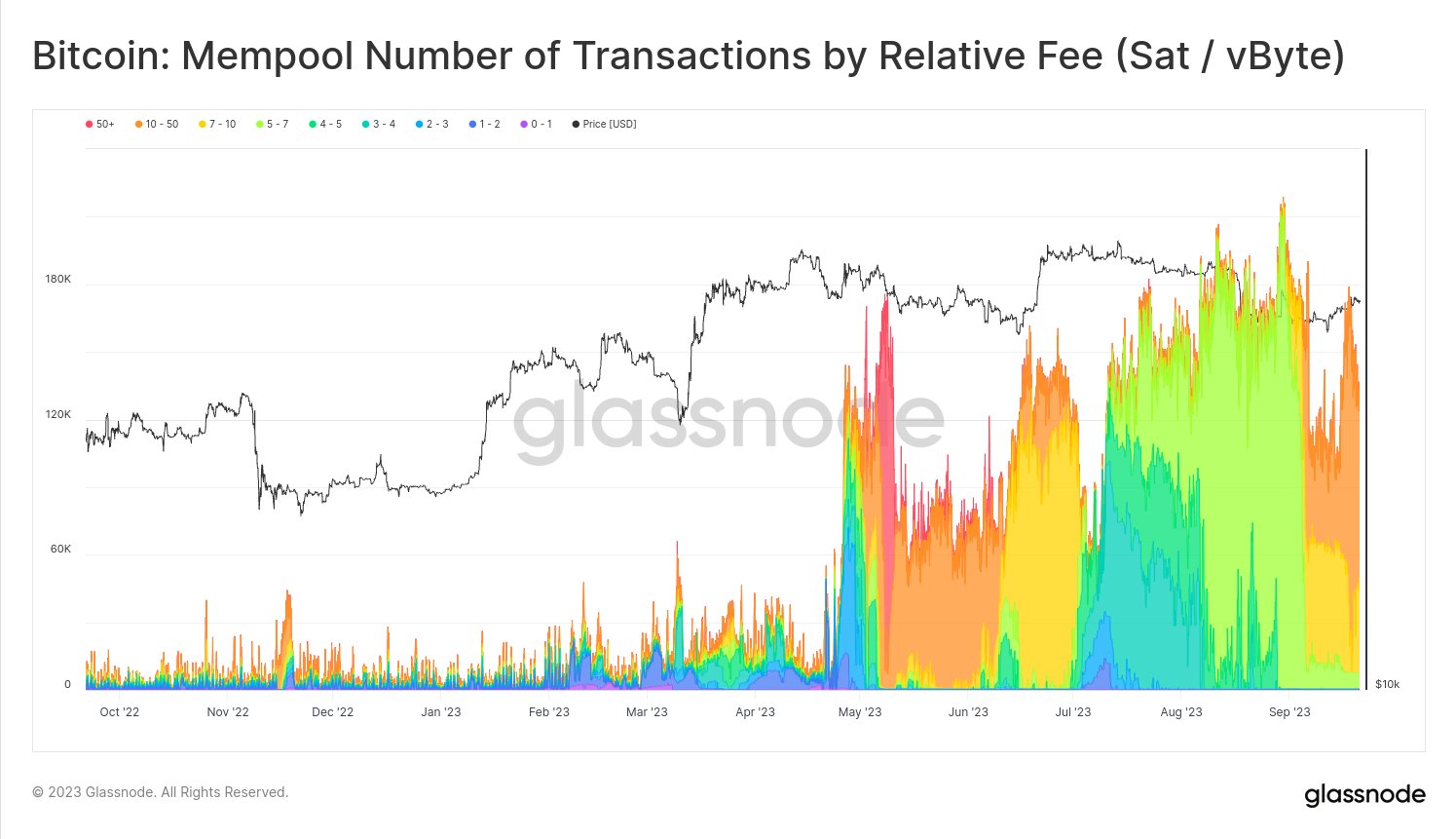

The Bitcoin network is treading unprecedented territory, with block fullness experiencing the longest period of in history, according to the latest data by Dune. As of press time, over 461,000 transactions are queued up in the mempool, a situation that has stirred both intrigue and in-depth examination within the digital currency sphere.

Glassnode’s chief researcher, James Check, widely recognized as “Checkmate”, has emerged with a comprehensive analysis attempting to decipher the causes behind this swelling blockspace demand. His assessment illuminates a puzzling paradox: while key metrics like new addresses and transaction counts are at remarkable highs, there’s a conspicuous dip in the on-chain settlement of BTC volumes, which he pointed out are “approaching yearly lows.”

Why Is Bitcoin Seeing Historical Block Fullness?

