- On-chain governance systems (DAOs, smart contracts), where rules are transparent and executed automatically.

We even used the Herfindahl-Hirschman Index (HHI) — a tool from economics — to measure the decentralization level of three major blockchains. Surprisingly, Ethereum ranked highest, with an HHI score of only 889 (well below the 1500 threshold for antitrust concerns), followed by Bitcoin. Solana, on the other hand, showed significantly higher centralization.

And today, we lower the lens. We zoom in on daily life.

We ask just one thing:

All this talk of “decentralization” — what does it actually have to do with you?

The answer is: everything.

It touches your wallet, your income, and even your entrepreneurial future. It’s not some idealistic slogan, but a real, evolving economic shift.

In this article, we’ll explore three core mechanisms through which decentralization is reshaping the new economy:

- Tokenization of everything — turning the Internet from an information network into a value network;

- The airdrop economy — shifting from user fees to platforms sharing profits with users;

- The open-source innovation flywheel — empowering anyone to build global-scale apps from modular components.

These aren’t three separate movements. Together, they form a closed-loop system — a new paradigm of exponential innovation.

1. Tokenizing Everything: Upgrading the Internet from an Information Network to a Value Network

Think back to when email first emerged. People were astonished that text, images, and audio could be sent instantly to the other side of the world. But for decades, one question remained unanswered: Could assets — like real estate, currency, gold, or future income — flow as freely and efficiently as information?

Now, we finally have a clear answer: tokenization.

1.1 What Is Tokenization?

In simple terms, tokenization means transforming real-world assets — like houses, cars, gold, or dollars — into digital certificates (tokens) on the blockchain. These tokens can be transferred globally, instantly — just like sending an email.

For example: say you have $1 million. In the past, a cross-border transfer would have taken several days, if not weeks, due to layers of banking procedures. But now, by converting your funds into 1 million USDC — issued by the company Circle — you can send that value to any blockchain address worldwide, almost instantly.

If the recipient wants to convert it back into fiat currency, they simply go through a compliant financial channel. Just like that, on-chain and off-chain assets become seamlessly connected, and value begins to flow as freely as information.

1.2 How Does Tokenization Work?

The entire process can be broken down into three steps:

Step 1: Custody and Verification of Ownership Take gold, for instance. The physical gold must be held by a compliant, regulated custodian. If the asset is crypto-native (like ETH), it can be locked in a smart contract.

Step 2: Issuance of Token Certificates Once custody is secured, the system generates tokens based on preset rules (e.g., 1:1 pegging). PAXG, issued by Paxos, is a classic example of a gold-backed token.

Step 3: On-Chain Circulation and Redemption Once issued, the tokens can be transferred globally, used for trading, or integrated into DeFi applications. Token holders can redeem the underlying assets according to the protocol.

This process drastically simplifies traditional asset transfer mechanisms — making it as efficient as sending an email.

1.3 Why Is Tokenization the Core of the Web3 Era?

To understand why tokenization is so crucial, we need to take a quick look at how the Internet has evolved:

- Web1 (Read-Only Era): In the 1990s, the Internet was mainly a static repository of content. Users consumed information but didn’t create it.

- Web2 (Read-Write Era): After 2000, social platforms flourished. Users began creating and sharing content — but the platforms owned the data and reaped the profits.

- Web3 (Ownership Era): Decentralized networks allow users to truly own their data and digital assets. And tokenization is the key technology that makes that ownership real.

In the Web3 era, tokenization is revolutionary in three key ways:

1.3.1 Value Can Flow Freely, 24/7

Take USDC for example. As of May 15, 2025, Circle reported that the stablecoin’s circulating supply was holding steady at around $60.49 billion, with cumulative on-chain transaction volume in the trillions of dollars.

Unlike bank transfers, token transfers aren’t restricted by business hours, holidays, or borders. Settlement becomes instantaneous, and the efficiency of capital flows reaches a level never seen before.

1.3.2 Assets Can Be Fractionalized, Lowering Investment Barriers

The rise of Real World Asset (RWA) tokenization allows ordinary people to access financial products once exclusive to the ultra-wealthy.

For example, Ondo Finance and BlackRock’s BUIDL fund are tokenizing U.S. Treasury securities and money market funds, letting users participate with as little as a few dollars.

A 2023 report by Boston Consulting Group predicted that by 2030, the global market for tokenized illiquid assets could reach $16 trillion.

As of early 2025, the tokenized portion of U.S. Treasuries alone has surpassed $700 million — and the number continues to grow.

1.3.3 Assets Become Composable and Programmable, Enabling Innovation

Tokenization brings more than liquidity — it enables composability and programmability, much like Lego blocks for finance.

Take Ether.fi, a restaking protocol on Ethereum: Users stake ETH to receive eETH, which can then be used as collateral for loans or to access yield strategies.

Or Pendle Finance, which separates and tokenizes future yield streams to create markets for fixed income and interest rate swaps.

As of May 2025, data from DeFiLlama shows that Pendle and similar yield-token protocols now manage over $4 billion in assets, showcasing the explosive potential of tokenized financial innovation.

1.4 Challenges That Tokenization Still Faces

Despite its promise, tokenization is not without its challenges:

- Custody and Compliance: How do we ensure off-chain assets are secure, verifiable, and auditable? Common solutions include third-party audits, on-chain reserve reports, and regulated custody frameworks — all still evolving.

- Oracles and Pricing Feeds: A single bad price feed could trigger mass liquidations across DeFi platforms. The industry currently relies on decentralized oracles (like Chainlink) and mechanisms like time-weighted average prices (TWAP), but these are still works in progress.

From all of this, it’s clear that tokenization has turned the Internet from a carrier of information into a network of transferable value.

It dramatically lowers the barrier to global investment, allowing ordinary people to access previously unreachable markets. It also redefines the logic and speed of financial services.

And once value can flow freely, platforms must change how they attract users — not by charging fees, but by sharing value.

That, precisely, is where the airdrop economy comes in.

2. The Airdrop Economy: A Leap from “User” to “Shareholder”

If tokenization allows value to flow as freely as information, then the rise of the airdrop economy is fundamentally rewriting the economic relationship between platforms and users.

We are witnessing a business model revolution unlike anything before —

From: users pay to use To: users use for free To now: platforms pay users to use

In this new model, users are no longer sidelined consumers — they are, for the first time, brought into the center of value distribution. They are no longer just users, but co-builders and beneficiaries.

2.1 The Essence of the Airdrop Economy: Value Trickle-Down + User-as-Shareholder

In the past, users paid for services. Later, platforms became free to use and profited through advertising. Now, decentralized platforms go a step further: they directly give users money.

It might sound like a fairytale, but it’s already happening. The airdrop economy refers to the practice of distributing tokens to early users, contributors, developers, and evangelists — effectively redirecting value that used to be monopolized by platforms back to users.

These tokens represent not only future profit-sharing, but also governance rights. In other words, they establish a new kind of user-shareholder platform model.

To understand the power of the airdrop economy, let’s look at how the flywheel model works in practice:

- Growth begins with airdrops: The platform allocates a portion of its tokens and distributes them freely to early users or contributors.

- Users gain rewards and a sense of belonging: After receiving the tokens, users not only benefit from price appreciation but also gain an identity: “I’m a part of this platform.”

- Increased platform engagement and liquidity: As users do more on the platform, TVL (Total Value Locked), trading volume, and community reputation all rise together.

- Platform value rises, token prices go up: Greater user participation lifts overall valuation and token price.

- New users rush in: The cycle restarts — token incentives become a perpetual motion engine for growth.

This logic isn’t theoretical. It has already played out many times in the real world.

