The co-founders of the crypto analytics firm Glassnode think Bitcoin (BTC) could have a strong performance next month.

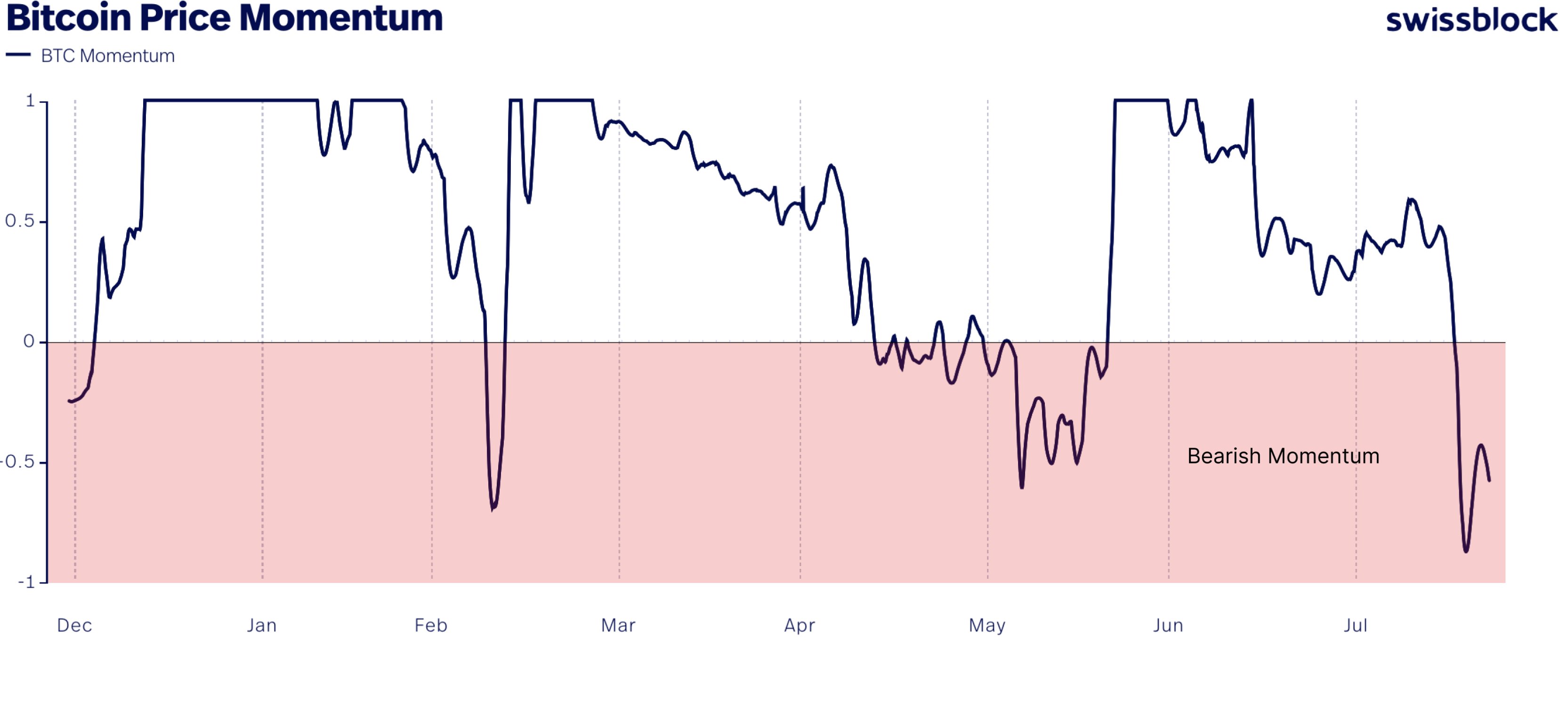

Glassnode co-founders Jan Happel and Yann Allemann, who share the Negentropic handle on the social media platform X, say that Bitcoin’s momentum indicator, the relative strength index (RSI), is flashing bullish for the king crypto heading into September, which begins Friday.

However, the co-founders warn if Bitcoin dips below the key level of $25,500 a move to the upside could prove difficult.

“Decoding Bitcoin’s August Trends: What’s Next?

Introduction: Bitcoin’s journey in August has caught the attention of the crypto world. Like a memory from June 2022, the daily relative strength index (RSI) makes people wonder about September. Questions arise about pain below $25,500 and the lack of buy orders above $26,000.

Charts and Now: The charts suggest weaker short-term energy, possibly affecting the $25,200 level. This is different from the neutral long-term view.

Outlook: September could bring good news as the RSI hints at a possible comeback. But we need to be careful because going below $25,500 and rising above $26,000 might not be easy. This balance shapes the road ahead.”

According to their chart, Bitcoin’s RSI sits just below 30 on a scale of zero to 100, which generally indicates oversold territory.

The co-founders also say that while bears are dominating the Bitcoin market at the moment, it appears the selling of BTC is slowing down. They are watching closely for a relief rally that could have Bitcoin retest the $27,000 level.

“BTC Sellers Losing Steam. Sellers losing grip as selling pressure weakens post-BTC drop below $26,500 support. Initial signs of system strength emerge but demand lacking for strong longs at $26,000. Price bounces on solid $25,230 support. Bullseye relief rally above $26,500 to reach $27,000 resistance. Stay cautious, shorts control.”

Bitcoin is trading for $26,059 at time of writing, down 0.1% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney