Declining volumes and activity on crypto futures and options markets is another signal that risk appetite for the asset class is diminishing in the bear market. Both retail and institutional activity is at a multi-year low as crypto winter drags on.

In its September 4 week on-chain report, analytics provider Glassnode reported that crypto derivative markets showed a continual liquidity outflow. This suggests that capital continues to “move higher up the risk curve to relative safety,” it stated.

Crypto Derivatives Decline

Derivatives markets have matured over the past few years, especially Bitcoin and Ethereum contracts.

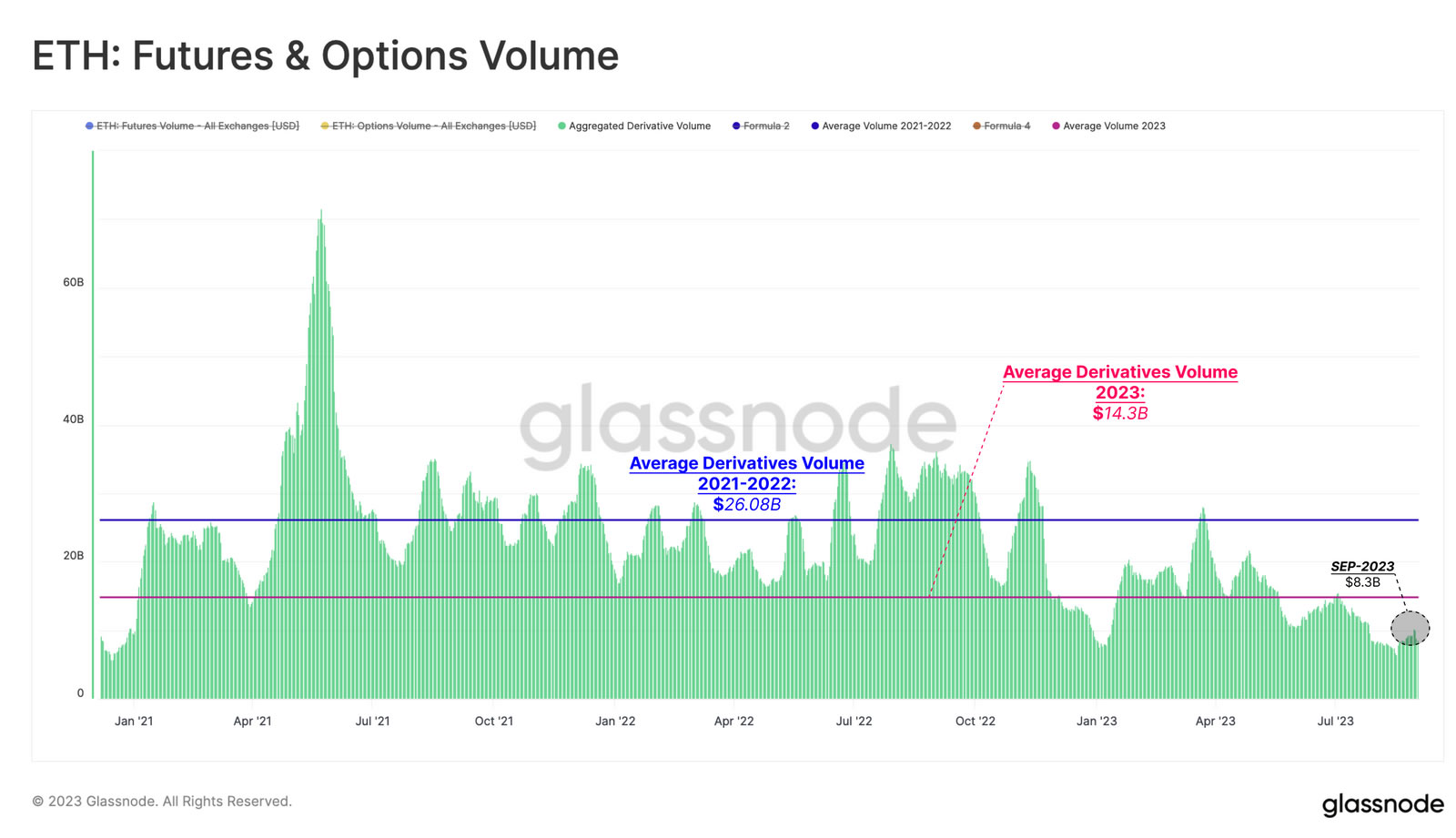

However, Glassnode reported that 2023 activity has fallen below levels seen in 2021 and 2022, especially for Ethereum futures and options.

The average daily trading volume for ETH derivatives has declined to $14.3 billion per day. Furthermore, this is around half the average volume over the last two years. Over the past week, it tanked even lower to $8.3 billion per day, “suggesting liquidity continues to drain from the space.”

Open Interest, or the number of open contracts yet to be settled, has been relatively stable for ETH products.

According to Deribit, ETH futures OI is around $143 million, where it has been for the past week or so. Comparatively, BTC futures OI is around $238 million. This metric has also been relatively stable for the past few months.

If you’re interested in trading Bitcoin derivatives, check out BeInCrypto’s guide here.

Crypto Market Outlook

Glassnode concluded that the initial optimism surrounding Grayscale’s victory over the SEC was short-lived.

“Spot markets continue seeing capital outflows, and derivative markets are also witnessing a persistent decline in liquidity.”

Overall, investors appear hesitant to return to the markets, it said.

As reported by BeInCrypto, centralized exchange volumes have also fallen to a three-year low. Moreover, institutional funds are still seeing outflows. It should be noted that these outflows have slowed from previous weeks.

Total market capitalization continues to decline, falling to $1.07 trillion during the Tuesday morning Asian trading session. However, it has returned to its consolidation zone that formed following the mid-August dump.

BTC was down 1.1% on the day, trading at $25,690 at the time of writing. Furthermore, it appears that $26,000 has turned from support into resistance.

ETH prices were also down 1% at $1,623, with $1,600 serving as support for the time being.

The post Crypto Derivatives Decline Signals Diminishing Investor Risk Appetite appeared first on BeInCrypto.