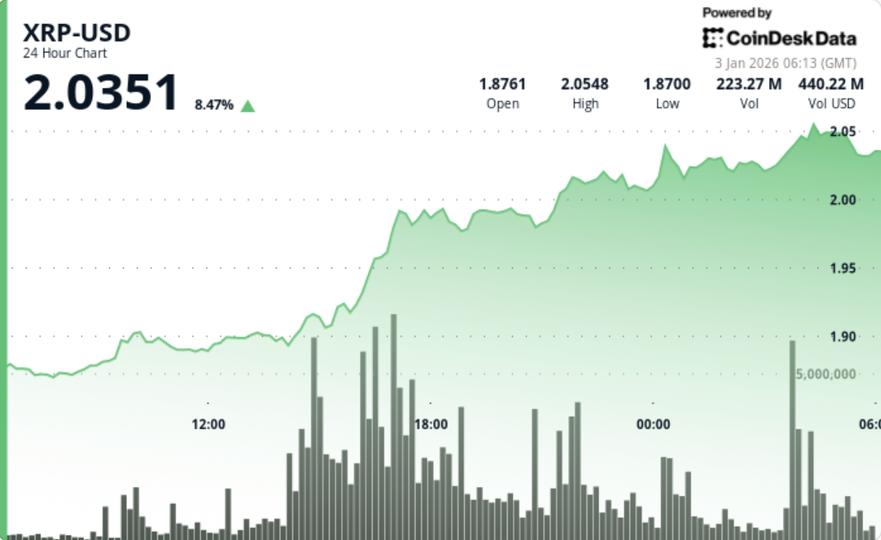

XRP surged to $2.02 after buyers forced a clean break through $1.96 on strong volume, flipping a key ceiling into support and putting the focus on whether the token can hold above $2.00 long enough to trigger a second leg higher.

News background

The move lands as traders re-engage with large-cap alts after a choppy stretch that repeatedly rejected XRP above the $2.00 handle. For XRP specifically, the $1.96 level has acted as a recurring decision point in recent sessions — rallies that cleared it briefly often struggled to hold, while failures at the level attracted fast selling.

That makes the quality of the breakout the story this time: rather than a thin, stop-driven pop, the rally came with sustained volume, suggesting larger participants were active. With positioning still sensitive into early January, XRP’s ability to stay above $2.00 could influence whether sidelined traders step back in or treat the move as another sell-the-rip opportunity.

Technical analysis

XRP jumped 8.7% from $1.8766 to $2.0227 over the 24-hour session ending Jan. 3, with the breakout gaining traction at 17:00 UTC, when volume surged to 154.4M — about 142% above the session average — and price pushed decisively through $1.96.

That level is the inflection point. Clearing $1.96 turned the prior ceiling into a potential floor, and XRP followed through into the $2.00–$2.03 band rather than immediately snapping back below it. Price then established a new support pocket near $2.01–$2.03, which traders will treat as the “must-hold” zone if this breakout is going to stick.

Late-session action showed the first real test: XRP pulled back from a $2.031 high to about $2.023, drawing 1.59M in volume during the dip. Importantly, that pullback stayed controlled — a ~0.4% retracement — and didn’t turn into a cascade back through $2.00. That’s the profile traders want to see after a breakout: digestion, not immediate rejection.

Price action summary

- XRP rose from $1.8766 to $2.0227 (+8.7%) over 24 hours

- The key break occurred as XRP cleared $1.96 on a 154.4M volume burst

- XRP established a new $2.01–$2.03 support zone above the psychological $2.00 level

- Price pulled back modestly from $2.031 to $2.023, holding the breakout structure intact

What traders should know

This move is now about holding the flip, not chasing the breakout.

The levels are clean:

- If XRP holds $2.01–$2.03 and keeps $2.00 intact: the breakout remains valid and the market can start working toward $2.03–$2.05 first, then the next resistance pocket above that. Sustained trade above the recent consolidation highs would signal buyers are still in control.

- If XRP loses $2.00 and slips under $2.01: it becomes a “breakout without follow-through,” and the market is likely to retest $1.96 — now the key line between a bullish reset and a return to the prior range.

- If $1.96 fails on the retest: the rally risks being treated as a liquidity event, reopening the downside toward the pre-break base.

Bottom line: $2.00 is the headline level, but $1.96 is the real line in the sand. If bulls defend both, the tape can build a continuation move. If not, this slides back into the same range the market just escaped.