Prominent crypto investor Layah Heilpern shares her rationale for persistently acquiring Ethereum (ETH) and her plan to liquidate her holdings as the crypto market gains momentum.

“I’ve been buying and will 100% sell in the bull market,” she stated.

Layah Heilpern Sees Potential For Rewards to Outweigh Risks

In a series of posts on X (formerly Twitter), Heilpern states her reasons for investing in ETH, while opting to sell when the market starts to see significant growth:

“Safer than all the alts and still smaller market cap than bitcoin so will pump harder when money flows in.”

Heilpern also emphasizes its safety, citing the United States Securities and Exchange Commission (SEC) not designating it as a security.

The SEC’s recent classification of numerous cryptos as securities has sparked skepticism among many investors regarding its potential impact on the broader market.

Learn more: Solana vs. Ethereum: An Ultimate Comparison

At the time of publication, Bitcoin has a market capitalization roughly three times larger than that of Ethereum.

Bitcoin boasts a market capitalization of $680.9 billion, while Ethereum stands at $226.4 billion.

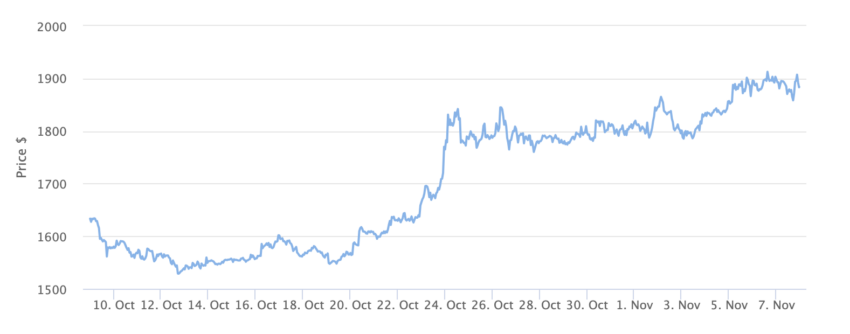

At the time of publication, Ethereum’s price is $1,881.

Recent Discussions Revolve Around Ethereum’s Price

The price of Ethereum has been widely reported in recent times.

BeInCrypto reported on November 6 that ETH’s price achieved a breakthrough, breaking a 200-day descending resistance trendline.

After a 203-day period of declining beneath this trendline, Ethereum’s price reached a new yearly high of $1,916.

Earlier reports stirred speculation in the crypto community as another investor amassed significant amounts of Ethereum.

On November 4, BeInCrypto disclosed that a crypto whale deposited 31.8 million USDT into Binance. Subsequently, he withdrew 8,698 ETH valued at about $15.94 million just hours later.

Further investigation revealed that the same whale deposited 24,495 ETH, roughly $45 million, into Binance following Ethereum’s price increase, securing a profit of approximately $5.47 million.

Learn more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

Top crypto platforms in the US | November 2023

Paybis

Paybis” target=”_blank”>No fees for 1st swap →

iTrustCapital

iTrustCapital” target=”_blank”>Crypto IRA →

Coinbase

Coinbase” target=”_blank”>$200 for sign up →

Uphold

Uphold” target=”_blank”>No withdrawal fee →

eToro

eToro” target=”_blank”>$10 for first deposit →

BYDFi

BYDFi” target=”_blank”>No KYC trading →

The post Why This Crypto Investor Plans to Liquidate 100% of ETH During Bull Market appeared first on BeInCrypto.