Key Takeaways

Why are more institutions entering the crypto space in 2025?

The approval of ETFs and rising returns on crypto treasury holdings have made digital assets more attractive to traditional finance players.

Which cryptocurrencies are leading institutional treasury adoption?

Bitcoin, Ethereum, and Solana are the top choices, with institutions collectively holding billions in each asset.

In 2025, institutional interest in crypto assets has reached unprecedented levels, challenging long-held views about the sector. This shift has led institutions to enter the market through vehicles like ETFs and crypto-focused treasury companies.

As a result, more firms are raising significant capital to acquire cryptocurrencies as part of their treasury reserves.

Amid this frenzy, Treasury Companies associated with Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have gained popularity.

Bitcoin treasury companies

Five years ago, the idea of companies holding Bitcoin was widely dismissed, as BTC was seen as too volatile and speculative.

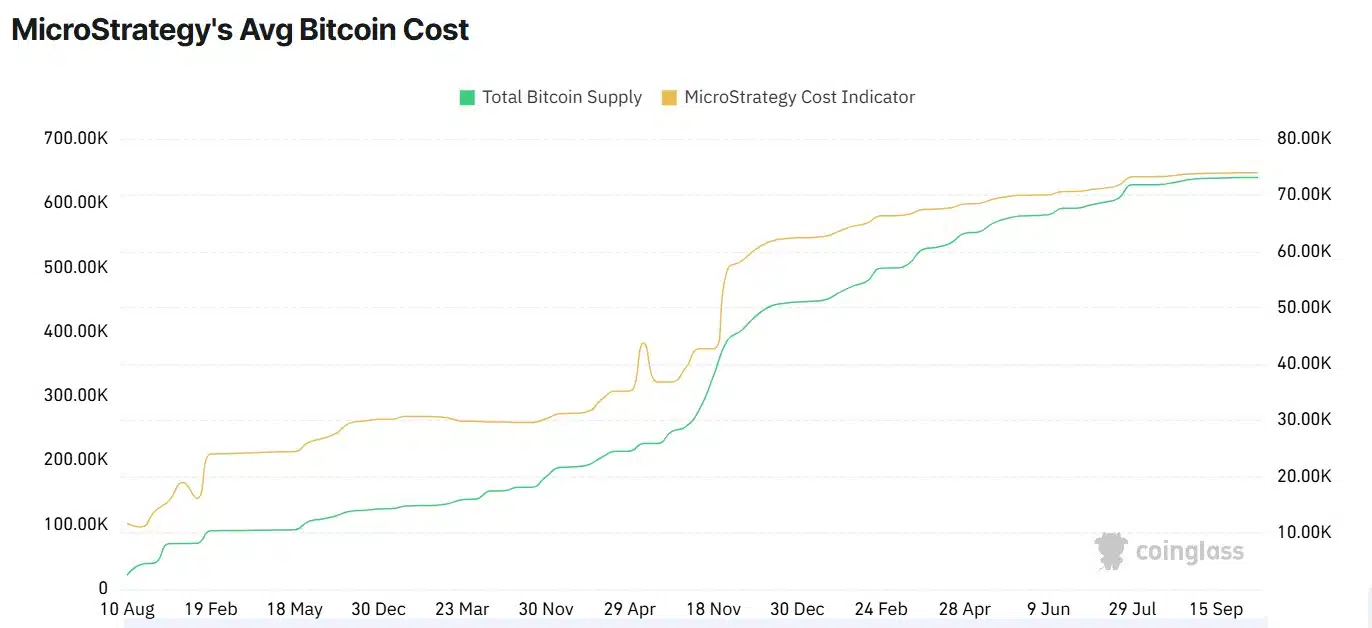

But in September and October 2020, the landscape began to shift, sparked by a bold move from MicroStrategy, which invested $425 million into Bitcoin, marking a turning point in institutional adoption.

