Quick Take

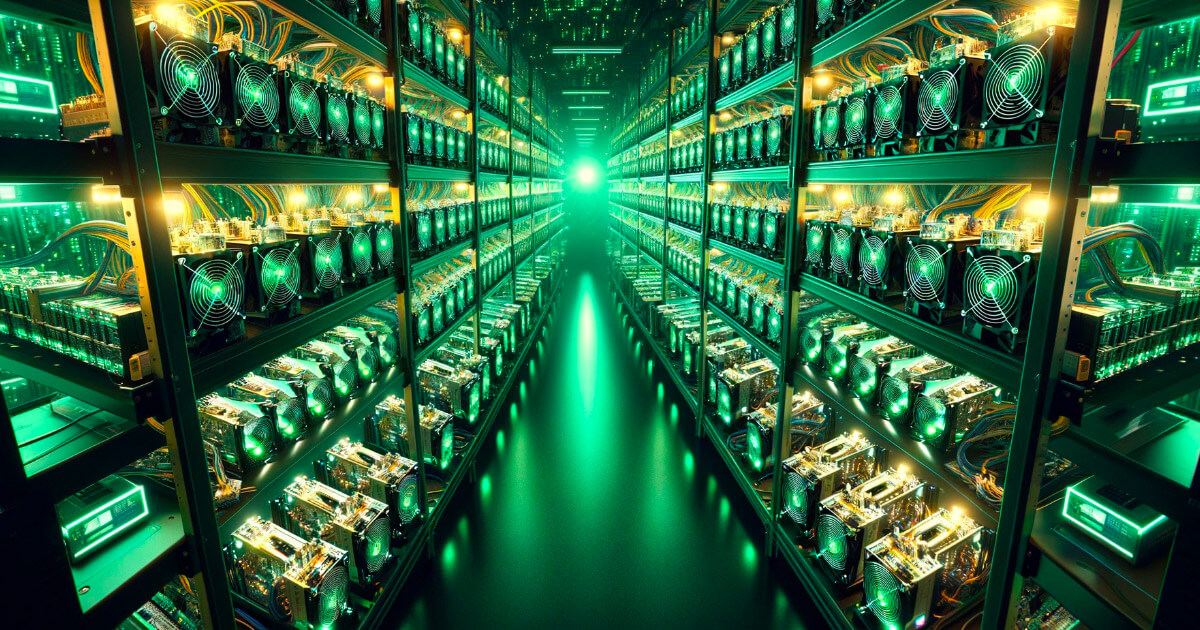

Bitcoin mining stocks have seen a remarkable performance in 2023, outpacing Bitcoin’s already impressive 160% YTD surge. Key mining players, including Hive and Marathon Digital Holdings, have recorded skyrocketing growth figures at an astonishing 274% and 767% YTD, respectively.

Data from Fintel points to an intriguing phenomenon – a significant percentage of short interest in these mining stocks, corroborated by analyst Mortensen Bach. This short interest has added momentum to their upward trajectory. CryptoSlate observed a divergence a few months prior between miners and Bitcoin’s price, a trend that has now caught up and exceeded the Bitcoin price.

| Mining Stock | Short Interest % |

|---|---|

| $HUT | 32.74% |

| $WULF | 22.58% |

| $MARA | 22.60% |

| $CIFR | 20% |

| $RIOT | 18.16% |

| $BTBT | 13.73% |

| $CLSK | 8.42% |

| $SDIG | 7.20% |

| $BITF | 6.51% |

| $HIVE | 5.25% |

| $IREN | 4.01% |

| $BTDR | 3.13% |

| $MSTR | 20.93% |

Source: Fintel

The Bitcoin mining proxy, WGMI, has surged 143% in the past three months, compared to Bitcoin’s 64% increase. The interplay of high short interest and rising prices on these mining stocks suggests a potential short squeeze scenario playing out. As prices continue to climb, shorts may be closing their positions, propelling prices upwards.

The post Bitcoin mining stocks dwarf Bitcoin’s gains amid short squeeze buzz appeared first on CryptoSlate.