2.2 The Airdrop Economy: Becoming a New Paradigm for Web3 Value Discovery and Community Formation

In traditional business logic, any form of financial outlay — whether it’s user acquisition bonuses or referral rebates — must be calculated meticulously with metrics like ROI (return on investment) and CAC (customer acquisition cost).

But in the Web3 world, the rise of the airdrop economy is disrupting this logic from the ground up.

It no longer follows the traditional model of “rewarding only after contribution.” Instead, it embraces a philosophy of “value first, trust-driven” — allocating ownership stakes upfront to potential users and contributors as a lever to activate their future participation and ecosystem co-building.

2.2.1 Uniswap: The Ownership Revolution Ignited by an Airdrop

Uniswap’s 2020 airdrop was a landmark event in this new paradigm. It wasn’t just a token giveaway — it was hailed as the crypto world’s “people’s IPO.”

Every early user woke up to find 400 UNI tokens sitting in their wallet — worth around $1,200 at the time, and over $10,000 at the height of the bull market.

What made Uniswap revolutionary was this:

- It was the first large-scale proof that “airdrop = advertising”: Giving tokens directly to users proved far more effective than traditional ad campaigns at attracting liquidity (TVL surged) and building brand momentum.

- It redefined governance: Users were no longer just liquidity providers or service consumers. By holding UNI, they became platform shareholders — able to participate in decision-making and influence future development. It marked a new kind of open-source project — where community members became core stakeholders.

2.2.2 EigenLayer: A Systemic Market Kickstart Driven by Expectation

Uniswap’s success opened the door to the airdrop economy. But later players refined it into something more strategic and sophisticated.

A prime example is EigenLayer, a restaking protocol. Unlike Uniswap, EigenLayer didn’t immediately launch a token. Instead, it built an intricate “airdrop expectation” mechanism, successfully attracting massive ETH restaking from users who otherwise would have left their assets idle on Ethereum’s mainnet.

EigenLayer’s strategy reveals the next stage of airdrop evolution:

- The magnetic force of future value: Before the EIGEN token was even launched, clear expectations and protocol design alone helped push its TVL beyond $10 billion.

- A systemic go-to-market experiment: In April 2024, its first token distribution didn’t just cause a stir in the crypto community — it sparked interest across entire sectors like modular security and Actively Validated Services (AVS). It went far beyond a simple user reward; it became a full-blown market experiment: using future ownership to bootstrap present-day participation and ecosystem expansion.

These broad-based, inclusive airdrops are not closed-door games for elite insiders. They are designed to be “consensus ignition events” — reaching across the ecosystem: from regular users, to developers, to node operators.

They breathe unprecedented energy and participation into the entire network.

2.2.3 The Airdrop Economy Has Become the Core Engine of the Web3 Narrative

From Uniswap’s groundbreaking experiment to EigenLayer’s expectation-driven innovation, we’re witnessing a clear trend: Airdrops are evolving from isolated marketing stunts into a systematic, foundational paradigm for Web3.

They are reshaping three core business questions at their root:

- Where do users come from? → From “paid acquisition” through ads to “co-creation partnerships” built on value alignment.

- How are communities formed? → From loose interest-based groups to “distributed corporations” grounded in shared ownership and incentives.

- Why does the platform grow? → From unilateral service output to growth driven by token economies and multi-stakeholder participation.

The essence of the airdrop economy goes far beyond the surface-level act of “giving away tokens.” It’s a redefinition of how to organize and incentivize people, treating the community as the core asset, the users as the growth engine, and the token as the connective tissue.

This is Web3’s founding vision in practice:

No longer using ads to attract users, but using value itself to attract value.

2.3 The Far-Reaching Impact of the Airdrop Economy

The emergence of the airdrop economy has fundamentally restructured the relationship between platforms and users — and opened a new door to mutual benefit for creators and developers alike.