Source: CoinGlass

Since then, Strategy (formerly MicroStrategy) under Michael Saylor has purchased 640,250 BTC, acquired for $47.3 billion, which is worth $73.7 billion. This marks the largest publicly traded company holding Bitcoin as a treasury asset.

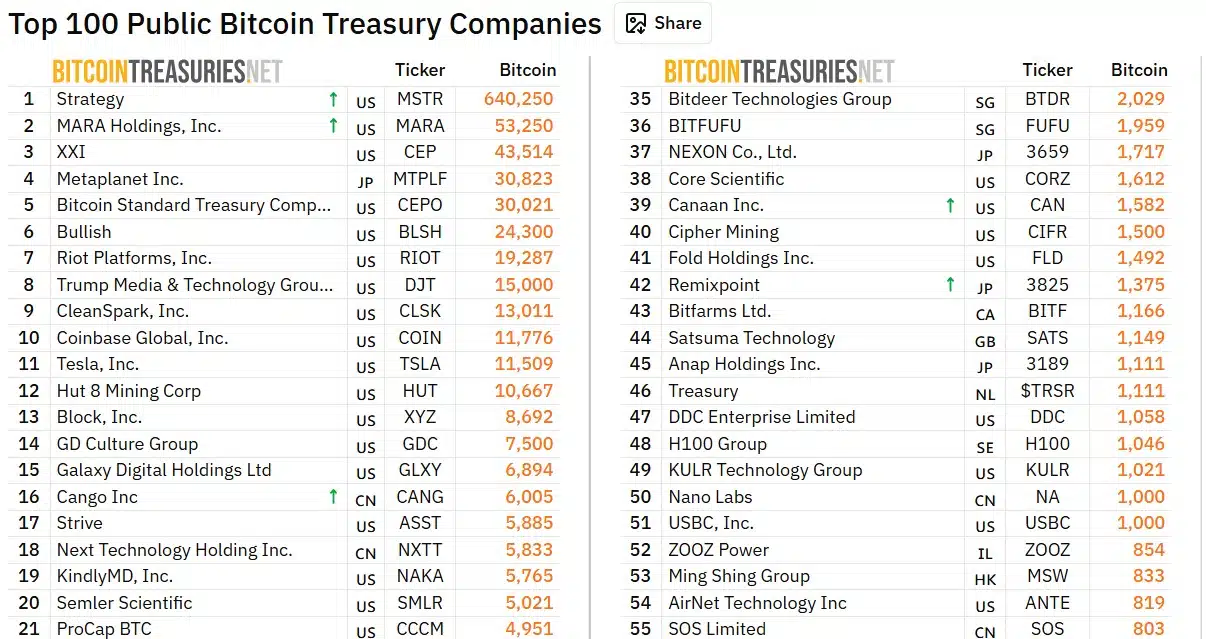

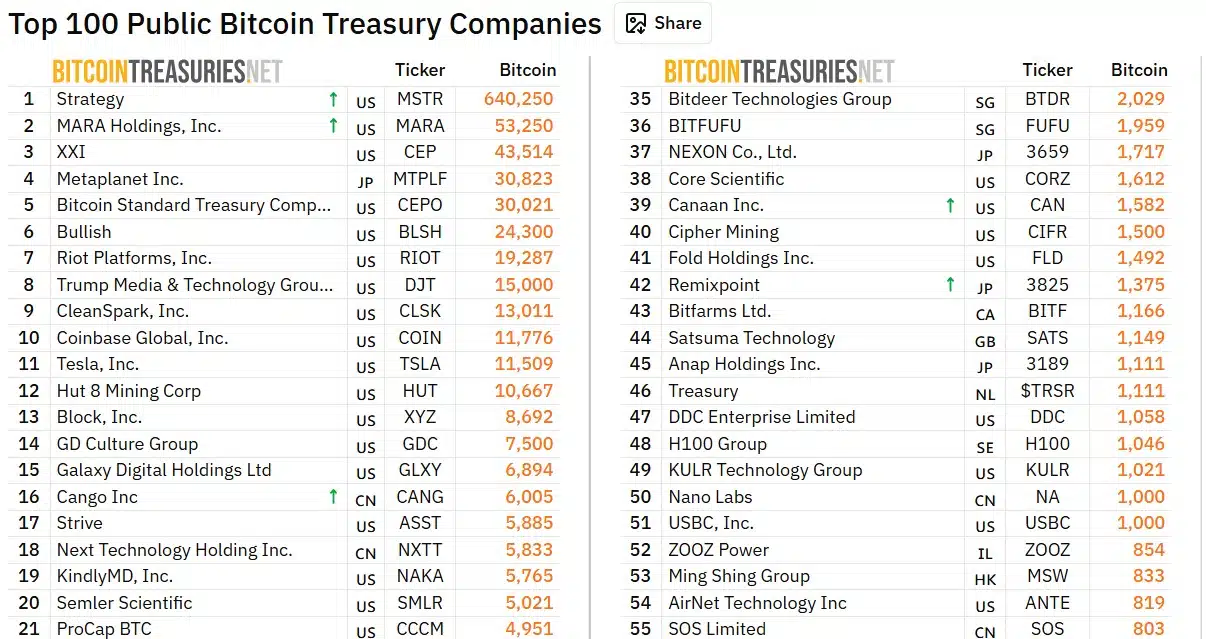

In terms of holdings, Strategy is closely followed by Mara Holdings [MARA], which holds 53.2k BTC worth $5.9 billion. In third place is CEP U.S., which holds 43.5k BTC, worth approximately $4.8 billion.

Source: Bitcoin Treasuries Net

Japanese firm Meteplanet ranks fourth, holding 30.8k BTC valued at $3.4 billion, followed closely by CEPO US with 30k BTC worth $3.3 billion.

In total, according to Coingecko, 122 institutions collectively hold 1,521,638 BTC, valued at $171 billion, accounting for 7.25% of Bitcoin’s total supply.

Five years ago, such institutional involvement in Bitcoin would have seemed improbable, underscoring how drastically the landscape has evolved.

Ethereum treasury companies

Treasury companies are no longer focused solely on Bitcoin; altcoins are gaining traction rapidly. Since the approval of ETH ETFs in July 2024, the number of companies accumulating Ethereum has surged.

By 2025, corporate ETH holdings will have reached an all-time high, with 4.7 million ETH held, according to Blockworks.

Source: Blockworks

Driven by growing demand for Ethereum, Bitmine Immersion leads all Treasury Companies with 3.03 million ETH valued at $12.1 billion, representing 2.5% of the total ETH supply.

The company has aggressively accumulated 962.7k ETH in the past 30 days alone.

SharpLink Gaming ranks second with 838.7k ETH worth $3 billion. In third place, Big Digital (BTBT) holds 150.2k ETH valued at $602.8 million, followed closely by Coinbase, which owns 136.7k ETH worth $548.8 million.

Source: Blockworks

In total, fourteen treasury companies are holding ETH worth $17.8 billion, representing 3.67% of the altcoin’s supply.

