Stablecoin issuers continue to mint new tokens such as USDT and USDC. This expansion is often compared to the spark that ignites major market rallies. However, data shows that the market caps of leading stablecoins have increased for months while the broader crypto market has not grown proportionally.

The following report outlines several reasons behind this mismatch, based on recent data and industry analyses.

Sponsored

Sponsored

3 Reasons Behind the Decoupling Between Stablecoin Growth and the Crypto Market

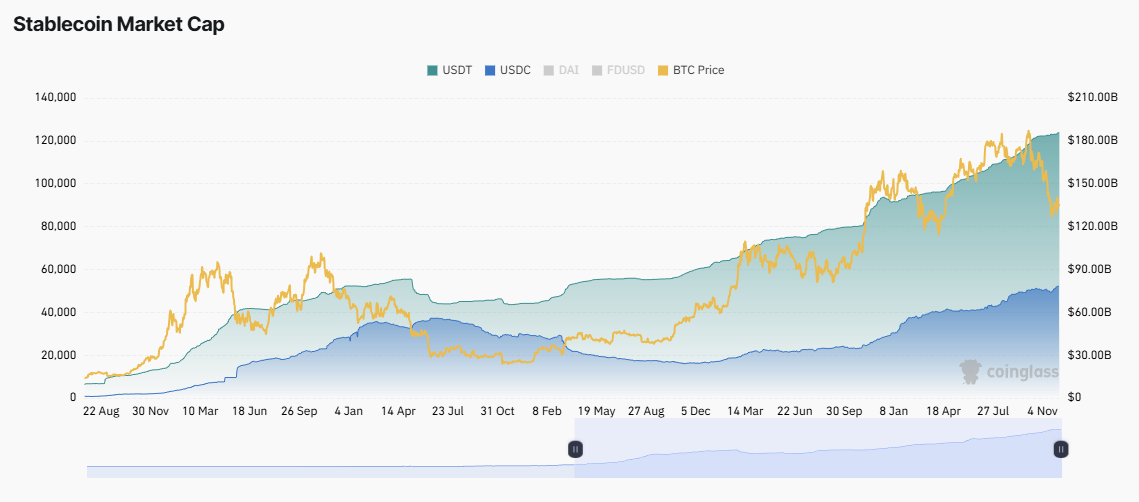

CoinGecko data shows that the market caps of USDT and USDC reached new highs in December, at $185 billion and $78 billion, respectively.

Both stablecoins have experienced steady growth since the start of the year. By December, Circle and Tether continued to issue aggressively. The latest report from on-chain tracker Lookonchain noted that Tether minted $1 billion and Circle added another $500 million.

Analysts often describe this capital as “dry powder” for the market. Yet the question remains: where has it actually gone?

More Stablecoins Flow Into Derivatives Exchanges Than Spot Exchanges

CryptoQuant data indicate that USDT (ERC-20) on derivatives exchanges has increased consistently since early 2025, rising from below $40 billion to nearly $60 billion.

Meanwhile, USDT (ERC-20) on spot exchanges has been trending downward. It currently sits near yearly lows.

Sponsored

Sponsored

USDC on spot exchanges has also dropped sharply in recent months, falling from $6 billion to $3 billion.

This data reflects a shift in trader behavior. Many prefer short-term opportunities with leverage rather than long-term spot accumulation. This shift makes it harder for altcoin prices to gain upward momentum.

Leveraged trading also introduces higher risk. It delivers fast profits but can erase capital just as quickly. Multiple billion-dollar liquidation events in 2025 illustrate this ongoing trend.

Stablecoins Now Serve Many Purposes Beyond Crypto Investing

Another reason stems from the broader utility of stablecoins. The issuance by Tether and Circle does not solely reflect internal demand for cryptocurrencies. It also reflects demand from the global finance ecosystem.

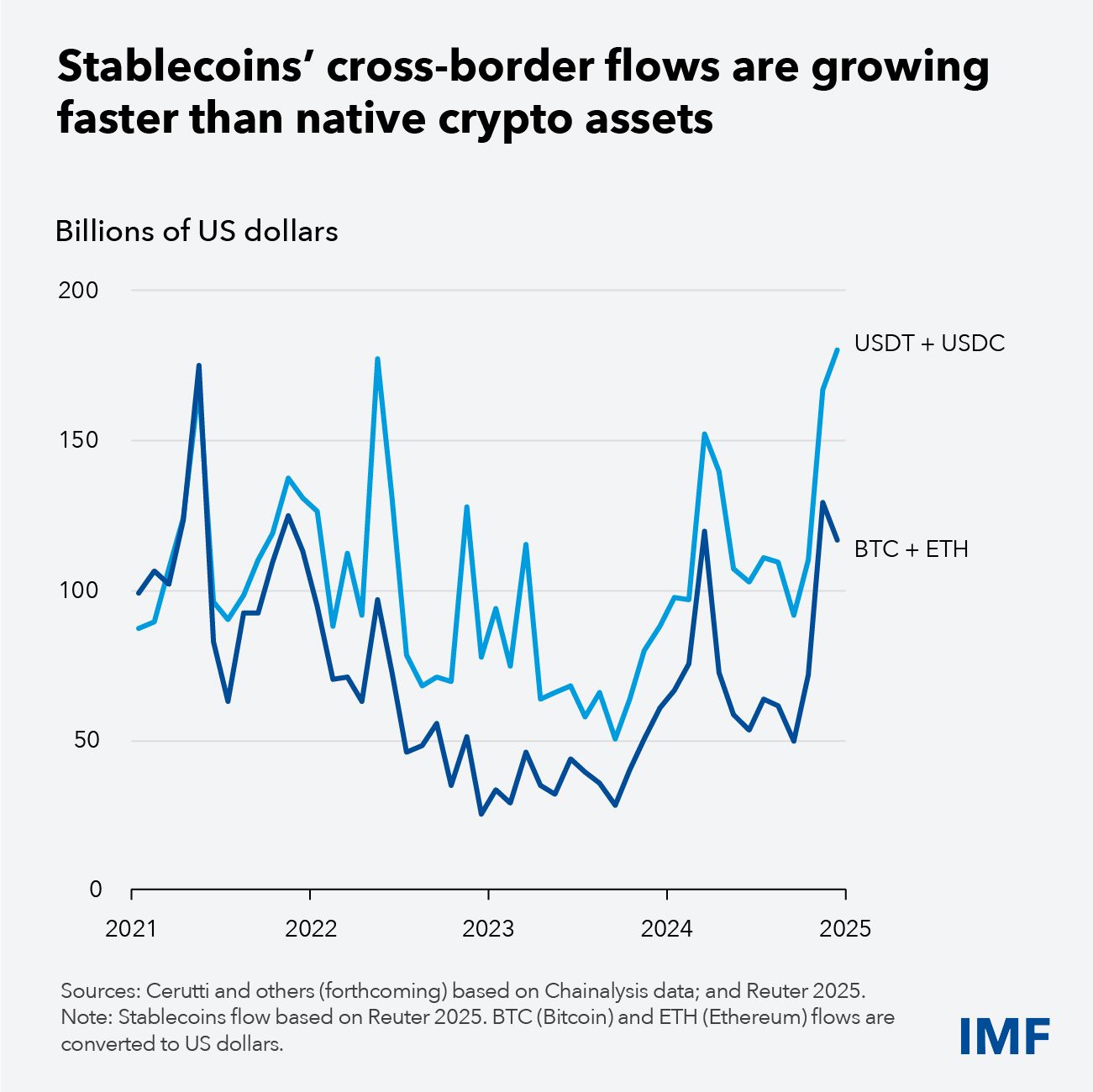

A new IMF report highlights the widespread use of stablecoins such as USDT for cross-border remittances.

Sponsored

Sponsored

The chart shows that cross-border flows involving USDT and USDC reached approximately $170 billion in 2025.

“Stablecoins could enable faster and cheaper payments, particularly across borders and for remittances, where traditional systems are often slow and costly,” the IMF noted.

As a result, even though supply increases, a substantial portion of capital is absorbed into real-world applications rather than speculation.

Sponsored

Sponsored

Investor Caution Slows Capital Rotation

A third factor is cautious investor sentiment.

A recent Matrixport report describes the current market conditions as lacking retail participation and exhibiting low trading volume. Sentiment indicators remain in “fear” and “extreme fear” territory.

“Simply put, without volume, enthusiasm cannot compound, and without enthusiasm, volume will not return, a classic crypto chicken-and-egg standoff,” Matrixport reported.

This sentiment pushes investors to hold stablecoins instead of deploying them into Bitcoin or altcoins.

Historical data reinforces this view. A comparison of Bitcoin’s price and the market caps of USDT and USDC reveals that, in the first half of 2022, stablecoin supply continued to rise even after the market had entered a bear phase. In late 2022, stablecoin supply dropped sharply as many investors exited the market.

An increase in stablecoin market caps does not automatically translate into higher Bitcoin or altcoin prices. The impact depends heavily on investor sentiment, capital flows, and the broader use cases driving stablecoin demand.