2.3.1 A New Logic of User Acquisition

In Web2, platforms typically followed the same playbook for acquiring users: burn money on ads, treat users as “targets for conversion,” and treat attention as a “resource to be monetized.” It was all about optimizing ad spend and bidding for eyeballs between Google and Facebook. From the outset, the user’s value was defined as something to be extracted.

In the Web3 world, this model has been flipped on its head.

Airdrops replace ad budgets. Instead of paying intermediaries to attract users, platforms convert that spend into tokens and distribute them directly to real users — those who actively use the product, share it with others, and help build the ecosystem.

It’s a trust-based, reverse-incentive mechanism: The platform is no longer trying to “reach users through advertising,” but instead is inviting users to become shareholders.

2.3.2 Users Become Shareholders

This shift doesn’t just alter acquisition strategies — it redefines the user’s identity.

In the past, you were a tenant of the platform — use it, leave it, be replaced at any time.

Now, you participate as a co-governing shareholder. You’re not just a user, but a contributor, a promoter, even a policymaker. Holding platform tokens is like holding equity in a company. And that ownership unlocks a deeper motivation to engage, a stronger sense of belonging.

2.3.3 The “Invisible Labor” Becomes the Foundation

A deeper transformation is happening among creators and developers.

In the Web2 era, platforms controlled the distribution channels and attention funnels. Creators relied on them to survive — but were often exploited in return: They helped grow the platform, only to watch it IPO and cash out, leaving them behind.

In Web3, more and more protocols are setting aside token allocations early on for the “base layer workers” of the ecosystem: content creators, independent developers, node operators. They’re no longer outsourced labor. They’re true co-builders — earning equity based on contribution, receiving dividends based on protocol rules.

The platform is no longer a wall to be stared at from below — It’s becoming a bridge that can be built together and whose success can be shared.

This structural shift isn’t just an upgrade to a business model. It’s a fundamental redesign of how value is distributed.

Its deeper message is this:

The platform is no longer the center — the community is. The user is no longer the target — but the partner. And from now on, every meaningful growth cycle will have real owners.

2.4 The Hidden Risks of the Airdrop Economy: Beware of Bubbles and Abuse

Of course, this model isn’t without its vulnerabilities:

- Sybil attacks: Some exploit the system by creating multiple fake accounts to harvest airdrop rewards, undermining fairness.

- Airdrop bubbles: The unchecked issuance of tokens, especially without underlying business substance, can lead to short-term speculation and long-term trust erosion.

- Regulatory gray zones: In some jurisdictions, airdrops are already being classified as securities offerings, putting projects under increasing legal pressure.

All of these risks serve as a reminder: Airdrops are not a miracle cure. They must be carefully designed as part of a long-term, sustainable incentive structure.

That said, replacing “charging users” with “rewarding users” represents a profound step forward in building mutually beneficial relationships between platforms and communities.

And what happens after users receive tokens? They don’t simply sell them or stash them away, hoping for appreciation.

Many begin creating.

Some start building their own projects.

And more and more people are beginning to realize: In a decentralized world, innovation and entrepreneurship are no longer out of reach.

3. Open-Source Innovation: From Idea to Product, Just a Few Lines of Configuration Away

If tokenization laid the foundation for value to flow, and if the airdrop economy redefined how that value is distributed between platforms and users, then what truly enables innovation to explode at an exponential rate in this new era is the most powerful engine of all: open-source innovation.

This is a paradigm shift unlike anything before:

You don’t need venture capital. You don’t need connections. You don’t even need an office or server infrastructure.

All you need are a few open-source modules, a clear incentive mechanism, and a laptop connected to the Internet — and you could ignite the future of an entire ecosystem.

But none of this would be possible without one thing at the core:

Decentralization.

3.0 Open Source: A Prerequisite for Decentralization

In a system without centralized oversight or trusted intermediaries, code that isn’t open-source is simply not trustworthy.

If no one can audit it, no one will use it.

Decentralization forces code to be open. And once it is open, it becomes a kind of global launchpad for innovation.

This isn’t just about lowering the barrier to entry. It’s about redefining the very productivity of innovation.

Decentralization makes open source a necessity. Open source makes innovation a flywheel.

And this path has never been clearer, nor has it ever been so close to every ordinary individual.

3.1 How Does This System Actually Work?

What did starting a business look like in the past?

You’d come up with a good idea — then spend months assembling a team, finding investors, building a backend, setting up servers, integrating payment systems, registering a company, filing trademarks, and launching marketing campaigns.

By the time you were ready to ship, half your energy was already gone — burned on the so-called “preparation.”

Now enter the Web3 world.

In this new age of “Onchain-as-a-Service”, all of that backend infrastructure has already been broken down into reusable open-source Lego blocks:

wallet logins, on-chain payments, NFT issuance, community governance, voting mechanisms, content distribution…

All you need to do is pull the code from GitHub, tweak a few lines of configuration, and you’re ready to launch.

And thanks to the rise of modular blockchains (like Celestia) and Layer 2 solutions (like Arbitrum Orbit and OP Stack), developers can now customize and deploy their own appchains with unprecedented ease.

In many cases, spinning up a new product is now as fast and frictionless as changing your phone case.

This isn’t just a change in technical architecture.

It’s a complete revolution in the paradigm of innovation.

Farcaster is a decentralized social protocol.But it’s not a single app — it’s a “social base layer”, an open foundation on which anyone can build freely.

By early 2025, the Farcaster ecosystem had experienced explosive growth on Base, the Layer 2 network incubated by Coinbase.Its groundbreaking feature, Frames, allows developers to embed interactive applications directly within social feeds — like running a mini-app inside a tweet.

Farcaster’s daily active users once surged past 50,000, while the number of applications built within the ecosystem (whether mini-programs embedded in casts or standalone clients) climbed into the thousands.

Some of the most popular Frames apps attracted tens of thousands of user interactions within just a few days, showcasing the speed of innovation that becomes possible when open protocols are paired with high-performance modular chains.

3.2 The Cliff-Like Collapse of the Innovation Barrier

For individual developers, the open-source innovation flywheel means:

- Dramatically reduced costs: Infrastructure modules are all open-source, deployment happens on-chain, and starting a business no longer requires expensive servers, DevOps, or centralized payment integrations.

- Significantly faster speed: Taking an idea from concept to launch no longer takes months — it now takes just a few hours.

- Clearer, more direct returns: Developers don’t need to wait for a corporate acquisition or IPO. They can earn directly through protocol-level token distributions, community incentives, or even on-chain dividends. It’s build to earn.

According to a widely cited report by crypto investment firm Variant Fund — which has been consistently validated through data across 2024 and 2025 — the average startup cost for a Web3 developer has dropped by over 90%, while code reuse rates have climbed to nearly 80%.

This means one thing: Ideas have become the core asset — while capital and connections are being marginalized.

3.3 Potential Risks: Fast ≠ Risk-Free

Of course, the more powerful the open-source flywheel becomes, the greater the potential risks:

- Long dependency chains: The module you use may depend on another module, which in turn may rely on yet another. If any link in the chain is compromised — through attack, shutdown, or bugs — the entire product stack can collapse.

- Legal gray areas: Not all open-source code is free to use however you like. Different licenses (MIT, GPL, Apache, etc.) come with different rules for commercial use. Misusing code could lead to infringement risks.

- Security vulnerabilities: Code reuse also means bug reuse. Unvetted smart contracts can quickly become honeypots for hackers. In 2024 alone, we saw multiple high-profile exploits caused by reentrancy attacks and oracle manipulation, resulting in massive fund losses. These incidents were yet another wake-up call.

So even in the “flywheel era,” auditing, testing, and legal compliance remain essential.

At this point, the difference becomes clear:

In Web2, you had to build an organization to innovate. In Web3, all you need is an idea — and a community to help you build it.