Solana treasury companies

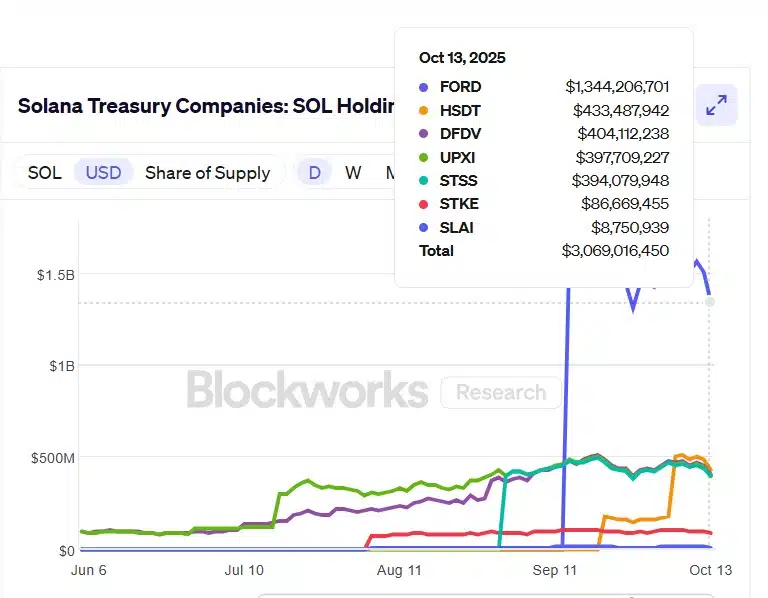

Solana treasury companies have recently entered the spotlight, following the path established by Ethereum and Bitcoin.

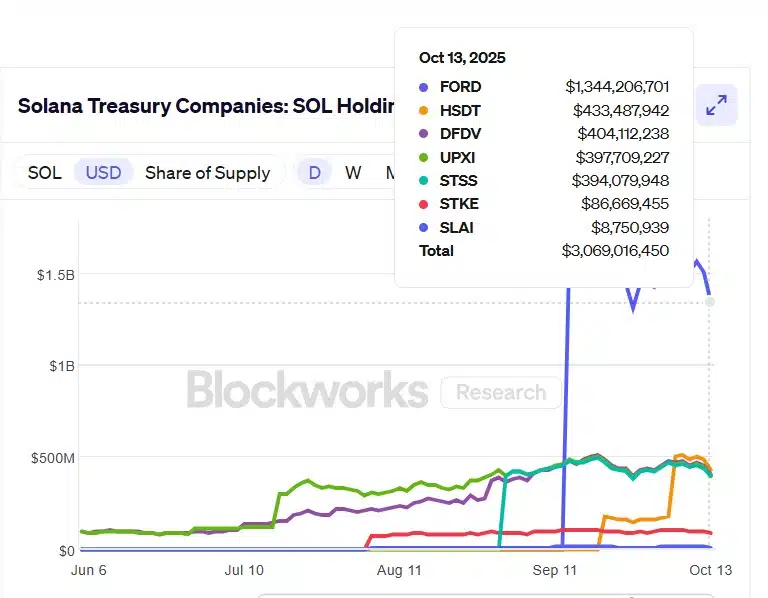

Over the past month, firms led by Forward Industries have aggressively accumulated more than 6 million SOL.

Forward Treasuries alone acquired 6.8 million SOL for $1.5 billion, though the holdings have since declined to $1.3 billion in value due to the recent market crash, resulting in a loss of over $200 million.

Source: Blockworks

In second place is Solana Company HSDT, holding 2.2 million SOL worth $433 million as per Blockworks.

Thirdly, DeFi Development Corp holds 2.09 million SOL, purchased at $226.9 million, and is now worth $410.7 million.

At fourth place is Upexi, which holds 2.08 million SOL worth $395 million, followed by Sharps Technologies with 2 million SOL worth $391 million.

Source: Coingecko

In total, 9 Treasury Companies are holding 13,441,405 SOL worth $2.63 billion, representing 2.46% of the total supply.

Are crypto treasury companies the key to the future?

Undoubtedly, the crypto space has changed significantly, maturing enough to mingle and connect with the traditional finance ecosystem.

Therefore, TradFi has all the incentives to venture into the crypto space and bridge the existing gap. In fact, the Total Asset Value of Companies’ crypto holdings has surged and peaked at $117 billion in October 2025.

Source: Blockworks

This growth reflects the increasing value of assets relative to the crypto assets held. This encourages more firms to venture as their returns are increasingly attractive.

From now on, more companies could venture into crypto holding, inspired by the industry’s maturity and rising returns on investment.

In turn, this will boost these crypto assets, including BTC, ETH, and SOL, leading to greater price appreciation and stability.