The crypto world is poised for a transformative year in 2025 and many investors and analysts are anticipating a year-long rally, especially after a new crypto-positive administration comes into power in the US.

Interestingly, investment management firm VanEck has revealed a bold set of predictions on the future of the crypto industry. These insights cover topics like crypto prices, an increase in activity, and institutional adoption that would send the industry into new peaks.

Bitcoin And Ethereum To Lead The Bull Market In 2025

According to VanEck, the crypto market is expected to experience a bull run that would reach a medium-term peak in the first quarter and new highs by the end of 2025. Particularly, the firm projects Bitcoin to climb above $180,000, Ethereum to surpass $6,000, Solana to exceed $500, and Sui to trade above $10. This bullish momentum is likely to be supported by a combination of macroeconomic factors and institutional adoption throughout 2025.

One of the important drivers of institutional adoption will be kickstarted by the US government. VanEck forecasts that the US will take significant steps to embrace Bitcoin, including incorporating it into strategic reserves. Additionally, the anticipated changes in SEC leadership are expected to lead to the approval of more spot crypto exchange-traded products (ETPs), including Ethereum ETPs featuring staking options.

VanEck sees 2025 as a pivotal year for the tokenized securities sector, which has already experienced massive growth this year, increasing by 61% to $12 billion. VanEck expects this growth to continue, with their value exceeding $50 billion.

The transition from permissioned chains to open-source blockchains is expected to be driven by advancements in blockchain bridging technologies. Key players like the Depository Trust & Clearing Corporation (DTCC) are projected to play an instrumental role in this growth.

Stablecoins, meanwhile, are going to revolutionize global payments. According to VanEck, daily settlement volumes of stablecoins could triple from the current $100 billion to $300 billion by the end of 2025.

This growth will likely be fueled by the increasing use of stablecoins in global commerce, remittances, and integration with major tech platforms. Such adoption could position stablecoins as a mainstream financial tool, handling transactions comparable to 5% of DTCC’s daily volumes.

Decentralized Applications, AI, And DeFi To Flourish

Decentralized applications (dApps) are set to narrow the performance gap with Layer-1 blockchain tokens, thanks to innovative launches in areas like artificial intelligence and decentralized physical infrastructure networks (DePIN).

VanEck anticipates a surge in AI agents, which are autonomous digital workers capable of performing tasks ranging from investment management to online community moderation. These agents are expected to expand their on-chain activity significantly in 2025 and create new use cases across DeFi, gaming, and social media.

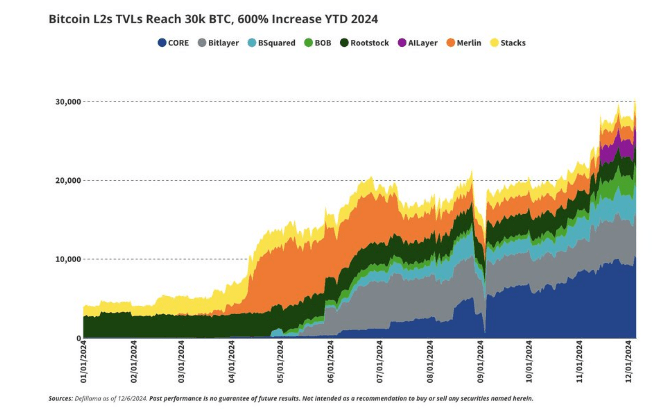

Furthermore, Bitcoin Layer-2 solutions are expected to amass 100,000 BTC in total value locked by 2025, following a remarkable 600% surge in 2024 that elevated TVL to 30,000 BTC.

According to VanEck, the total value locked in the DeFi industry is going to hit $200 billion, decentralized exchange (DEX) volumes could reach an all-time high of $4 trillion, while NFT trading volumes could rebound to $30 billion.

Featured image from Pexels, chart from TradingView