XRP price has struggled to regain traction over recent weeks, with multiple failed recovery attempts deepening bearish pressure. The token remains locked in a downtrend, reflecting hesitation across the broader crypto market.

Despite this weakness, XRP ETFs continue to attract capital, signaling that institutional demand remains resilient.

XRP ETF Demand Remains Strong

Losses among XRP holders have steadily increased, adding pressure to near-term price action. Net Unrealized Profit and Loss data shows unrealized profits have dropped to a yearly low. Investors who purchased XRP above $1.86 are now holding losses, while only those who entered below this level remain in profit.

Sponsored

Sponsored

This shift raises concerns around long-term holder behavior. Addresses holding XRP for more than a year may consider selling to lock in remaining gains. If profit-taking accelerates among these holders, selling pressure could intensify and further weigh on XRP price stability.

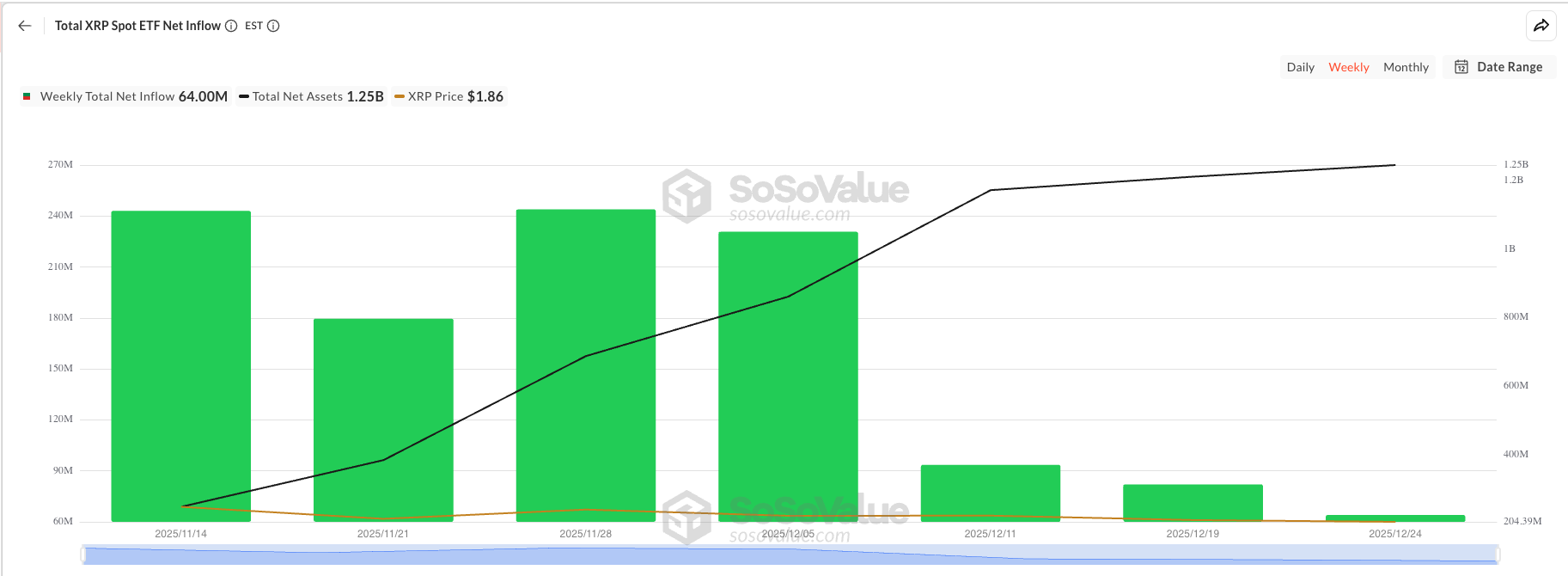

XRP ETFs remain the asset’s strongest macro support. Since launching six weeks ago, the funds have not recorded a single day of net outflows. This consistency stands out amid broader market uncertainty and declining activity in the spot crypto market.

Momentum has continued into week seven. On the trading day before Christmas, XRP ETFs recorded $11.93 million in inflows. This data suggests institutional investors maintain confidence in XRP’s longer-term outlook, even as retail sentiment weakens and price action remains constrained.

XRP Price Downtrend Continues

XRP traded near $1.86 at the time of writing, holding just above the $1.85 support level. Price remains capped beneath a downtrend line that has persisted for over six weeks. Repeated failures to break this structure have reinforced bearish sentiment among short-term traders.

A breakout appears unlikely under current conditions. Market direction remains unclear, and rising losses increase the risk of additional selling. ETF inflows may help stabilize price, potentially keeping XRP above the $1.79 support. A breakdown below that level could extend the downtrend toward $1.70.

However, a shift in broader market conditions could alter the outlook. Improved risk sentiment may allow XRP to bounce from $1.85. A decisive move above the downtrend line would target $1.94. Clearing that level could open a path toward $2.00, invalidating the bearish thesis.