The cryptocurrency industry took a significant hit last year as a series of collapses forced major crypto firms into bankruptcy. This financial cataclysm impacted countless amateur investors, erasing their hard-earned savings.

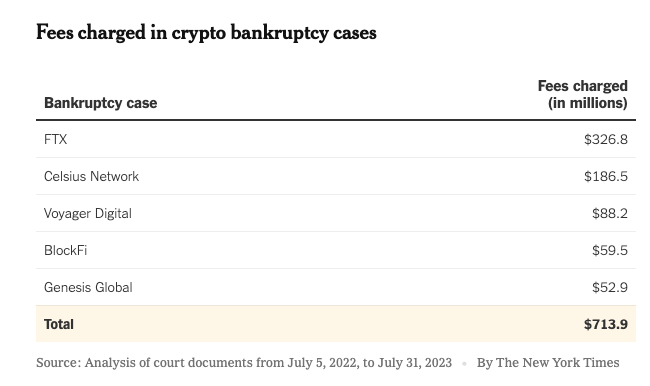

However, lawyers and corporate turnaround specialists emerged as the undeniable beneficiaries of the turmoil. These professionals have raked in more than $700 million in fees, a number set to soar as more cases unfold.

A Windfall for Legal Eagles

The staggering amount collected by professionals is not just limited to lawyers. The list of beneficiaries also includes accountants, consultants, and cryptocurrency analysts.

Two law firms in particular, Sullivan & Cromwell and Kirkland & Ellis, have billed astronomical sums. Indeed, the former charged over $110 million for handling FTX’s bankruptcy alone.

While high fees in bankruptcy cases are not uncommon, the crypto industry throws a unique curveball. Many of those who are owed money are not financial titans but rather everyday people who have invested their life savings.

Daniel Frishberg, a 19-year-old investor who lost approximately $3,000 when Celsius Network filed for bankruptcy, criticized the costs as “exorbitant and ridiculous.” For creditors, every dollar spent on fees is a dollar less they can hope to recover.

Click here to read more about the FTX collapse.

Professionals involved in these bankruptcy cases argue that the high fees are justified due to the intricacy and complexity of cryptocurrency transactions.

Lack of Clear Regulations Pushes up Costs

Andrew Dietderich, a partner at Sullivan & Cromwell, mentioned that the lack of clear regulations around cryptocurrencies adds another layer of complexity, thereby driving up costs.

The crypto community, known for its hyper-vigilant online presence, has put the magnifying glass on these soaring bankruptcy costs. The fees in FTX’s case have been especially scrutinized.

Creditors have questioned the high hourly rates of Sullivan & Cromwell, which go up to $2,165 for partners. This scrutiny amplifies the tension between crypto’s democratic ethos and the harsh reality facing many amateur investors today.

Click here for our guide to the 13 best no KYC crypto exchanges.

In an effort to control costs, bankruptcy judges have appointed fee examiners to oversee expenditures. These fee examiners, however, have recommended only modest reductions, leaving creditors unimpressed and calling for more aggressive cuts.

The crypto industry initially attracted millions of amateur traders with the promise of leveling the financial playing field. However, as the bankruptcy cases unfold, traditional power brokers like lawyers and accountants walk away with profits.

This tragic irony reflects the gap between crypto’s utopian ideals and the unforgiving realities of financial markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Why Crypto Collapses Are the New Legal Goldmine appeared first on BeInCrypto.