Decentralization has turned “ideas” into currency. And it has made what once seemed wild and out of reach, radically executable.

And this loops us right back to the previous two flywheels:

- The new applications you build generate new assets, new users, and new forms of value.

- That value gets tokenized, initiating new airdrops.

- The airdrops bring in more contributors…

- And so on.

Eventually, you yourself become part of the flywheel.

4. Is There a Closed-Loop Logic Behind the Decentralized Business Model?

You may have already sensed it — Tokenization, the airdrop economy, and the open-source innovation flywheel are not isolated trends. In fact, they form an intensely interconnected loop.

This isn’t some coincidence. It’s a new mode of economic organization.

4.1 How Positive Feedback Takes Shape

The Internet was originally built for the free flow of information. Web3, at its core, is about the free flow of value.

Step 1: Tokenization — Making Everything Priced and Transferable

Tokenization gives value a standardized, on-chain “format” and “address.” Any asset — physical or abstract, local or global — can now be digitized, split, transferred, and recombined.

You can:

- Use USDC for cross-border payments;

- Use stETH as collateral in lending markets;

- Invest in tokenized U.S. Treasuries like BlackRock’s BUIDL;

- Even tokenize and monetize niche assets like attention, storage space, bandwidth, or security services (e.g., AVS on EigenLayer).

It all begins with pricing it on-chain.

Step 2: The Airdrop Economy — Distributing Value to Ordinary People

Once a token exists, the question becomes: who owns it?

In Web2, users created value, but platforms captured it. You might spend hours watching videos, commenting, inviting friends to sign up — but the ones getting rich were the platforms and their investors.

Web3 flips that logic. Instead of buying traffic through advertising, platforms “give money directly to users” to earn their loyalty.

Projects like EigenLayer, Starknet, and Wormhole prove a simple truth:

If you want adoption, the most effective strategy isn’t storytelling — it’s profit-sharing.

And from there, a new startup logic emerges:

- Use open-source modules to quickly and cheaply build an on-chain application;

- Launch a token and airdrop it to attract early users and contributors;

- As user activity increases, TVL rises, token prices go up, and attention pours in.

Airdrops aren’t just rewards. They’re the spark that ignites the flywheel.

Step 3: The Open-Source Innovation Flywheel — Constantly Spawning New Products

Once you have:

- Tokens (fuel),

- Users and capital (engine),

you’re ready to fire up wave after wave of innovation.

And it’s the open-source innovation flywheel that solves the biggest pain point for Web2 builders: high barriers and slow timelines.

You no longer need to build wallet systems, set up backend servers, or manage payment integrations. Everything is now modular — ready for you to plug and play.

Lowered innovation thresholds + open token incentives have led to a global wave of “code-native entrepreneurship.” Now, even a single person with a simple idea can launch a viable product.

So now we’re seeing a historic surge in on-chain innovation.

For example:

- Farcaster’s Frames: one idea can attract tens of thousands of users in days.

- Appchains on modular blockchains like Celestia or OP Stack are launching almost weekly.

- Restaking ecosystems (e.g., AVS on EigenLayer) are spawning dozens of projects around a single core protocol — each distributing points and airdrop expectations to grow their networks.

These projects eventually generate new assets and accumulate new value, which in turn gets tokenized, triggering the next airdrop, drawing in the next generation of builders.

4.2 The Ecosystem Flywheel Is Spinning Faster Than Ever

When you connect these three parts — tokenization, airdrops, and open-source innovation — you begin to see an astonishing pattern:

- Tokenization gives everything a digital expression, allowing value to move freely.

- The airdrop economy distributes value to users, creators, and developers.

- Open-source innovation continuously spawns new use cases, assets, and applications.

These new apps then generate more tokenizable value, triggering new airdrops, attracting new contributors — fueling the next wave of growth and innovation.

This structure doesn’t scale linearly.

It explodes exponentially.

