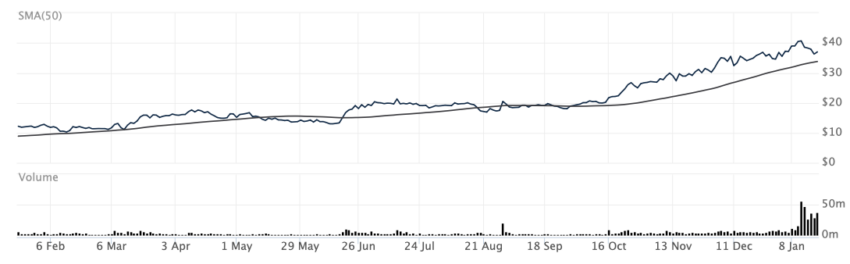

Grayscale Investments recently sold Bitcoin (BTC) after converting its closed-ended Grayscale Bitcoin Trust (GBTC) to an exchange-traded fund (ETF). Experts differ on what the selling could mean for Bitcoin’s price in 2024.

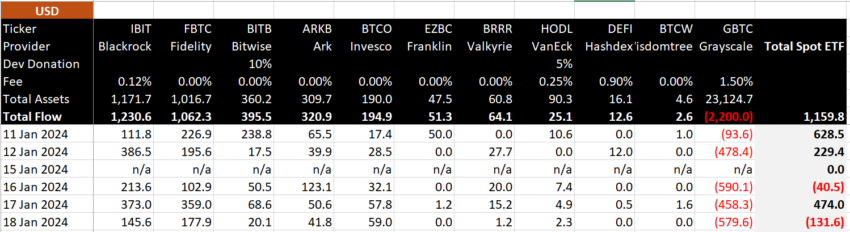

Last week, it was revealed that Grayscale sold BTC in several tranches as investors moved to ETFs with lower fees, and some investors cashed out.

How Grayscale ETF Sold BTC in Recent Days

The discount between GBTC shares and the underlying net asset value of the BTC they held narrowed to 0% after the US Securities and Exchange Commission approved Grayscale’s ETF.

However, authorized participants in the ETF have to sell BTC if the GBTC share price dips below the value of the underlying Bitcoin. These can cause the Bitcoin price to drop.

Grayscale sent 8,730 BTC to Coinbase Prime on January 16, 2024. They moved $41 million to a Coinbase Prime wallet four days earlier, which could have followed an earlier sale. A senior ETF analyst at Bloomberg, Eric Balchunas, estimated the Trust saw outflows of $95.1 million on January 11, 2024, and $484 million on January 12, 2024.

Experts Digress on Future Bitcoin Price

Chris J. Terry, a Bitcoin payments specialist, argued that if Grayscale continues selling, its fee, higher than what BlackRock charges for its iShares Bitcoin Trust, would be considered one of the “biggest strategic errors in crypto history.” He expects the Bitcoin price will continue flat or lower before a possible liquidation of GBTC.

However, Galaxy Digital CEO Mike Novogratz disagrees with Terry’s thesis. Instead, he expects Bitcoin’s price to stabilize in six months as people move money to other funds. They are unlikely to cash out GBTC without considering other Bitcoin investments.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

“While I think people will sell GBTC, I think most will switch into other ETFs… Let’s not miss the forest through the trees. It’s now gonna be far easier for boomers to buy corn. And you can get 4×5 times leverage on this BTC exposure. This indigestion will end and BTC will be higher in 6 months.”

Gary Black, a Managing Partner at Future Fund, a sovereign wealth fund, expects Bitcoin to shed the 184% gains it notched in the past year. He argues that institutional interest may end up being lower than initially predicted.

“As btc and other crypto currencies continue to sell the news (-12% from its peak) following the SEC’s approval of 11 spot btc ETFs, we expect btc to give up much of its +184% gain over the past year as expected institutional interest fails to materialize.”

Read more: Bitcoin Price Prediction 2024/2025/2030

Do you have something to say about the outlook for the Bitcoin price amid massive selling by Grayscale or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

![]()

Coinbase

Coinbase” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

Metamask Portfolio

Metamask Portfolio” target=”_blank”>Explore →

![]()

Wirex App

Wirex App” target=”_blank”>Explore →

![]()

YouHodler

YouHodler” target=”_blank”>Explore →

![]()

Margex

Margex” target=”_blank”>Explore →

Explore more

The post What Impact Will the Grayscale ETF Sell-off Have on the Bitcoin (BTC) Price? appeared first on BeInCrypto.