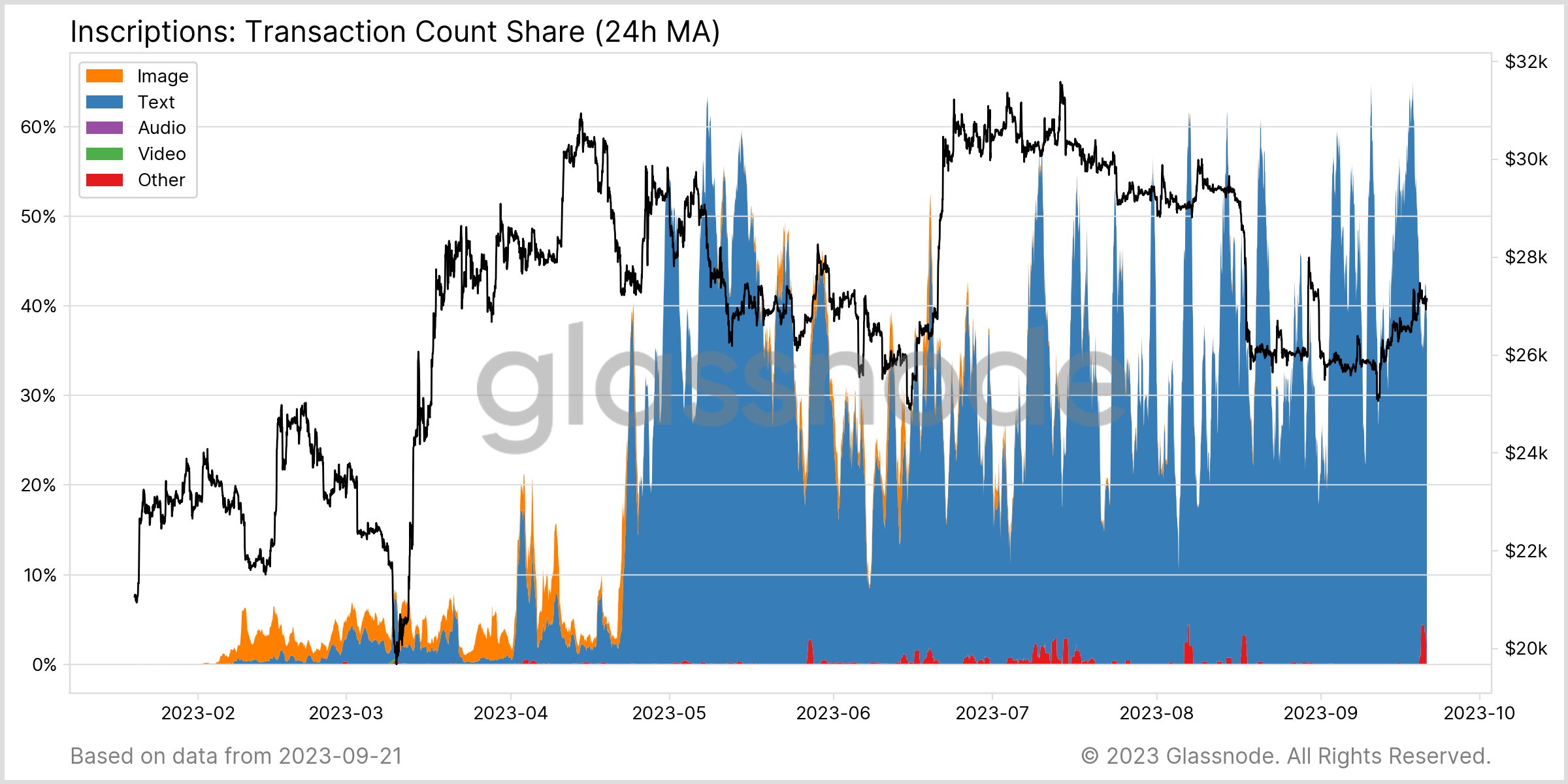

The crux of Checkmate’s findings revolves around the relatively new phenomenon in the Bitcoin network: “Inscriptions.” Text-based inscriptions, to be specific, have been accounting for a significant 50% to 60% of all transactions confirmed since mid-April, the same timeframe from which the Bitcoin mempool hasn’t cleared.

However, what’s even more perplexing is that, despite this substantial percentage of transaction confirmation, these inscriptions hold a surprisingly low footprint in block sizes. They consume just about 10% of the block size in terms of bytes and are accountable for around 20% of the transaction fees.

This pattern, Checkmate suggests, underscores a BASELOAD fee pressure, an economic scenario where users show a preference for consuming lower-cost blockspace. “Fee pressure has certainly cooled down from the spike in May. #Bitcoin fees are elevated relative to the bear market, but far from the exuberance of the bull,” the Glassnode researcher notes.

And despite the numerical superiority of inscription transactions, the data shows that the lion’s share of the block – over 80% – still pertains to monetary transfers. This stands in stark contrast to the substantially reduced number of such transfers happening now. Checkmate concludes:

Inscriptions are sensitive to high fees, but are willing to buy cheap blockspace. In many ways, this demonstrates that Inscriptions do not price out monetary transfers. […] Inscriptions fill the void left by empty blockspace, and have done for 5 months.