We’re not just seeing “one great product emerge.” We’re seeing entire ecosystems replicate themselves — again and again.

It’s a never-ending acceleration spiral:

- One protocol spawns a token;

- One token inspires a new ecosystem;

- One ecosystem gives birth to a new set of economic rules.

So what is the real value of decentralization?

It’s not just “putting data on-chain” or “removing the middleman.”

For the first time in history, we are:

- Creating, distributing, and transmitting value with unmatched efficiency;

- Allowing thousands of individuals — without relying on institutions or hierarchies — to collaborate through pure incentive and shared consensus;

- Enabling innovation to self-replicate and evolve at scale, unleashing a new civilizational level of productive energy.

This isn’t just a technological revolution.

It’s a revolution in economic structure and institutional design.

Conclusion: The Future Has Arrived

As we look back over the three-part “Decentralization Trilogy,” a clear narrative arc begins to emerge.

Part I peeled away the mask of “fake decentralization.” We saw that no matter how long the blockchain is or how flashy the code looks, if the underlying infrastructure still relies on centralized cloud services and legacy platforms, then “freedom” is nothing but a facade — just a shiny wrapper for an old illusion.

Part II dissected the real foundations of decentralization: distributed ledgers, incentive mechanisms, and on-chain governance. Together, these form a new order — more stable, more trustworthy, more censorship-resistant.

And today, we finally answered the most fundamental question:

“What does this have to do with you?”

The answer is: a lot.

Decentralization is not some distant technical ideal. It’s a power shift unfolding in real time, and it’s already shaping:

- Whether you can grow your wealth with smaller capital through access to global value flows;

- Whether you can bypass gatekeepers and become a platform shareholder instead of just a “user”;

- Whether you can take a simple idea, stitch together a few modules, and launch it globally — without funding, gatekeepers, or red tape.

In the Web2 era, we were “users” — our data collected, our attention extracted, our consent buried in endless terms of service.

In the Web3 era, we can finally become co-builders, partners, governors — true stakeholders in every sense.

For the first time in history, ordinary people have the power to participate in institutional design at near-zero cost.

Not through a ballot box. Not through petitions. But through a wallet and a signature — by holding a token, joining a DAO, or simply being an early user of a protocol — you can become a co-architect of the next wave of systems and rules.

Because at the end of the day, the decentralization revolution is not just about a new technical stack.

It’s about who gets to create value, who gets to distribute it, and who gets to decide.

Yes, the U.S. stablecoin bill has introduced new variables into this story. It opens new doors for dollar-based liquidity — but also tightens the noose around the principles of open, permissionless innovation.

And yet, the true meaning of decentralization lies in this:

The power, profit, and future that once belonged only to big companies and big capital, for the first time, now belong to you.

This is a restructuring of production relationships. This is a redistribution of power from the top to the bottom. This is a paradigm shift in the very relationship between platforms and users.

And we — we are sitting in the front row of this great transformation.

You don’t have to be a developer. You don’t have to mine Bitcoin.

You only need to recognize one thing:

This era has changed.

The next wave of opportunity won’t belong to the platforms that got there first.

It will belong to those who are willing to learn, act, and trade sweat for equity.

The future won’t belong to giants. It won’t belong to those who simply “knew early.” It will belong to those who dare to act after they know.

The “Decentralization Trilogy” ends here. But your own journey into decentralization may have just begun.

So where should you start?

If you’re new to this space, begin with the Zero-to-One Tutorial Bundle I’ve put together. You’ll quickly learn the basics while participating in a few zero-cost airdrop opportunities, helping you build your first layer of assets and understanding with minimal risk.

If you’re already a Web3 native, join us in building AlphaDaii — a community of frontier explorers where we search for real decentralization dividends and uncover the next high-potential Alpha projects.

This time, don’t just watch from the sidelines.

Are you ready?

What Does Decentralization Have to Do with You, Really? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.