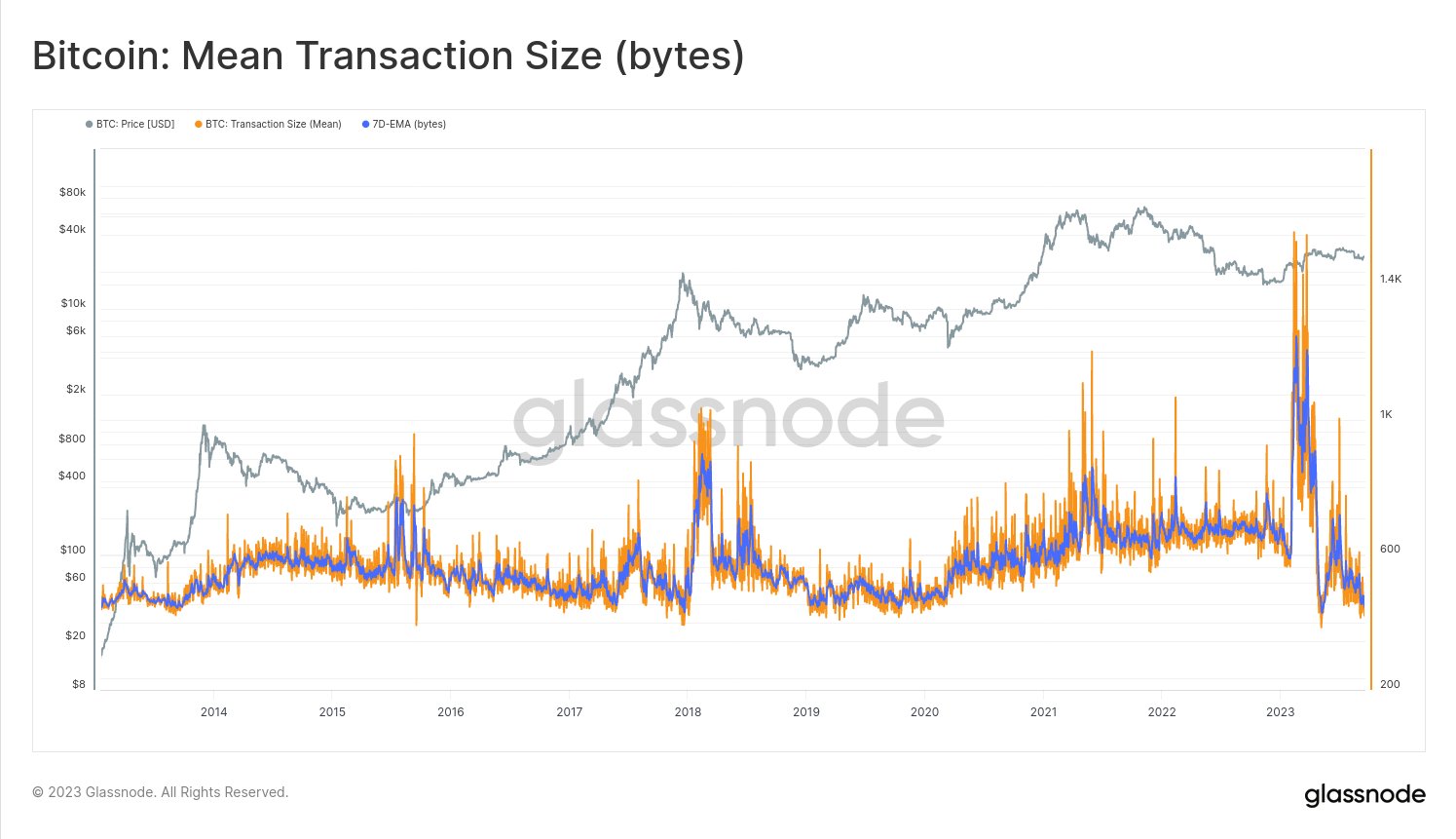

Further deepening the analytical dive, Checkmate highlighted a noteworthy trend in average transaction sizes over Bitcoin’s history. Historically, the average transaction size hovered between 550 to 600 bytes. But with the introduction of image inscriptions in March 2023, there was a spike, with the average transaction size vaulting to over 1.4kb. In the subsequent period, text inscriptions have reduced the average size to an all-time low of 435 bytes.

On a broader spectrum, Checkmate mused over the philosophical and cultural ramifications of these inscriptions. He sees them as more than mere data inputs, but as timestamps that capture the zeitgeist of society. In his words, such features transform Bitcoin into something more humanistic. He believes that Bitcoin, in its undying and incorruptible nature, is essentially humanity’s “golden record.” It’s the unalterable ledger that, he says, “tells the truth about what happened.”

In conclusion, the burgeoning trend of inscriptions and its myriad implications for the future of the Bitcoin network are bound to remain focal points of debate, exploration, and innovation within the Bitcoin space.

At press time, BTC traded at $26,991.